by Zipbooks Admin

Square Payroll: 2019 Review

Square is best known as a credit card processor and Point of Sale (POS) system. But Square offers a variety of other services—like Square Invoices and Working Capital—that help you manage business finances more efficiently. Today, we want to tell you everything you need to know about Square Payroll.

What is Square Payroll?

Square Payroll is a cloud-based payroll solution ideal for small businesses. The software is now available in all 50 states and runs completely online, either through the Square dashboard or a new mobile app. Square guarantees payroll compliance, and supports employee setup, pay runs and tax reporting.

Square Payroll is similar to small business solutions like SurePayroll or Gusto (ZipBookers get 3 months free).

How much does Square Payroll cost?

Like most other wage management products, Square Payroll charges you a base monthly price and an additional cost per team member. There are no subscription fees and you can cancel at any time. Additionally, if there is a month that you don’t need to pay any employees, you will not be charged for that month.

One of Square Payroll’s unique features is the ability to pay independent contractors only. A contractor-only account is free to set up and has no base monthly charge. Instead, you pay $5 per team member per month—that’s it.

If you have a combination of employees and contractors, you will pay $29/month as a base fee and then an additional $5 per team member per month. The monthly price accounts for additional features such as automatic payroll, tax filing and more.

See the full pricing-to-feature breakdown in the table below:

|

Contractors Only |

Employees and Contractors |

|

|---|---|---|

|

$0/month +$5 per contractor/month |

$29/month +$5 per person/month |

|

|

Unlimited payroll runs |

x |

x |

|

Access to the Square Payroll App |

x |

x |

|

Online accounts for team members |

x |

x |

|

Direct deposit |

x |

x |

|

Time tracking |

x |

x |

|

Overtime calculations |

x |

x |

|

Custom reporting |

x |

x |

|

PTO or sick leave tracking |

x |

x |

|

Integrations with Square POS, QuickBooks online, AP Intego and more |

x |

x |

|

US-based phone support |

x |

x |

|

Generate and file tax reports |

1099s only |

1099s and W-2s |

|

Automate and file taxes |

x |

|

|

Tip calculation and importing |

x |

|

|

Automated payroll |

x |

|

|

Calculated pay for new hires and terminations |

x |

|

|

Benefit deductions and contributions |

x |

|

|

Employee reimbursements |

x |

|

|

Off-cycle payments for flexibility |

x |

|

|

New hire reporting |

x |

When you sign up with Square Payroll, you won’t be charged until your first pay run. Pricing scales with your business—if you pay fewer team members during one pay period, the cost goes down.

In the combined plan, you can pay any mix of hourly, salaried or flat-rate employees. Payments can be sent at any time. Rather than waiting until the next pay period, you can run payroll as often as you need to within a month without any additional cost.

What are some of the features of Square Payroll?

Automated tax filings

Square Payroll guarantees that all payroll processes will be fully compliant with tax law. Square can also file all federal and state payroll taxes for you.

If you are on the employee and contractor plan, there is no extra cost for tax filing—it’s included in your $29/month. Square manages all W-2 withholdings and payments, post-tax deductions and reimbursements, and new-hire reports. Team members also have 24/7 online access to W-4, W-2 and 1099 forms.

Timecard sync

If you are already using Square POS for your business, syncing with Square Payroll will happen automatically.

Team members can clock in and out at your service desk using unique passcodes for secure and accurate time records. Remote contractors can track time in the same way, signing in through the Square App rather than an in-store iPad. When it’s time to run payroll, employee POS timecards are integrated with Square Payroll and can be transferred over with one click.

If you are not using the Square POS app for time-tracking, Square Payroll does integrate with top employee time card systems like Homebase, Deputy, TSheets and When I Work.

Square Payroll also automatically calculates PTO and sick leave, based on the policies you set. Similarly, any overtime or double time pay is computed for you. You can manage any of these preferences and review or edit team hours through the Square Dashboard.

Online accounts

Both you and your team members will have 24/7 access to account information through Square Payroll’s online dashboards.

When employees or contractors are added to Payroll, they receive an email with a link to their online account. They are invited to create their login, set up direct deposit and fill out their W-4s, so you don’t have to worry about these steps. Once they have set up their accounts, employees have 24/7 access to review their pay stubs or tax forms.

Benefits

You can also integrate benefits into your Square Payroll processes. You choose the benefits that best suit your employee needs and business budget. Employees enroll from their online accounts, which means no extra work for you. Benefit deductions and contributions are synced with payroll, so they are automatically calculated every month.

Square is partnered with leading benefit providers that offer a variety of carrier packages:

- Health insurance: SimplyInsured (includes dental and vision)

- Workers’ compensation insurance: AP Intego

- 401(k) retirement plans: Guideline

- Pre-tax benefits: Alice

Automatic payroll

If you select the employee and contractor plan, you can opt in for automatic payroll. If you choose to have payroll run itself, Square will import hours, calculate salaries, send confirmation emails and notify you when the process is complete.

Team members who are enrolled in direct deposit will receive an email listing their net pay. Team members without a bank account or email will still have payroll calculation automated—all you have to do is cut the check.

Free app

More recently, Square Payroll released a mobile app for their service. The Square Payroll app is free to download and has largely positive reviews thus far.

All features from the Square dashboard are available on the app, including reviewing time cards and paying team members.

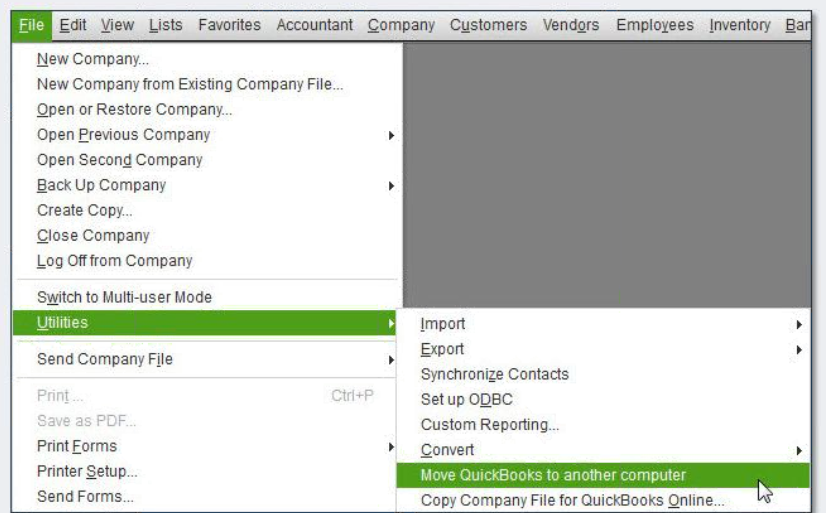

Switching over

The switch to Square Payroll is easy. Integrations with programs like ADP, Intuit and Paychex allow them to archive past payroll reports. You just have to fill out a little information about your employee taxpayer information and your team—they do all the rest of the paperwork.

What do the reviews say about Square Payroll?

Overall, most users are happy with Square Payroll. It checks all the boxes, and like other Square products, it provides a great user experience.

However, the service is still relatively simplistic. For a small business without many employees or with contractors only, it is an affordable option from a great company. If you have a larger team, you may need more from your payroll.

Consider a few recent user reviews:

“It is incredibly easy to use…Being on the go, their customer support is easy to contact and quick to respond.”

“I was recently audited..and passed with flying colors because we use Square up for our payroll services. I am busy leading my business…and I have always depended on Square up to file the right forms, charge the correct rates, and pay my employees…The surprise, random audit put your services to the test. Thank you!”

“Great for managing payroll company compliance. Decent price and you can get a free trial. The fact that it’s cloud-based is also a huge PLUS. Super easy to use and its a mobile app…I didn’t have any issue to report. May not be suitable for larger businesses.”

Should I use Square Payroll?

If you’re already using Square POS for your business and you don’t have too many employees, Square Payroll could be a good choice for you. It does lack some of the depth and customizability of its competitors (like Inova Payroll), but most people who have chosen Square Payroll have not regretted their choice.