by Tim Chaves

Sole Proprietorship vs. LLC vs. S-corp: Pros and Cons

For many entrepreneurs fresh to the startup world, they’re likely to incorporate as either a sole proprietorship or a limited liability company (LLC). Both legal structures are affordable and require little paperwork in order to get up and running. So, which one should your business choose? Are there pros and cons associated with these entities? Let’s break both formations down to find out.

Sole proprietorships

The pros: Incorporating as a sole proprietor allows the owner to do several things that they would be unable to do with any other entity. Chiefly among them is the ability to be the boss. You, and only you, gets to call the shots and exercise complete control of the business.

Aside from putting yourself in charge, a sole proprietorship is ideal for small businesses that have little to no liability risk. If you own a storefront, this entity might not be a good fit for you. However, if you ran a business from home such as an Etsy shop, freelance programming or working as an online consultant, then a sole proprietorship may be up your alley since there are so few opportunities for unforeseen circumstances and risks, like customers being injured on your property, to occur.

The cons: Sole proprietorships do not offer liability protection. What does this mean, exactly? Many entities will provide liability protection which allows for the separation of personal and professional assets. If you decide to incorporate as a sole proprietor, then you are held responsible for everything that happens to your business. The entity has made you its boss and there is no line of separation provided between the business and your own personal properties. A customer may be injured at your home, but you might lose valuable customer information or accidentally damage products. If that happens, you are held liable for it. And, if you’re not careful, your business may even be faced with a lawsuit.

Another con in the sole proprietor corner is the issue of financing. Once again, this all ties in with the lack of separation between the business and its owner. If a sole proprietor wants to reach out to potential investors in order to finance or expand the business, for instance, there won’t be a business line of credit for their team to review. Instead, all eyes will be on the owner’s credit — which is hopefully in solid shape.

For further reading, check out our comprehensive guide on sole proprietorship advantages.

Limited liability company (LLC)

The pros: One of the biggest advantages to incorporating as an LLC is that the formation provides its owners with liability protection. This helps keep professional and personal assets separate from one another, since the business is considered to be its own entity. Under an LLC, if a customer’s information is lost or products are damaged then the owner is not held personally responsible.

LLCs also allow for more flexibility. Perhaps you don’t want to work out of your home and would rather have a brick and mortar storefront. If you incorporate as an LLC, you may be allowed to open up a physical location. You may also choose your own tax entity as an LLC, picking either an S Corporation or C Corporation.

The cons: If you aspire to take your business public, remember that an LLC is not a public structure. You will need to switch to another entity, like a corporation, that is a public legal structure.

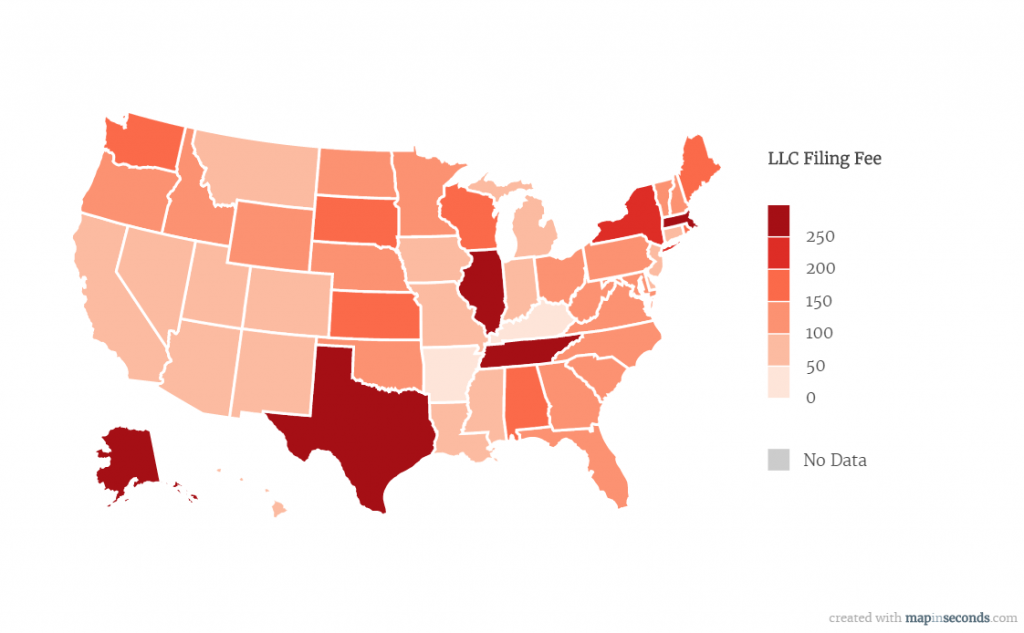

There are a lot of ways to measure the cost of creating an LLC. In order to be able to create an accurate visualization, we limited our scope to the cost of the initial filing to create an LLC. Some states cost above $250 just to file for an LLC and some cost hardly anything at all. Check out where your state falls.

Special thanks to Reddit’s gravityTester for providing a great tool for quick visualizations.

S-Corporation

At ZipBooks, we often get asked about S-corps, so we wanted to add them to the roundup as well.

An S-corporation is a legal business entity that is more like what you would consider a “big company”. It’s less cumbersome to set up and maintain than an ordinary “C-corporation” but it does offer many of the same advantages.

On the paperwork side, an S-corporation does come with a number of requirements that must be met, and should be set up with the help of a legal expert as it can be somewhat more complicated than setting up an LLC. For example, bylines must be drafted and adopted, stock must be issued, and annual meetings must be held. Strict guidelines must be met in the running of the company, as well, or the S-corporation designation can be disallowed.

Legally, of course, the structure includes the full separation of business and personal assets. There is no owner liability in terms of debt, or in terms of legal responsibility, for any actions undertaken by the business. (Except in certain cases of gross misconduct or neglect, that is, but not under ordinary circumstances.)

The main advantage to the S-Corp structure for a small business owner is in the way that income is distributed and taxed. An S-corporation pays its owners and employees a “reasonable” salary, on which the company pays half of the “employment taxes”, and the employee pays the other half. The employment taxes paid by the company are tax-deductible as a company expense, and reduce the amount that the company declares as income. (This income is not taxed at the corporate level on Federal income tax returns, but may be taxed on state returns depending on where the company is located.) The owners then report this salary on their individual income tax return, and pay the commensurate taxes on it. However, any additional income that the company then chooses to pay out after expenses have been met, can be distributed to the owners as “dividends” rather than as ordinary income, and will be taxed at a lower rate on the owners’ individual returns.

Read our full guide on S-corporation taxes here.

Considerations before choosing a structure

So there are a number of issues to consider when choosing how to structure your new business:

- Legal/debt protection — either the LLC or the S-corporation is excellent for this purpose.

- Cost to set up/maintain — a sole proprietorship is the simplest and cheapest, as nothing needs to be filed at all. An LLC can cost several hundred dollars in legal fees, and taxes are more complicated, but it is essentially not very complicated or expensive. An S-corporation can be complicated to set up, requires more in the way of legal oversight and accounting, and is more costly to maintain.

- Tax benefits — The clear winner is the S-corporation. Firstly, owners do not have to pay the full weight of the self-employment taxes on their salaries, as the company pays half. And secondly, any excess income paid out beyond the “reasonable” salary paid to the owners is taxed at the dividend rate, which can be far less than the rate assessed on ordinary income.

Please discuss your options with an experienced legal or tax expert before choosing your structure. It is not easy to change from one to another if you choose incorrectly initially.

[end Editor’s insert]

What if I formed a sole proprietorship, but want to switch to an LLC (and vice versa)? Can I do that?

Of course! You don’t need to keep your business incorporated as the same formation forever, simply because you incorporated as one at its offset. It’s always possible to make the switch to a new formation, but it is also not my place to tell you which entity is right or wrong for your specific business. You might want to consult with a legal professional first to decide if this is truly the right move for your company and ask them any questions about what the process entails.

Tim is Founder and CEO of ZipBooks. He keeps his desk really nice and neat.