by Jennifer Ringger

12 Tools to Make Your Tax Season Less Horrible

The first few months of the new year can either be exhilarating or frightening. If you’re setting new goals, the new year is great. If you’re a small business owner, the fear kicks in because you know tax season is right around the corner.

Filing taxes isn’t necessarily difficult, it’s just a time that accounts for a lot of procrastination. However, with the host of digital tools now available, tax season can be much less of a nightmare.

To simplify the process, I like to break it down into three parts: Capturing information, organizing it, and processing it. Each of these phases has apps and online tools that help make things easier.

Capturing your tax information

Having all of your information in one spot is a must for a small business owner. To accomplish this, you first need to capture all of your information, such as your receipts and invoices. You can use the tools available to upload receipts and track expenses.

Quick PDF Scanner: This is a free, easy-to-use app that has plenty of features. It will import information from local and cloud locations and multiple file types.

Scantastic: Scantastic is a new app. It focuses more on style and design than some of the other apps currently available, but it still performs all the basic functions you need. The one-tap scanning and uploading make this app very impressive.

Receiptmate: This app is one of my favorites because it scans directly to Evernote and auto-detects amounts. It will also keep a running total with very little manual work for the user.

Organize

Now that you’ve captured all of your information, it’s time to organize it. For creative types, the organization is often the worst part of the process. These apps will make it easier.

Evernote: Evernote is one of my favorite apps. It’s the do-everything notebook that can keep track of expenses, income, and job-related tasks. It also integrates well with many third-party apps.

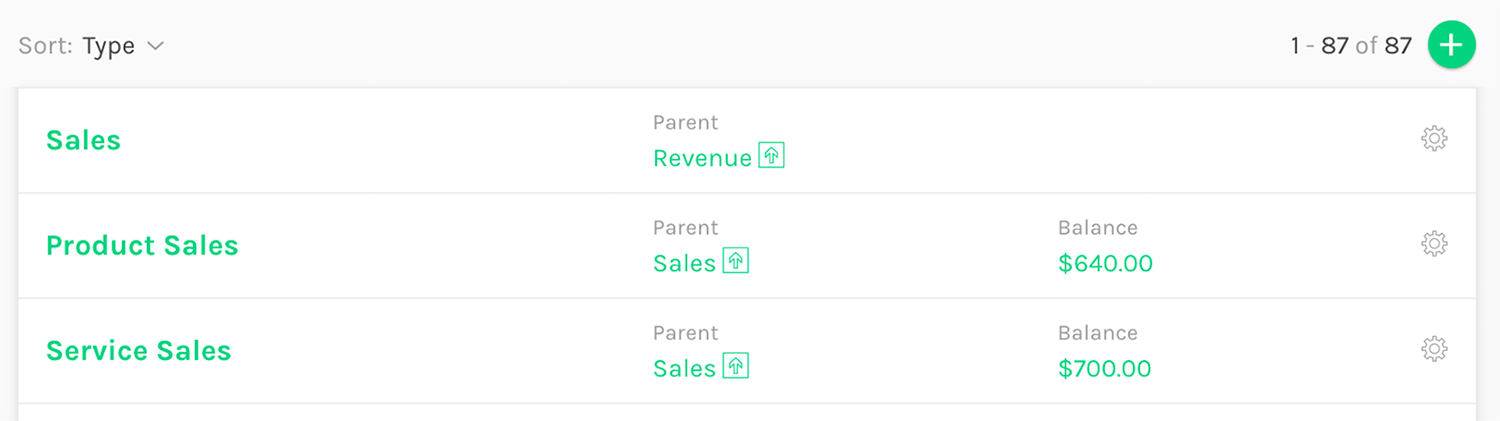

Zipbooks: Zipbooks is newer to the market. This streamlined service allows for online accounting, billing, expense tracking, online invoicing, and credit card payments, to name a few services. My favorite feature of Zipbooks is the dashboard. Here you can view your total accounts receivable, paid invoices, average invoice age, and time tracked by team members, all in one view.

There’s also the always-reliable choices of Dropbox, Google Drive, Box, and SkyDrive to help with the organizational process as well.

Process

OK, now that you’ve captured and organized, it’s time to process.

Mint: Mint is a great choice because it links your bank account and credit cards. This means you can automatically track budgets and tag spending. Mint will also alert you at different thresholds so you know where your money has gone.

Google Sheets: It you’re more of a simple processes type of person, Google Sheets is a good option. With it, you can generate free and simple spreadsheets that you can access anywhere, even from a mobile device.

Shoeboxed: This is a receipt-digitalization app that makes bookkeeping rather painless. User-submitted receipts are changed into images the IRS will accept. This mean you can simplify the tax filing process and maximize your deductions. Simply send receipts through email or sync with a Gmail account.

Free help from the IRS

Yes, the IRS does want to help! Their best tool available is probably the free federal income tax preparing and filing option.

If you make below $60,000 a year, IRS.gov offers free filing software. If you make above $60,000 a year, free electronic forms are also available. Other tools available on the IRS site include a “Where’s My Refund” status, a withholding calculator, and an instant issuer for employer identification numbers.

When to turn to a professional

Even with all of these amazing tools, websites, and apps available, there may come a time when you need to hire a tax professional.

If you have elements beyond the basics, like rental properties, additional sources of income, multiple 1099s, or you have moved out of state, it’s a good idea to consult a professional accountant. According to the National Society of Accountants, the average cost of using a professional tax preparer is around $273. That includes a 1040 tax form with itemized deductions.

Many people don’t want to spend the money to hire a professional, but the cost often outweighs the benefits of missed refunds or opportunities to save.

One last tip

Filing taxes earlier in the season will often earn you discounts. The closer you get to the April 15th deadline to file your taxes, the more rates will go up. Earlier in the season you can find great tax deals, like free returns.

Tax season doesn’t have to be scary or intimidating. When April 15th rolls around, just make sure you have all of your documents in order and are using the tools available to help you with the process. There’s many free or inexpensive resources available for small business owners.