by Zipbooks Admin

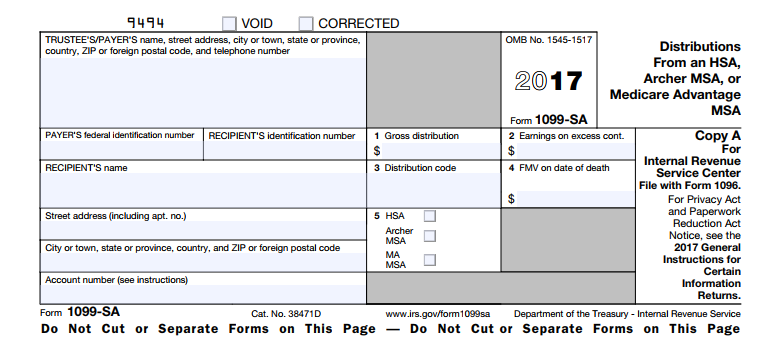

What Is IRS Form 1099-SA: Distributions from an HSA, Archer MSA, or Medicare Advantage MSA?

While most health insurance plans offer the ability to pay for your premiums with pre-tax dollars, there are now some plans that offer additional tax-free or tax-deferred benefits.

If you participate in a high-deductible plan that is paired with a Health Savings Account (HSA) or Medical Savings Account (MSA) for your out-of-pocket expenditures, then your contributions to the HSA were made pre-tax as well. And when you make a withdrawal from the account, the distribution will trigger a 1099-SA from your plan administrator.

What is Form 1099-SA?

Distributions From an HSA, Archer MSA, or Medicare Advantage MSA

You will get a 1099-SA and have to report it on your tax filing if you have taken a distribution from one of the medical savings accounts. However, the distribution will only be taxable if you did not spend the money on qualified medical expenses.

Who is eligible for an HSA or MSA?

Only certain high-deductible health plans (HDHP) are eligible to be paired with a pre-tax HSA or MSA. The requirements are strict for these plans. Your only coverage must be the HDHP (that is, no spousal coverage under another plan), you cannot be a dependent of another taxpayer, and you cannot be on Medicare.

When you choose your plan, your plan description will let you know if it is considered an HDHP and eligible for pairing with an HSA.

Who makes the contributions to the HSA?

You will be the primary contributor to your HSA, generally through paycheck deductions. These deductions are made, like your premium payments, with pre-tax dollars, which can save you a significant amount of money if you are in a high-tax bracket. Your employer may also make contributions to your HSA, although it is not required.

What if I don’t use the money?

In the long term, the HSA can grow untaxed, like a 401(k), until you make withdrawals to pay for your out-of-pocket medical care costs. Any money not spent in the year that you make the contributions simply rolls over to the next year. This can happen indefinitely, and your HSA can really grow if you are fortunate enough to remain in good health.

The very best benefit of an HSA comes in if you don’t use the money: once you reach retirement age, you can withdraw the money for any reason, tax-free. Because of this, some financial advisers will incorporate this into their clients’ retirement plans, but it is best to assume that any money you set aside for medical expenses will actually be used for medical expenses.

What happens when I do withdraw the money?

As long as you are younger than retirement age and use the money for qualified health-care expenses, you will not pay a penny of tax on either the contributions that you made, or the gains that were accumulated while the money was in your account.

When you receive a distribution from your HSA, your plan administrator will issue you a 1099-SA, indicating the amount of the distribution and the amount that is non-taxable.

But the 1099-SA shows my gross distributions! That’s not all taxable!

You can list all of your medical expenses, which should offset the distribution. Even if you normally don’t itemize your deductions, you will want to list all of your medical expenses so that you can offset the distribution.

Your distribution will only be taxable if you have fewer medical expenses than the distribution that you took. You will have to list that on the “other income” line on your tax return, and pay ordinary income tax on the amount. There is also a 20% penalty on the excess distribution, so be careful about the amount that you choose to withdraw, and make sure you are not withdrawing more than you need.

What is the difference between an HSA and a MSA?

In practical terms, they are very similar.

In technical terms, an HSA is available to people who choose an HDHP. They can be self-employed, employed by a small company or employed by a large company. The account can be funded by either the employee, the employer, or both.

The MSA (formally known as the Archer MSA, after the congressperson who introduced the concept as an amendment to the HIPAA law in 1996) was originally created for self-employed people and employers with fewer than 50 employees, who chose HDHPs. It can be funded by the employee or the employer, but not both. MSAs are no longer an option for new health-care plans, but some older plans may still exist.

Medicare MSAs are similar to HSAs but are offered to older people who choose a high-deductible Medicare Advantage (part C) health plan. The contributions to the MSA are then made by Medicare on your behalf, and you can withdraw from the account to pay for your out-of-pocket expenses as needed.