by Zipbooks Admin

1099 Form: Complete Guide for Businesses & Contractors

Hi! I’m Meg, and I’m self-employed.

Confession time: I recently did something pretty awful.

I read everything I could find about 1099s on the IRS website. I kind of had to because, for me, tax time is a bit trickier than just submitting my standard W-2s.

To avoid being penalized, I have to obtain a 1099 form (1099-MISC, in this case) from every client who paid me more than $600 during the previous tax year—that’s a lot of paperwork to keep organized.

Download our free template for organizing freelancer invoices

Whether you’re a new freelancer or a business owner thinking about hiring an independent contractor, understanding the ins and outs of 1099 form filing requirements can feel overwhelming.

What is a 1099?

1099s are “information returns” issued by any entity or person that increases income.

It’s common for freelancers to receive 1099s for their work, but self employment earnings aren’t the only thing reported. Interests, dividends, debt cancellations, HSA distributions and other payments are reported with 1099 forms (-A through -SA).

As a rule, you should report all income on your tax return, which is why Form 1099s are considered “informational.” You may or may not owe taxes on money from a 1099; in some cases, the income reported is not taxable (think 529s, IRAs, etc). These reports are for your records and serve as proof of transactions.

All 1099 forms must be sent out by January 31st.

The 1099-MISC is the most common because it covers all of the gray areas, but there are a lot of variations out there that we’ll cover.

Don’t want to read the whole thing?Feel free to use the links below to jump to the section you’re interested in.

1099-MISC

What is Form 1099-MISC?

There is a surprisingly large amount of 1099 forms, but the most common is the Form 1099-MISC. The IRS uses this form to keep track of miscellaneous income to taxpayers.

If you worked for someone as an independent contractor, you should receive a 1099-MISC form from every person who paid you more than $600 over the course of the year. If you were paid less than that amount, you will not receive a 1099 form from this employer, but you are still required to report those earnings on your tax return.

If you’re a business owner, the 1099-MISC form is how you’ll report payments made to freelancers and independent contractors. Employees do not receive 1099 forms; they receive W-2s. Both of these forms are considered “information returns,” but they serve different functions.

Employees vs Contractors

When distinguishing between employees and contractors, there’s more to consider than hours and pay schedules. Employees can be part-time and contractors can make more than salary. The IRS distinguishes between the two by whether the payer “has the right to control how the worker performs the services” or just to direct the result.

There are three categories of evidence that the IRS considers when determining that a worker is an employee:

- Behavioral: Does the company have the right to control what the worker does and how the worker does his or her job?

- Financial: Are the business aspects of the worker’s job controlled by the payer? (These include things like how the worker is paid, whether expenses are reimbursed, who provides tools/supplies, etc.)

- Type of Relationship: Are there written contracts or employee type benefits? Will the relationship continue and is the work performed a key aspect of the business?

Employees, essentially provide their services under direction.

Independent contractors, also frequently called “freelancers,” are hired to do a particular job or project. They are in control of how, when and where they perform their work, though the employer can accept or reject the result. They are professionals paid an agreed-upon rate for a particular service, and they do not receive a salary or employee benefits.

(Think graphic designers, copywriters, photographers, web developers, and event planners).

Who needs a 1099-MISC?

You should send a 1099-MISC to every contractor–this means individuals or unincorporated businesses such as LLCs–to whom you paid $600 or more for services, rent, awards, or other miscellaneous business-related activities during the year.

You only need to issue 1099s for business payments to non employees–like the person who decorated your office or the one who designed your new website. You do not need to file a 1099 for the photographer who took your wedding photos–that’s a personal expense, not a business expense.

Here are a few guidelines to help you remember who you need to file a 1099 for:

✔ Do file a 1099 for independent contractors and unincorporated businesses to whom you paid over $600 in a single tax year.

✘ Do not file a 1099 for employees. You’ll report your employees’ wages, tips, and other compensation on a Form W-2. Not sure whether someone is a contractor or an employee? Go back to the previous question.

✘ Do not file a 1099 for Corporations. If the person you paid is classified as an s-corp or a c-corp, you won’t need to file a 1099 for them. You’ll be able to tell whether they’re incorporated or not based on the Form W-9 they filled out when you hired them.

1099 Form Guide for Business Owners

How do I file 1099s for my business?

The easiest way to complete your 1099 forms is to use a payroll service. For example, we’ve partnered with Gusto–and they automatically file all tax forms for you!

However, if you’d rather do it yourself, you’ll need to take several steps including gathering the needed information, sending a copy to the independent contractor, sending a copy to the IRS, and submitting Form 1096 if you file a physical copy. Don’t worry, I’ll break down each step for you below.

Step 1: Gather the needed information for each 1099. You must have the following things for each contractor, which you should be able to find on their individual W-9:

- Total amount you paid to the contractor during the year–check your bookkeeping records to be sure you’re accurate.

- Contractor’s legal name–double check the W-9 even if you think you know it.

- Contractor’s address

- Contractor’s taxpayer identification number–this will likely be their Social Security Number if they’re a sole proprietor. If they’re a Non-Resident or Resident Alien, they’ll have a designated identification number for you to use.

Step 2: Complete Form 1099-MISC using the information you gathered in Step 1.

Step 3: Submit Copy B to the Contractor no later than January 31 so they can file their own taxes by the deadline.

Step 4: Submit Copy A to the IRS by February 28 if you’re filing by mail, or March 31 if you’re filing electronically. You can check the IRS’ exact deadlines for the filing year you’re working with by reading the “When to File a 1099 Form (Deadlines)” note at the bottom of the form.

Step 5: If you submitted a physical copy of the 1099 to the IRS, you must also submit Form 1096, which tracks every 1099 that you are filing for that particular tax year. The deadline for Form 1096 is the same as the deadline for 1099s.

Step 6: Check whether you need to file your 1099s with your state tax commission. Your CPA will be able to help ensure that you’re compliant with your state’s tax laws.

Should I file physical or electronic 1099s?

You have the option of either mailing a physical copy of the 1099 to the IRS or filing electronically, but either way, you’re still required to send a copy to each independent contractor. The way you’ll file your 1099s is slightly different depending on the method you’re using, and there are pros and cons to each.

Filing 1099 Form Electronically

Copy A–If you choose to file electronically, you will use the IRS Filing a Return Electronically (FIRE) feature. You’ll work with your accountant or a compatible accounting software to actually submit your 1099s to the IRS.

In order to use FIRE, you’ll need a Transmitter Control Code (TCC). To get one, fill out Form 4419 and then mail it or fax it to the IRS. Be sure to submit this form at least 30 days before the 1099 deadline to avoid penalties. After the IRS sends you your TCC, you’ll use it to create a FIRE account.

Copy B–You can send the independent contractor their copy electronically, but first you have to have their consent to do so.

For example, if you’re planning to use a payroll service like Gusto, the contractor should have created an online account with Gusto and filled out a W-9 there. Or, if you’re planning to email the form, you should first send an email to the contractor to get their permission.

The IRS has specific rules for how you must obtain consent to send a 1099 electronically. You can view all of the IRS rules here.

Filing 1099 Form by Mail

1099-MISC Copy A–If you choose to file physical copies of your 1099s, you’ll need to fill out a physical copy of Form 1099-MISC that you’ll get from the nearest IRS office–you can’t just print one off of the IRS website.

After you complete the form, you’ll mail it back to the IRS by February 28.

1099-MISC Copy B–For the copy you’ll send to the contractor, you can either fill out a physical copy of Form 1099-MISC or print off an electronic version of Copy B from the IRS website. Be sure to send the completed form to the contractor by January 31. You can get additional information about filing physical copies of your 1099s on the IRS website.

1099 Form Filing deadlines for businesses

In general, the deadline to send out 1099s (either digitally or by mail) is January 31st. Depending on your forms and filing method, there is some variation:

- If you filled out Box 7, Nonemployee Compensation: January 31

- If Box 7 is blank or you’re filing for a previous year:

- Sending Copy B to independent contractors: January 31, or February 15 if you filled out Box 8 or Box 14.

- Sending Copy A to IRS: February 28 if filing by mail, or March 31 if filing electronically.

1099 Late Fees and Penalties

Late filing fees for 1099s aren’t hefty, but they will apply, even if you’re only a day or two alllate. Be sure to mark the deadlines on your calendar so you don’t risk a late fee. If you need more time, you can file for an extension using Form 8809, but you must still submit Copy B to your independent contractors by January 31.

The following fees apply for each late 1099 form (that means every 1099 you file for every contractor):

- $50 if within 30 days of the filing deadline

- $100 if after 30 days but by August 1

- $260 if after August 1 or not at all

- $530 if you intentionally fail to file

Small businesses who file after August 1 are limited to $1,072,00 in penalties. Large businesses (with gross receipts over $5 million) are limited to $3,218,500 in penalties for the same deadline.

Any entity who intentionally disregards filing 1099s has no limitation on their penalty amount.

1099 Guidelines for Independent Contractors

What is the 1099 tax rate?

Self-employed individuals are obligated to file the standard annual tax return as well as make estimated payments four times during the year. 1099 contractors are considered self-employed by the IRS.

On your return, you will be required to file income tax and self-employment tax (SE tax). The self-employment tax rate is 15.3% of your net income and covers social security and medicare taxes. Essentially, the SE tax bracket covers the payments your employer would have withheld from your paycheck.

Don’t get caught off guard come tax time! Set aside money each month and mark payment dates in your calendar. Track expenses in your accounting software and take deductions—remember, you’re entitled to them!

What to do if you don’t receive a 1099 from a client

If any one client paid you $600 or more during the tax year, it is that client’s responsibility to send you a complete copy of Form 1099-MISC by January 31. If the deadline rolls around and you haven’t received a 1099 from a client and you think you need one, request it as soon as possible so you can meet the filing deadline.

Whether or not you receive a 1099 from every client you worked with during the year, be sure to report all of your earned income on your tax return or risk penalties and a potential audit.

What to do if you’ve been misclassified as an independent contractor

Occasionally, a shady employer will attempt to misclassify their employees as independent contractors in order to save money on things like payroll taxes. This is bad news for you as the misclassified employee because it means the following:

- You’re responsible for paying all of your own Social Security and Medicare taxes out of pocket without any contributions from your employer

- You’ll be ineligible for employee benefits like paid time off, health insurance, and unemployment insurance

- You’ll be ineligible for worker’s compensation benefits

- You’ll have no right to other workplace benefits like minimum wage, overtime pay, and sick leave

- You’ll be ineligible for employee coverage under the Affordable Care Act

As you can see, being misclassified as an independent contractor when you should be an employee has the potential to be very costly. You should take the following steps if you believe you have been misclassified:

- Talk to your employer. Explain the situation and ask whether they will consider reviewing your classification and re-classifying you as an employee. If nothing else, they should be able to explain to you why they classified you as a contractor in the first place.

- Contact the IRS. If your employer refuses to reclassify you and you still believe you should be classified as an employee, you can ask the IRS to review your status by filling out Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. There is no fee to file this form.

- Form SS-8 will ask you a list of questions about your work and how your employer treats you on the job. After you submit the form, the IRS will contact your employer to get their side of the story. Keep in mind that the IRS will likely identify you to your employer, so you should consider bringing the problem up to your employer first. If the IRS determines that you should be classified as an employee, your employer must comply or face penalties.

- File your taxes with Form 8919. After the IRS has determined that you should be classified as an employee, be sure to file your tax return with Form 8919, Uncollected Social Security and Medicare Tax on Wages. This form prevents you from being responsible for all of your Social Security and Medicare taxes, because since you’re an employee, your employer is required to pay half.

If you were misclassified as an independent contractor and then were fired or laid off, you can file an Unemployment Insurance Claim with the Unemployment Office.

If you were injured on the job while you were misclassified as an independent contractor, you should file a Workers’ Compensation Claim. Visit the U.S. Department of Labor website for a list of state workers’ compensation agencies.

All 1099 Forms (-A to -SA)

There are a lot of different types of 1099 forms, and some are much more common than others (-DIV, -K and -SA to name a few).

While some 1099 forms aren’t as popular as others, in order for this to be a “complete” 1099 form guide, we included the other less commonly issued 1099 forms.

1099-A

Acquisition or Abandonment of Secured Property

This form is used when your lender forecloses or repossesses your personal property. You could receive more than one of these forms on the same property, if there was more than one mortgage that was foreclosed.

The reason the IRS is involved in this scenario is because if there was a gain, the IRS wants the tax due on the profit. Even though you didn’t actually sell the property, you may have still realized a gain. So the outstanding loan balance will be deducted from the “selling price” (or the fair market value of the property at the time of the foreclosure) to determine if there was a gain or a loss.

If there was a gain, it must be reported on Schedule D on your income tax return. While it may seem like it is adding insult to injury (first you lose your house, then you have to pay tax on a gain?) you will likely be exempt from paying any tax due to the large exclusion for capital gains on a main residence. However, it still must be reported, even if there will be no tax due.

1099-B

Proceeds From Broker and Barter Exchange Transactions

Your broker will issue this form when have bought or sold corporate stock or non-Treasury bonds during the year. The broker will total all of your gains and losses from all of your transactions throughout the year, and the total will be reported on the 1099-B.

The 1099-B will also include all of the details for the transactions: description of investment, purchase date and price, sale date and price, and profit less commissions paid. All of this information will have to be reported on your income tax filing.

1099-C

Cancellation of Debt Income

Any lenders who have forgiven debt that you owe to them will issue you a 1099-C, to reflect the amount of the debt that you no longer have to pay. If, for example, you negotiated with your credit card company to pay only 50% of the debt that you owed, the remaining amount is subject to taxation as income. The good news is, you will only get this form if the lender has forgiven over $600 in debt.

This form will also apply if you negotiated on a home for the outstanding loan to be forgiven, or if you negotiated a short-sale on your home. This could result in a significant tax obligation, but you may be able to apply for an exclusion under the Mortgage Forgiveness Debt Relief Act of 2007. If you receive a 1099-C for this type of activity, please consult with a tax expert to be sure you are paying only the tax that you must pay.

1099-CAP

Changes in Corporate Control and Capital Structure

You will receive a 1099-CAP if you own shares of a corporation that underwent a major structural change, resulting in cash, stock or property to you. This form only applies to cases of over $100 million, so it’s unlikely that you will ever see one of these.

1099-DIV

Dividends and Distributions

This form is issued by corporations and investment fund companies that pay out dividends or distributions to their shareholders. The minimum threshold for a 1099-DIV is $10, and it is issued for ordinary dividends, total capital gains, qualified dividends, non-taxable distributions, federal income tax withheld, foreign tax paid and foreign source income.

(Yes, this sounds complicated. Just trust that your investment company knows what they are supposed to report, and that they do it.)

1099-G

Certain Government Payments

You will receive a 1099-G if you receive over $10 in unemployment compensation; state or local income tax refunds, offsets or credits; reemployment trade adjustment assistance (RTAA) payments; taxable grants; or agricultural payments.

Other types of income paid by a government source, like contest winnings or interest payments, will be included on a different type of 1099 and not on a 1099-G.

1099-H

Health Coverage Tax Credit (HCTC) Advance Payments

If you received a credit in advance (that is, it was paid monthly to your health insurance provider to lower your monthly out-of-pocket premium payments), you may receive a 1099-H detailing the amount of the credit you received. This credit is limited to a very small portion of the population and has strict requirements, and you must enroll in it, so you can check your eligibility with the IRS.

1099-INT

Interest Income

This form is issued by banks and any other institutions that may pay interest on your deposits. Any institution that pays you more than $10 in interest during the year must issue a 1099-INT. This could be interest earned in a checking or savings account from a bank or credit union, a money market account, a brokerage account, certificates of deposit (CDs), and savings bonds issued by the U.S. Treasury.

Accounts that may earn interest but that will not be issued a 1099-INT form include traditional IRAs, and Health and Medical Savings Accounts (HSA, MSA), because those accounts are not subject to taxation. Interest earned in an account held in a foreign country will also not receive a 1099-INT, because that will receive a different form.

1099-K

Merchant Card and Third Party Network Payments

This form is issued by payment processors, such as Paypal or Google Checkout, and credit card companies like MasterCard and Visa. If you own a business and do over 200 transactions and $20,000 in sales in a year, you will receive a 1099-K from each payment processor that you used. Credit card companies report when your sales total over $600 in a year.

1099-LTC

Long-Term Care and Accelerated Death Benefits

If you have received Long-Term Care benefits from an insurance policy, the insurance company is required to provide you with the 1099-LTC. This includes both payments made directly to you, or those paid to a third-party (like a long-term care home) on your behalf.

While the amount on this form could be significant ($20,000 or more), it is not necessarily taxable as income. You will deduct your expenses from the benefits in order to determine if there is any tax due.

The form may also be issued if you received accelerated death benefits for a life insurance policy, as a terminally ill patient. This may also be called a “viatical settlement”.

1099-MISC

Miscellaneous Income

The most commonly seen 1099 form is for someone who is self-employed or working as a contract employee: Form 1099-MISC. Your employer doesn’t employ you directly, pays you gross wages (without any tax deducted) and offers no benefits. You will receive this form if you earned over $600 from this entity during the fiscal year.

If you worked for multiple entities, you may receive multiple 1099 forms. They will all have to be reported on your personal income tax return.

1099-OID

Original Issue Discount

This form is issued when bonds are purchased at a discount to their face value and don’t earn interest, instead of being purchased at face value and then earning interest. Examples of this are zero-coupon bonds. The income reported on this form is treated as interest income for taxation purposes.

1099-PATR

Taxable Distributions Received From Cooperatives

This form refers to income received from a farm or cooperative, when it is operated as a business of which you own a portion of the equity. You’ll get this form if you received at least $10 in patronage dividends

1099-Q

Payments From Qualified Education Programs (Under Sections 529 and 530)

1099-Q reports money received from qualified tuition programs such as a 529 or a Coverdell ESA plan. However, you only receive the 1099 and owe tax when you make withdrawals from the plan to pay for educational expenses, not when the contributions to the plan are made.

529 plans are generally not subject to taxes when used for qualified education expenses, so this form may just serve for record-keeping purposes.

1099-R

Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

If you received a distribution of at least $10 from any retirement source, you’ll get a 1099-R detailing it. You may get multiple 1099-R forms, if you are making withdrawals from multiple sources (a pension, an annuity and an IRA, for example).

If you do a rollover from one account to another (from a 401(k) to an IRA, for example), you will receive a 1099-R if the money was ever in your possession. If you did the rollover directly from one institution to another, however, you should not get a 1099-R for the transaction.

1099-S

Proceeds From Real Estate Transactions

If you sell real estate, it doesn’t matter if you have a gain or a loss—you will get a 1099-S from the closing company. There are only a couple of situations where this transaction is not reportable:

- If the sale was for a primary residence and the sale was for less than $250,000, the transaction is not reportable.

- If the sale was for less than $600 total, then the sale is not reportable.

All other sales are likely reportable, and will apply to either your Investment Income (personal use real estate) or your Business Income (rental or investment property) when you file.

1099-SA

Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

You will get a 1099-SA and have to report it on your tax filing if you have taken a distribution from one of the medical savings accounts. However, the distribution will only be taxable if you did not spend the money on qualified medical expenses.

SSA-1099

Social Security Administration Benefit Statement

When you become eligible to receive benefits from the Social Security Administration, you will receive this form from the government to detail any distributions you received. Whether your benefits are taxable or not depends on several factors, such as other sources of income, and total Adjusted Gross Income (AGI).

RRB-1099

Railroad Retirement Board Statement

This form is for railroad workers, who don’t participate in the Social Security system. Their payroll deductions are paid into a system called the Railroad Retirement Board. When they receive retirement distributions from the RRB, they receive this form detailing the benefits paid out.

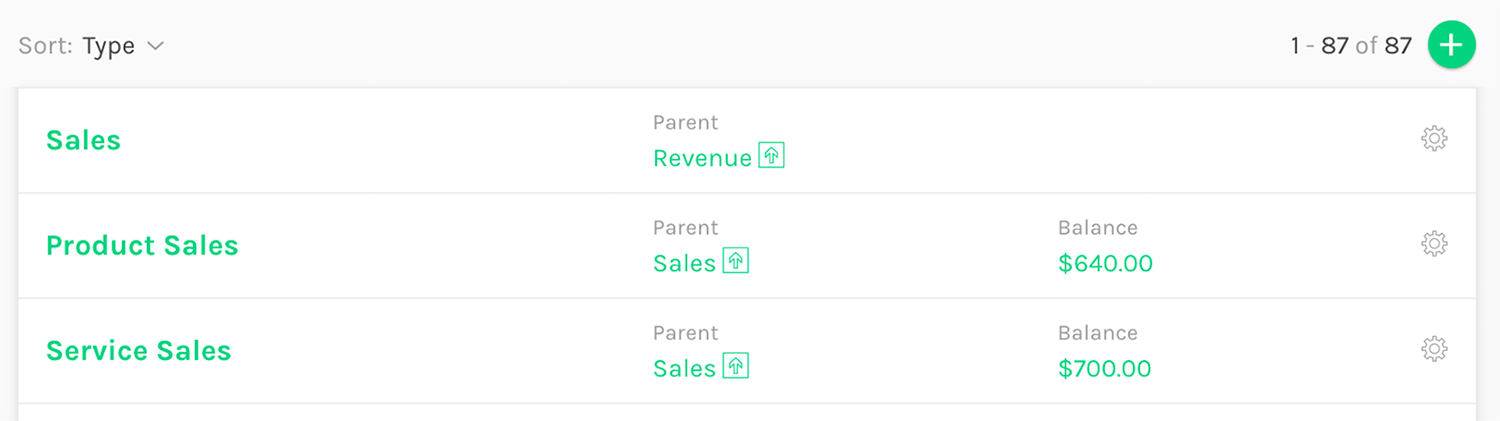

Save time on your 1099s with smart software

Freelancers and business owners alike want to simplify tax-processing and accounting. ZipBooks makes it easy to flag transactions as a 1099 expense and tag vendors as 1099 contractors so you don’t miss a beat come tax-time.

We built ZipBooks with small business owners in mind, not just accountants. Because of that vision, we think our platform offers a more streamlined interface, more intuitive reporting, and more visually appealing workflows.

It’s simple to use, but offers the muscle of more expensive products.

You can also take advantage of ZipBooks’ virtual bookkeeping services to hand off your books to someone else. But we promise, accounting with us isn’t scary. You’ll find yourself more empowered and more confident by our smart software–try it out for free!