Invoice financing for small businesses

Invoice financing gets you paid faster

Are you sending out an invoice that’s due in the future, but you'd like to get paid now? Invoice financing options advance the cash you need so you can say goodbye to cash flow worries.

Whether you are a small startup or an established enterprise, invoice financing allows you to put more money back into your business and solves the problem of customers taking a long time to pay. Traditional loans can require a long wait and be difficult to be approved for, but invoice financing applications are fast and small-business-friendly.

How much does it cost?

Invoice financing can have higher fees than traditional financing, but it’s the cost of having money on hand now, rather than later.

Most financing companies will advance you about 85% of the value of your invoices and hold the rest in reserve until your customer sends payment. Invoice lenders collect a processing fee (typically around 3%) and can charge a factor fee as well, depending on how long it takes your customer to pay.

While these percentages can add up, the benefit to your business can often be worth the price. The predictable cash flow provided by invoicing is what you’re paying for, a convenience fee for your business’ working capital.

Invoice financing vs factoring

Another common cash flow solution is invoice factoring. Invoice financing and factoring perform similar functions, with a few distinctions.

With invoice financing, you put your invoices up as collateral for a line of credit. With invoice factoring, you sell invoices for immediate cash. Invoice factoring is not a loan, but a purchase of your accounts receivables.

With invoice financing, you maintain the responsibility for collecting the amount of unpaid invoices. With invoice factoring, the factoring company is responsible for collecting invoice payments. However, there is no guarantee of collection—you have to trust that the factoring company will successfully collect unpaid invoices from customers on your behalf. Both services charge a fee of around 3%, it just depends on who you want to be in charge of collection.

Where do I start?

If you currently have outstanding receivables, you can qualify for invoice financing. Most services offer streamlined, online applications with quick turnaround. Because existing invoices act as the loan’s collateral, you are more likely to qualify for invoice financing—though some companies may look at your credit report too.

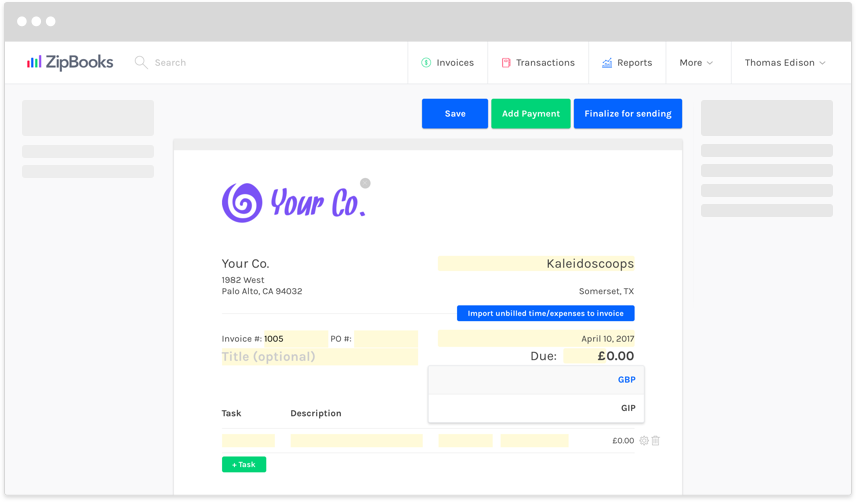

Invoice financing and factoring companies (like Fundbox and BlueVine, respectively) will typically connect to your business’s accounting program (that’s us!). Because you have clean and professional invoices neatly organized in ZipBooks, it will be easy for you to share your accounts receivables and get cash right away!