by Zipbooks Admin

Category: Taxes

Thoughts on growing a business, raising money, getting the word out,

and increasing profits. Plus, ZipBooks news!

-

What Is a Schedule K-1 Form?

Taxes can get all kinds of complicated. You have to fill out a series of forms that you don’t understand and then the IRS penalizes you when it’s not done properly. There’s no reason to make things harder than they need to be. So, let’s break down the Schedule K-1 form together. Very basically, a […]

Read More

-

How to Fill Out a Schedule C Tax Form

If this is your first year in business, you are about to experience filing taxes as a business owner. This can either be a complete pain or a piece of cake, depending on how savvy you are when it comes to taxes and deductions. When you’re a regular employee, you receive a W-2 form that […]

Read More

-

Business Expense Categories Take the Hassle Out of Taxes

William Shakespeare famously wrote: “To business expense or not to business expense, that is the question.” Just kidding. Don’t believe every quote on the internet. However, the question has probably haunted you more than Hamlet’s father haunted him. What qualifies as deductible and what doesn’t? How do navigate expense categories? Deductible Expenses If you’re doing […]

Read More

-

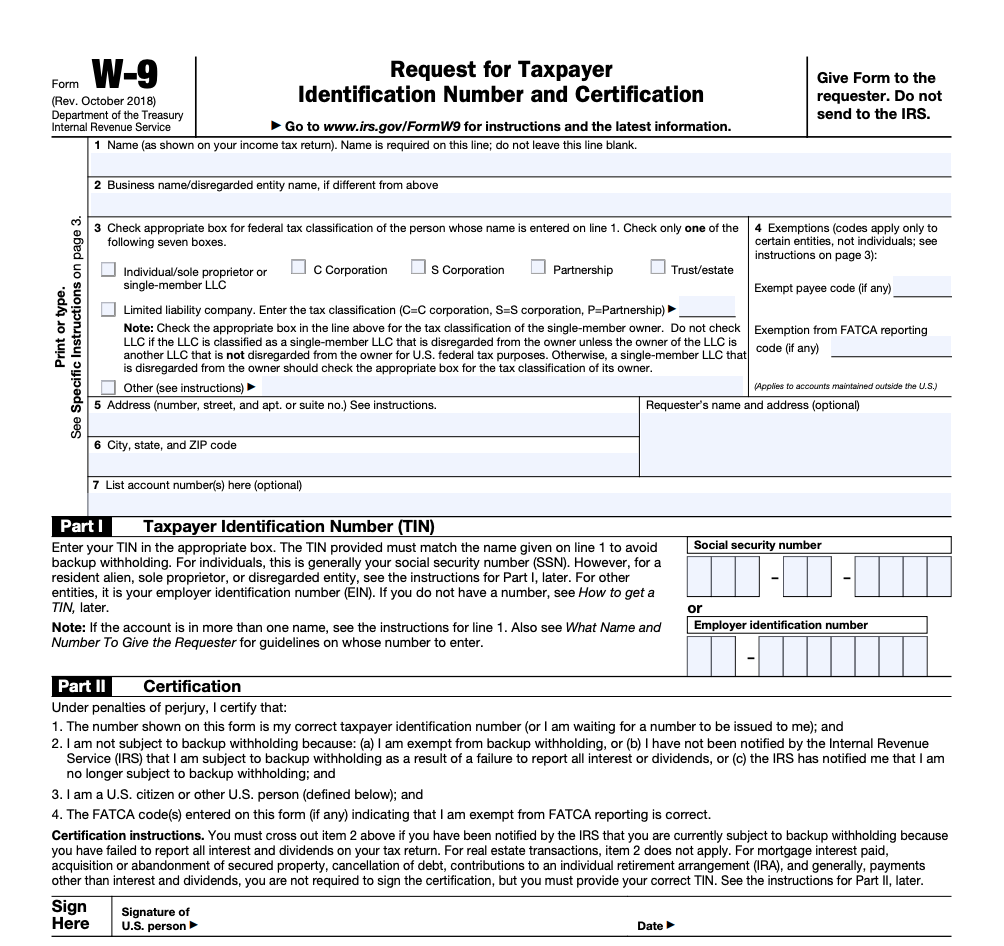

IRS Form W-9

Like all IRS forms, filling out a W-9 form is not very interesting. But W-9 forms are a very necessary part of hiring contractors, so we’ll try to make it as painless as possible. So, you may have heard of a W-4. W-4 forms essentially for hiring full-time employees. They verify the identity of potential […]

Read More

-

It’s Not Too Late to Procrastinate Filing Your Taxes

So today’s the deadline for filing your taxes, but you’ve procrastinated filing your taxes this long, why stop now? With one form from the IRS, you can keep up your streak of “I’m going to get to that really soon” for another 6 months. Then sit back and enjoy that sweet, sweet procrastination. IRS makes […]

Read More

-

S Corporations, Taxes, & You

I put together a presentation on S corps for an Assembled 2017 breakout session and decided to turn it into a blog post. Maybe it’s just me, but I much prefer reading my information to watching it in video form where you are limited by the speed of the presenter. I’m going to walk you […]

Read More

-

Tax Avoidance vs. Tax Evasion

There’s an issue I wanted to address before tax season arrives. There’s a big difference between tax evasion and knowing tax regulations well enough to avoid paying unnecessary taxes. People who don’t know where the line is often try to be safe by staying as far away from tax evasion as possible and end up […]

Read More

-

Small Businesses, Are You on Top of Your Quarterly Taxes?

So you decided to quit your full time job to start your own business. Congratulations! That’s a big step. However, now you’re likely to have a new concern: how to pay taxes. After all, in the past someone probably automatically withheld your income tax for you. Don’t worry–it’s a fairly straightforward process. Now that you work for […]

Read More

-

Tax Deductions for the Self-Employed: a Guide

Updated 04/15/2019 One of the greatest things about being self-employed is the freedom to do your own thing. You are the boss; you make the decisions; you reap the rewards. However, you also pay 100% of self-employment taxes, which would have been split 50/50 with your employer if you held a regular job. Fortunately, though, […]

Read More