by Zipbooks Admin

What Is a Schedule K-1 Form?

Taxes can get all kinds of complicated. You have to fill out a series of forms that you don’t understand and then the IRS penalizes you when it’s not done properly. There’s no reason to make things harder than they need to be. So, let’s break down the Schedule K-1 form together.

Very basically, a Schedule K-1 is a tax document used to report income, losses, and dividends of a trust, estate, partnership, LLC, or S corp.

When it comes to federal income taxes, these kinds of entities are known as “pass-through” entities. Essentially, this means that they aren’t required to pay income tax on a corporate level. Instead, the owners figure out their share of the profits and losses and pay taxes individually on their portion of the business’s income.

A Schedule K-1 is fairly similar to a W-2 or 1099, except it gets a little more complicated. It includes a few different categories of income that you have to calculate differently.

Some of these categories fall under capital gains income while others are defined as regular income, so they will have different tax rates. You need to be sure you’re paying the correct rate, otherwise you could up overpaying or underpaying.

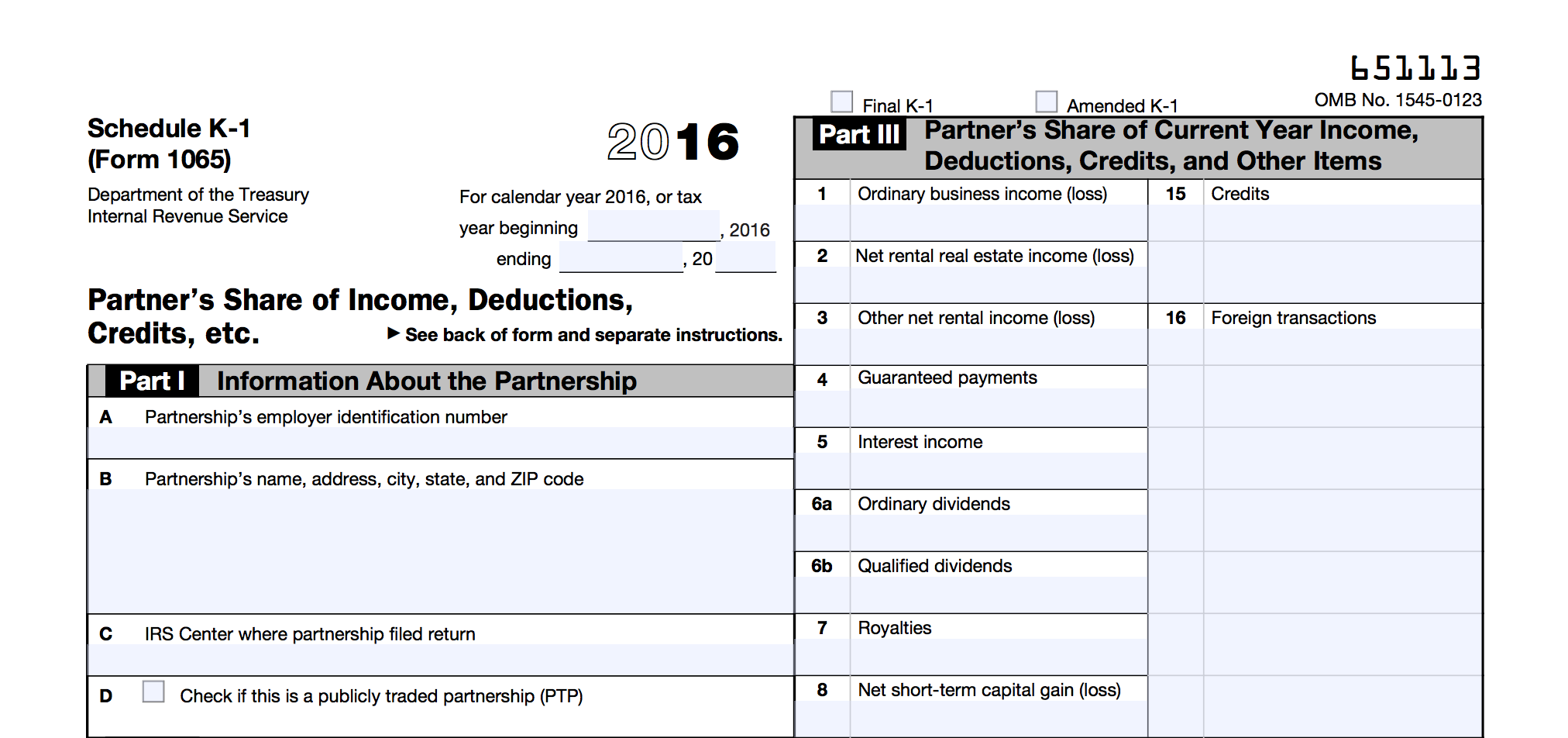

Schedule K-1 1065: Partnerships

For a partnership or a multi-member LLC, the company does not pay corporate-level taxes. Instead, each partner fills out a Schedule K-1 1065 Form to report their own personal percentage of the company’s profits, losses, dividends, deductions, and credits.

For example, say you and one equal partner had a business that earned $100,000 in taxable income. If one partner acts as the business manager for the partnership, that partner will fill out a K-1 for each of them. It will show how much of the business’s income is allocated to each partner ($50,000) and what kind of income it is – ordinary business income, rental from real estate, interest or dividends, capital gains, etc.

Each partner is then responsible for including that income on his or her personal 1040 return, on Schedule SE, Supplemental Income or Loss. The K-1 also has to be filed with the IRS as an “information return”.

When filling out a K-1 for a partnership, some additional information is required that is not required for a K-1 for other business types:

- Partner’s share of profit/loss/capital at the beginning and end of the tax year

- Partner’s share of liabilities at the beginning and end of the tax year

- Partner’s capital account analysis: beginning balance, changes, and ending balance

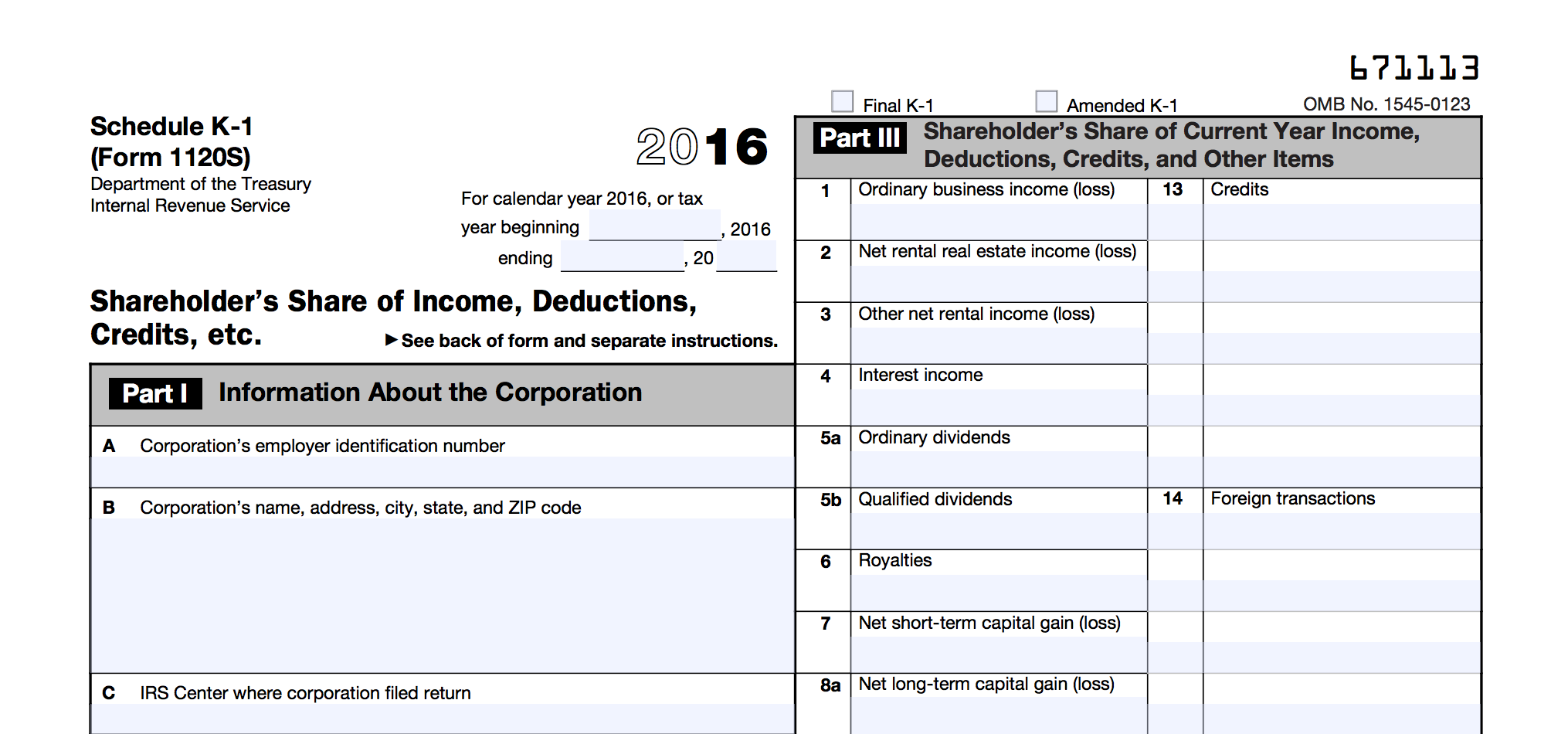

Schedule K-1 1120S: S-Corps

The Schedule K-1 1120S Form for S-corporations is similar to the 1065 for partnerships. However, instead of dividing income between partners, it reports the ownership percentage of each shareholder, and the share of profits, losses, deductions, and credits for each. The shareholders then report this on their personal tax returns, on Schedule SE.

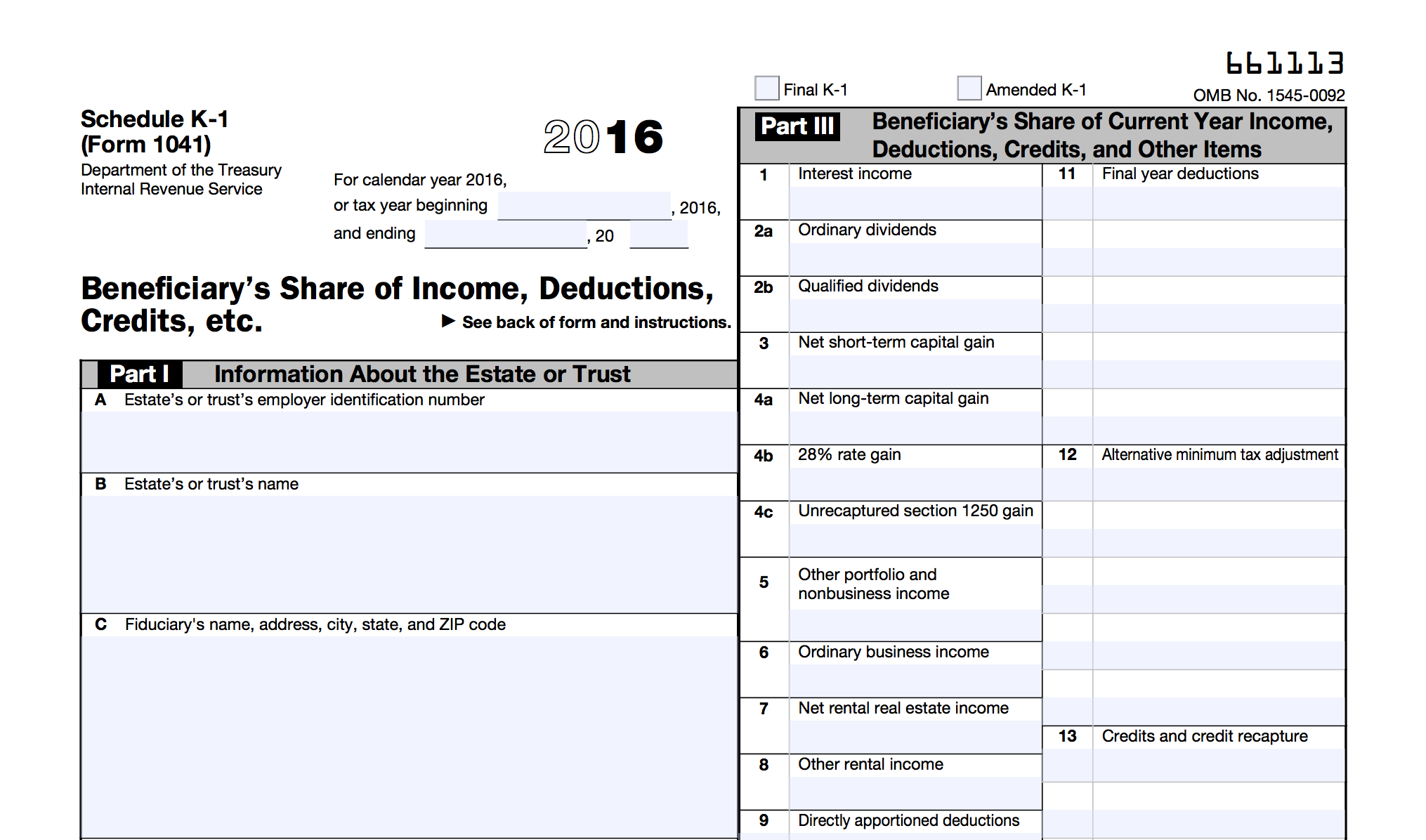

Schedule K-1 1041: Trust and Estate Beneficiaries

When a trust or estate passes its income on to its beneficiaries, the beneficiaries each receive a Schedule K-1 1041 Form. This form will include the amount of income they are responsible for reporting. They then file this along with their personal tax returns. The trust or estate then deducts that same amount on its 1041 so the government will only tax the income once.

Consider Professional Bookkeeping

In order to avoid the headache of taxes, forms and deductions, you should consider outsourcing the financial work to our professional bookkeeping service. We will make sure that you don’t overpay or underpay your taxes. We can also help you fill out all of these forms– and any others you need– properly. Check us out and see if we are a good fit for your small business!