Billing and Invoicing Software

Get paid any way you want — from simple credit card acceptance to fully automated auto-billing, all through smart and seamless software.

Every business needs an efficient way to keep the cash coming in. ZipBooks gives you a smart method of keeping your billing on track and on time, while providing you feedback as you go. Choose regular invoicing, or set up a subscription for continuous billing that you can customize to your needs.

Billing Management

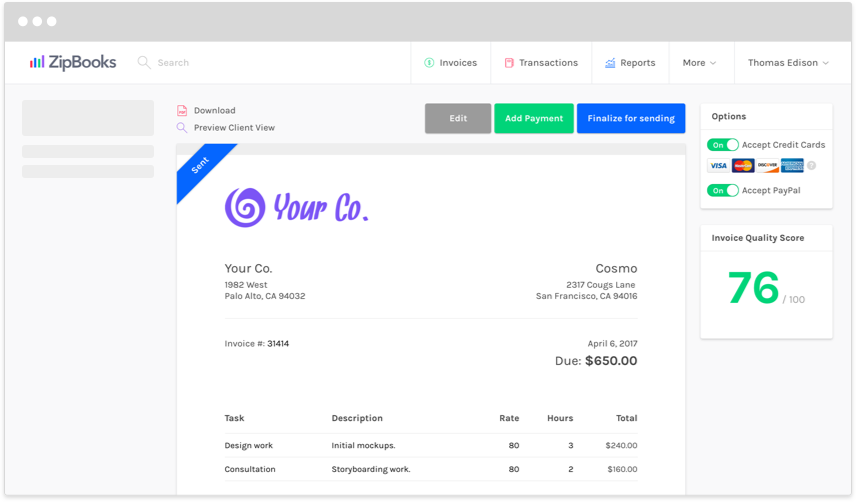

Customize your invoices according to your needs by adding your logo, specific colors, and contact info. Stay up to date by keeping track of customer payment and invoice history, overdue balances, and taxes collected. See when your customer has opened an invoice, and prepare and view receipts.

Smart Feedback

Do you want to know how and when your invoices could be better? ZipBooks will provide you with an Invoice Quality Score based on research from 200,000+ invoices. We’ll tell you which details matter and how to tweak them so you can keep customers and get paid faster.

What to look for in billing software

It can be easy to get lost in the sea of competing invoicing and billing solutions out there. We think ours is worth considering! (But, of course, we’re biased). So we thought it would be helpful to put together a guide letting you know what you should be looking for in a modern billing solution. Here it is.

Professional invoicing

In 2019, there’s no excuse for not appearing professional. There are too many tools available for free or cheap. You simply won’t look credible if you’re still sending hastily-edited word processor documents as invoices.

ZipBooks, and other tools as well, solve this problem for you by allowing you to customize and send a professionally-designed invoice. It’s simple in ZipBooks you to add your own color and logo, so the invoice has your brand identity, while retaining standards that make for a professional invoice.

You should make sure that any invoice you send has a complete item name and description, quantity, and price. If you’re billing for services instead of products or goods, the invoice should reflect that by showing “rate” and “hours” instead of quantity and price. (Yes, ZipBooks supports this, and it’s easy to do!)

Electronic sending and payment

When you’re ready to send your invoice, the modern way is to do it over email—your billing app absolutely must support this feature. Yes, you can still print an invoice and mail it, but customers appreciate the convenience of receiving an invoice in their email. You’re also likely to get paid more quickly when your invoice arrives instantaneously (as opposed to the two-to-three-day lag through traditional mail).

And speaking of getting paid quickly—it’s imperative that you offer integrated credit card processing (and ideally, ACH or bank transfers), through your invoicing system. On average, customers pay 15 days faster when they pay via credit card. You need to be aware, of course, that you incur fees when accepting credit cards (usually in the 3% range; see ZipBooks pricing here).

Often, these fees are negligible compared to the importance of getting cash in the bank quickly; in that case, credit card payments are a great way to get paid. When selecting your billing solution, make sure you know how quickly you’ll be paid out.

Most commonly, when you accept a credit card, that payment will get sent immediately to a “merchant account,” a temporary holding place for the funds your customer has had charged to their card. Depending on your merchant account provider, those funds can sit in that account for up to several days. The transfer from that account to your checking or other account can take several more days. Be sure to understand what those terms are when you’re selecting billing software.

Trusted ZipBookers can get those payout times shortened (in total), to about two days, as fast as just about anything in the industry.

Time Tracking

For many businesses — especially service businesses — time tracking and billing are inextricably linked. From lawyers, to graphic designers, to plumbers, there are many professions and businesses that bill time directly.

Many of these types of businesses track their time in a spreadsheet or elsewhere, then multiply their rates and manually enter all of that into an invoice before sending it to their customers.

In 2019 that’s a completely unnecessary workflow. Software solutions like ZipBooks automate all of it.

In ZipBooks, time tracking businesses can start a timer with a click of a button, and that time can be assigned to a customer, a project, or nothing at all. When an invoice is being created for that customer, ZipBooks can pull in all of those time entries, do the math, and create line items automatically. It’s even customizable to allow for project rates or staff rates, depending on how you bill.

All that said, not all time tracking is created equal. ZipBooks has an advanced time tracker that keeps time across devices (you can check your live time tracker on mobile, or web, or both, and it’s always in sync). It even keeps tracking if you accidentally exit the program. We know how annoying it is to lose tracked time — we’ve been there! ZipBooks makes sure you’re in control of your tracked time.

Other apps may have or integrate trackers may be more well-suited for payroll or time and attendance.

Pass-through expenses

Many businesses incur expenses on behalf of their clients. Imagine a graphic designer that purchases stock photos or art to put in a client website; that expense will often be sent through for the client to pay.

Great billing software makes this easy. If you handle this type of expense (and most businesses do, at some point), make sure that it’s fully supported by your invoicing solution.

In ZipBooks, for example, when you incur one of those expenses, it will show up in your transactions list (either because we imported it from your bank, or because you added it in manually). Once you see it there, simply add a customer’s name under “Pass through to customer.” The next time you create an invoice for that customer, you’ll be able to pull in the expense with its amount and details at the click of a button.

Recurring billing

Did you know that when you’re getting investment or selling your business, recurring revenue can be valued as much as 3x other revenue? The most profitable businesses — and the most valuable ones — are built on recurring revenue.

For that reason, it’s important that your billing software be able to handle recurring billing. As you make recurring deals, you want to make sure that you can count on that revenue to turn into cash reliably.

Advanced billing software makes this easy — in ZipBooks, for example, you can bill on weekly, monthly, quarterly, or annual schedules. And not only that, you can set start dates and end dates, and schedule discounts. You can easily create, pause, and set live recurring invoices. You can choose whether you want to send an actual invoice or just a receipt, and even pull in unbilled time and expenses (like we talked about in previous sections).

Discounting and taxes

Invoices aren’t always straightforward. Sometimes, yes, they’re as simple as adding the line items from your time or products.

Other times, they’re more complicated. You may need to add taxes, for instance. Sales taxes and VATs are common scenarios. You may need to apply these types of taxes to some line items and not to others, so when you’re testing, make sure that your billing software can handle that (again, ZipBooks does this beautifully!). In ZipBooks, you can handle up to two separate taxes per line item.

You may also want to discount your invoice. Like with taxes, this may be across the entire invoice or apply just to certain line items. On recurring invoices, it may be only for a short period of time. All of this functionality will be available in modern, advanced invoicing apps.

Saved items and inventory

It’s not uncommon for businesses to have “items” (whether they be goods or services) that they reuse across many clients with standard names, descriptions, and prices. It can be a hassle to enter these manually each time (even if you are a master copy-and-paster).

Modern billing software should manage this for you by offering some sort of “saved items” functionality. In ZipBooks, you can do this in two ways.

First, you can simply create a saved item by adding its name, description, and price. That item can then be simply selected as you start typing in a name in the invoice line item.

Second, you can create a saved item from an existing line item. Simply click the icon to the left of the line item, and we’ll automatically save that item for future use.

Many small business owners complain about the amount of time they have to spend billing. As we’ve already addressed, this can be significantly mitigated by using electronic sends and reminders, and in some cases with integrated time tracking. The ability to save items for future use is yet another way to spend less time invoicing, and more time doing what you’re best at.

Reminders

Even the best businesses don’t always get paid on time. It’s a fact of life. Clients sometimes have cash flow problems of their own, or are simply forgetful, or have deprioritized accounts payable management.

This often means you, the business owner, end up having to follow up — sometimes multiple times — before you get paid on an invoice. This is both awkward and time-consuming.

Billing solutions like ZipBooks help alleviate this pain with automated late payment reminders. With reminders, you can set up an automated email to send to your clients a certain number of days after their invoice is due.

This can help alleviate awkwardness in that the reminder comes from an automated system — ZipBooks is the sender, and it’s simply following an objective set of rules. It also helps save the time of manually tracking accounts receivable and sending emails to clients to urge them to pay.

One caution is that you’ll want to be very judicious in setting up email reminders; billing software can’t exercise judgment when it’s deciding whether or not to send one. Often client relationships require some finesse and you should only set up automation when you’re absolutely sure you want emails to go out on their own.

Estimates and Quotes

Invoicing is often a two-step process: first, sending an estimate or quote to a potential customer so they know what to expect when it comes time to actually pay. Then, sending the invoice when the work is complete.

Your billing software should be able to handle this. In many invoicing solutions, estimating and invoicing are two sides of the same coin. That’s true in ZipBooks, where estimates look just like un-payable invoices. The workflow for creation is very similar. The difference is in how the customer or client responds: with an estimate, the client approves it; with an invoice the client pays it.

Once you have an approved estimate, ZipBooks allows you to convert that estimate to an invoice with a click.

Seamless integration into your books

Billing is inextricably linked to the rest of your accounting transactions.

As an example, when you send an invoice, your accounts receivable should (usually) increase — accounts receivable meaning the amount of unpaid bills you’ve sent out. When the invoice is paid, the accounts receivable should decrease.

Some invoicing apps don’t tie directly to your books; they may show an “accounts receivable” figure, but in reality, that’s just a number added up from invoice totals on invoices that haven’t been marked as paid.

More advanced accounting and billing apps (yes, like ZipBooks) actually log proper accounting transactions when actions take place on an invoice. The advantage of doing it this way is that you have a detailed record of everything that’s happened that affects accounts receivable — you can simply look back at the transactions. It also means you can have other transactions that affect accounts receivable outside of your standard invoicing process, and the number will remain accurate.

When you get paid, not only does your accounts receivable go down, but your cash balance should go up. In billing apps that are truly integrated into your books, this cash balance is accounted for and gives you a true understanding of where your cash is at. In more basic accounting or invoicing solutions, you can mark something as “paid” but still have a foggy picture of where your cash is at — one of the most important metrics of running a great business!

That’s it for now

I hope this guide has helped you understand what you can expect from a modern billing solution. We’ll keep this updated as technology advances so you can make sure you’re using best practices as you continue to grow your business.