by Zipbooks Admin

When to Use Tax Form 1099-C for Cancellation of Debt

Sometimes, despite your best efforts to manage your debt responsibly, the situation gets out of your control and you find yourself owing more than you can reasonably pay back. In that case, there are ways for you to negotiate with your creditors so that they accept less than the total of what you owe.

Unfortunately, when you do manage to pay less to your lenders, the IRS may slap you with a large tax bill. How can this be fair?

What is Form 1099-C?

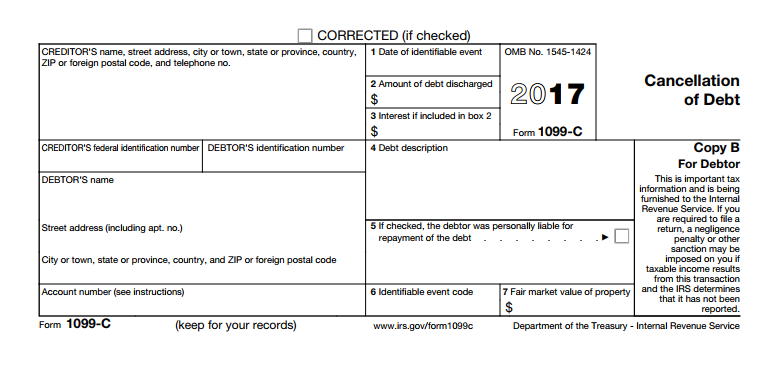

Cancellation of Debt

In the event of a debt write-down, your creditor will file a 1099-C with the IRS. They will also mail a copy to you so that you can report the debt cancellation as income when you file your personal taxes. Like other 1099 forms, the 1099-C is an “information return”. This means that the lender sends a copy to you and to the IRS. Therefore, the IRS knows that you have received this form, and expects to see such information included when you file your 1040 personal tax return.

Here’s what a 1099-C looks like:

Why is cancelled debt taxable as income?

This is a good question, and one that frustrates many people who are on the receiving end of a 1099-C. The fact is, the lender originally loaned you money with the understanding that you would pay it back in full with interest.

However, when the lender agreed to forgive some or all of the loan balance then that debt forgiveness becomes taxable as income because they are essentially “paying” the debt balance for you.

So, as unfair as it seems, the IRS wants their share of tax on that income. You may be surprised to find that you have to add the cancelled debt to your earned income for the year, and dismayed by how large the tax bill can become.

The most common types of debt forgiveness that will trigger a 1099-C from a lender include credit cards, but many real estate transactions will also fall into this category; repossession, foreclosure, return of property to the lender, abandonment of property, or modification of the loan on your principal residence.

Help from the Mortgage Forgiveness Debt Relief Act

Fortunately, the government recognized that this could be an issue after the housing crisis that began in 2007, and Congress passed the Mortgage Forgiveness Debt Relief Act for struggling homeowners. This act permits you to exclude the income that comes from debt cancellation on your primary residence, but applies only to debt that was forgiven in the years from 2007 to 2016. It also applies to debt forgiven in 2017, as long as the agreement was in place in 2016.

Additionally, the excludable debt forgiven was limited to $2 million for a couple that filed jointly ($1 million for someone filing separately.) For most homeowners, this provided full relief for the amount of mortgage debt that they were able to renegotiate with their lenders.

Other Non-taxable Situations

The tax that would ordinarily be assessed on income that is classified as Cancellation of Debt can be avoided in a few other situations:

Bankruptcy – If the cancelled debt was included the cancelled debt in a discharged bankruptcy proceeding, or a proceeding that is currently in process.

Insolvency – If you can show the IRS that you were essentially insolvent at the time the debt was cancelled. You can fill out Form 982 to prove your solvency status.

Student loans – Certain student loans that were forgiven by an educational institution can be non-taxable. The institution has to be tax-exempt and you have to agree to work for a particular number of years for a qualified employer. More information can be found in Publication 970.