by Tim Chaves

What Is IRS Form 1099-Q?

If you’re paying for education expenses out of a tax-free education account for yourself or a dependent, then you’ll receive a 1099-Q form from your plan administrator at the end of the year.

The 1099-Q details the distributions that you received from your qualified tuition program. As long as the distributions are spent on “qualified education expenses,” the money that you withdraw from the account—including any gains that have been generated—will be tax-free. (Your contributions can always be withdrawn tax-free, since you have already paid taxes on that money.)

What is a 1099-Q?

A 1099-Q is an “information return”, which means the company which handles your education account provides a copy to you and to the IRS. If you don’t report the distribution and offsetting expenses when you file your personal tax return, the IRS computers will flag that discrepancy, and you will likely be asked to explain why you didn’t include that income on your personal tax return.

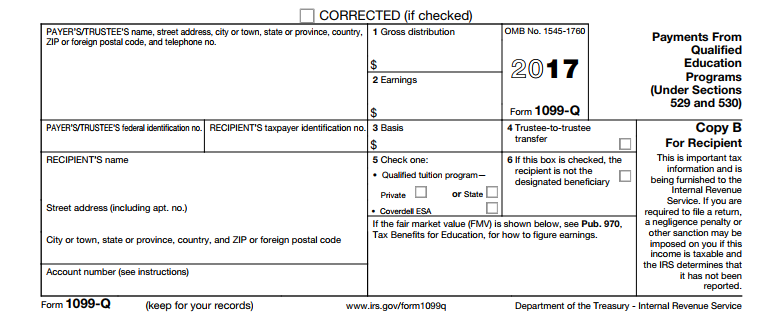

Here’s what a 1099-Q looks like:

What kinds of education plans will trigger a 1099-Q?

Currently, there are two types of qualified tuition programs that would trigger a 1099-Q when you take distributions: Coverdell ESA and 529 plans. Although their tax-free treatment at the time of distribution is the same, there are several important differences in the accounts themselves.

Coverdell ESA

Here’s everything you need to know about Coverdell ESA tuition plans in a nutshell.

Coverdell ESA accounts can:

- contain self-directed investments, just like a self-directed IRA. You can choose the investments and the amounts in the account.

- be used for K-12 education costs, as well as college expenses.

- be contributed to by corporations or trusts with no income limit.

Coverdell ESA contribution limits include:

- $2000 per student per year, across all Coverdell accounts.

- sliding scale reduction in maximum contribution allowed once the contributor’s AGI is greater than $110,000 (single) or $220,000 (married filing jointly.)

- Contributions can only be made for students who are 18 or under.

529 Plan

- investments are chosen by the plan administrator.

- offers pre-paid tuition plans as well as tax-free savings plans.

- may limit educational institution choices to those of one state or one institution in particular.

- may only be used for college expenses.

- no contribution limits (however, the money may be subject to gift tax if the contribution from one person exceeds $14,000 in one year)

- no income limits.

- no age limits for designated student.

- may possibly qualify for state tax-free status in additional to federal tax-free status.

What education expenses qualify for tax-free distribution?

Qualified education expenses include what you would expect:

- Tuition

- Class fees

- Uniforms

- Room and board (student must be enrolled at least ½ time and the cost must be commensurate with the cost supplied by the school)

- Educational supplies and equipment (includes computers, printers, software, etc. and internet connection fees)

- Academic tutoring

- Services for special needs students in connection with attendance at an educational institution

What will the 1099-Q report?

The 1099-Q will report the amount of the distributions that you received during the tax year. Whether any of that income is taxable will depend on how much you report in qualified expenses.

If you received more in distributions than you spent in qualified expenses, you will have to report the excess as “other income” on your personal tax return, and pay tax on it. You will also be subject to a 10% penalty on that income as well.

Considerations in conjunction with other tax credits

Note that if you take a distribution from a Coverdell account, you are prohibited from claiming either the American Opportunity or Lifetime Learning tax credits during the same year for the same expenses. If you have separate expenses that were not covered by the distribution from the Coverdell or the 529, then those credits can be claimed.

Looking to simplify expense tracking and bookkeeping? Try ZipBooks for free–forever!

Tim is Founder and CEO of ZipBooks. He keeps his desk really nice and neat.