by Zipbooks Admin

What does a bookkeeper do?

We get this question a lot.

That’s probably due to the business we’re in (accounting software, with a healthy dose of bookkeeping on the side).

Either way, we talk about it all the time.

What does a bookkeeper actually do?

There are often other questions that go along with that one: are bookkeepers the same as accountants? Do they do taxes? Are they they also CPAs?

We’ll go through each of those in turn, but for those out there with short attention spans (✋), here’s your TL;DR:

TL;DR

A bookkeeper makes sure that you have accurate, up-to-date financial statements — primarily, an income statement and a balance sheet — that show you exactly where your business has been and where it’s at.

There’s no formal designation or certification required to be a bookkeeper — bookkeepers may or may not be CPAs, and in their function as a “keeper of the books,” they do not prepare taxes.

What are the “books,” anyway?

The books, in this context, refer to the financial records of the business. Again, the income statement and balance sheet are the biggies here. When your books are “kept,” that means that those financial statements are up-to-date and accurate.

The Chart of Accounts (it’s not as scary as it sounds)

Ok, so how does the bookkeeper keep those books?

The very first thing a bookkeeper should do is get the chart of accounts set up correctly.

A “chart of accounts” might sound a bit scary, but it’s not! It’s basically accountant-speak for the group of categories that a business’s transactions could pertain to.

Let’s say you have a business, like ZipBooks, that sells both products (in our case, software) and services (in our case, bookkeeping). Though you certainly want to know how much you’re doing overall in sales, you’ll probably want to see a breakdown of how your sales are going on both the products side and the services side, too. That way, you can see more specifically what’s working, what’s not, and where you might want to focus.

So what your bookkeeper will want to do is set up three categories (or “accounts”) for your sales.

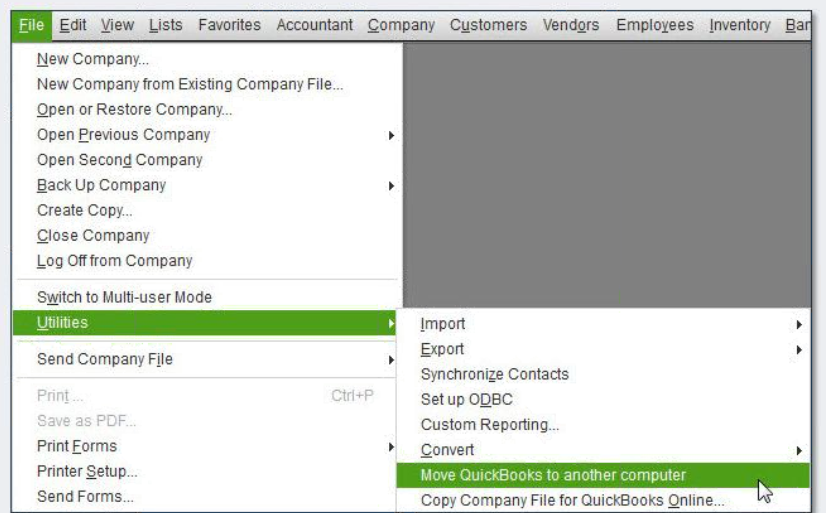

Three, you say? Why, yes! Your bookkeeper will set up a “Sales” category first. Then, they’ll set up a “Product Sales” category, and a “Service Sales” category, both of which are children to your “Sales” category. A chart of accounts is always hierarchical — you can have categories with subcategories, as many levels deep as you’d like. In ZipBooks, our example setup looks like this:

What’s cool is that with those three accounts (let me emphasize again: when I say “account” you can think of that as a “category”) I can now see what’s going on, sales-wise, at any level I want to. I can look at just my product sales, just my service sales, or my total sales, by looking at one of those three accounts.

Of course, sales categories aren’t all that a bookkeeper will set up.

They’ll want to set up accounts for other things as well, like expenses — some common expense categories might include Software Subscriptions, Payroll, Rent, Office Supplies, or more (your accounting software may give you a reasonable default list of accounts for you to start with, like ZipBooks does).

A good bookkeeper will customize any default list to be as granular as you’d like. Note that there’s a trade-off here: the more accounts they create, the more specific your reports will end up being; the fewer they create, the easier it will be to categorize.

You may be thinking, “This is easy! I might as well do this myself.” Well, that’s definitely possible — you might be right! But one word of caution: there are a few categories that may need more advanced setup.

As an example, say you’ve purchased a truck for your business. That will need its own “account,” or category, so it gets tracked an asset that’s worth something on your balance sheet (don’t worry — we’ll talk about balance sheets in a bit). Smaller items, like pens or pencils, don’t need to be set up as assets — you can simply classify your purchase as an expense.

But what about those in-between items, like computers, for instance? An experienced bookkeeper, though they may not know the tax rules about what should be tracked as an asset and what can simply be marked as an expense, will know that they’re in an area where they’ll want to be careful, and bring in outside knowledge, if necessary. They’ll also make sure to set up the books so that any future changes will be easy to make.

Categorization

Once a bookkeeper’s got our chart of accounts set up, they’ll begin the work of categorization (you might also hear this called “classification”).

This is where a large percentage of the bookkeeper’s work takes place. In very small businesses, there might be very few transactions and not a whole lot to do. But when businesses get a little more complex, the task of correct categorization can start to be time-consuming.

In a typical modern accounting system, you’ll often have a bank account connected to import transactions automatically, leaving your bookkeeper with a list of uncategorized transactions to categorize. In ZipBooks, that looks like this:

You’ll see a few different items of information here, depending on the transaction: at a minimum, you’ll see the date of the transaction, the amount, the bank memo, and the account the transaction came from. Sometimes, that’s all that your bookkeeper will have access to. In that case, they’ll need to get to know the business in question quite well, so they know how to categorize the transaction correctly.

Let’s go through these one at a time to understand a little bit more about the bookkeeper’s work.

At the top of the list, on February 28, we immediately see a $15 deposit into our Chase Checking account. Our bookkeeper would know that we have a software plan that costs $15/mo, so that’s almost certainly sales for software. The bookkeeper would then feel confident categorizing that as “Product sales,” using the category we created earlier.

Next, we see a $360.30 withdrawal on February 13 from our Chase Checking account with the memo “Gusto withdrawal.” We use Gusto for payroll, so our bookkeeper will feel confident categorizing that under Wages.

On the next line, January 30, We see a $95.33 withdrawal with the memo “Costco purchase.” And here’s something we haven’t seen before — a pre-categorization with a little 61% next to it. Allow me to brag about ZipBooks for a moment: what you’re seeing here is our AI-powered auto-categorization. ZipBooks has seen an expense like this in the past, so it went ahead and took a stab at categorizing (making the work easier for the bookkeeper!).

The number next to it is the “confidence score,” indicating how confident ZipBooks is that it got it right (it’s orange because ZipBooks isn’t too sure about this one). The more transactions ZipBooks has seen that have similar attributes, the higher its confidence will be. The bookkeeper’s job, then, is to just make sure the category looks right, and change it if not. In our example, we shop at Costco for office snacks, so that is correctly categorized as an Office Expense — we’re all set!

And so on and so forth. On those final two, if you guessed some kind of Software expense for the first, and thought the auto-categorized Travel looked right for the second, then you’re well on your way to becoming a bona fide bookkeeper! ?

As you can imagine now that we’ve gone through the workflow, when you first bring on a bookkeeper to help with your business, it will require a lot of communication. A bookkeeper may see “Costco,” but have no idea why you shop there. They’ll likely get in contact, ask you about it, and do the categorization. As the bookkeeper becomes more accustomed to the ins and outs of the business, they’ll be able to do more and more without needing input.

The accounting equation

Ok. We get why and how a bookkeeper sets up a chart of accounts, and how they go about categorization, at least at a high level.

With that knowledge, let’s get a little deeper understanding of what the bookkeeper is really doing here.

Remember those categories from the “chart of accounts” our bookkeeper spent so much time setting up? And remember how that chart of accounts is hierarchical, with sub-categories? Well, here’s the most basic way that applies: every account in a chart of accounts is actually a child to one of three fundamental accounts: Assets, Liabilities, and Owner’s equity.

These three fundamental accounts, or categories, interact in a way that will give you an exact picture of what’s going on financially in your business. That picture is what’s called the accounting equation:

Assets = Liabilities + Owner’s Equity

It’s important to remember that this equation is always true in bookkeeping and accounting, when best practices are followed. Why it’s always true will become clear once you understand those three accounts.

Stay with me on this — if we can get through this somewhat technical portion, a bookkeeper’s work will really start to click!

Assets

An asset is a some sort of property that has value to the business.

Cash is an asset. Land and equipment are assets. Inventory is an asset.

But so are things like “accounts receivable” — debts owed to you. Though accounts receivable aren’t tangible, they represent a future claim on other, more tangible assets (like cash), and therefore are classified as assets.

Now, how does your business acquire assets? Well, there are two fundamental ways — through liabilities, or through owner’s equity. Let me explain what I mean.

Liabilities

A liability is a debt owed by the business to an outside party.

Let’s go back to our example where your business purchased a truck. One viable way to purchase a truck is to get a loan for it. Let’s say the truck costs $10,000, and we also got a loan for that amount.

Our bookkeeper would categorize the transactions such that the company’s assets increased by $10,000 (the value of the truck), and its liabilities increased by $10,000 (the value of the loan, a debt we owe to someone else) — thus keeping our accounting equation true (since it increased by $10,000 on both sides).

In this case, we acquired a new asset by correspondingly increasing our liabilities. The other way we can add assets is through owner’s equity.

Owner’s Equity

Owner’s equity is value that represents the owners‘ claim on the business’s assets (unlike liabilities, which represent a debt holder’s claim).

As a simple example of owner’s equity, let’s say we’ve just formed a new business. We need $10,000 to get started, so we dig in to our savings and contribute that amount to our newly-created business bank account. Our bookkeeper, in turn, sees that transaction and does two things: first, they increase the Cash (which is an asset!) category/account of the business by $10,000, and then increase the Owner’s equity category of the business by $10,000.

The first move the bookkeeper made should be intuitive — the business certainly has $10,000 of cash assets it didn’t have before. The second is a little less clear; why did Owner’s Equity increase?

Well, if we look at our definition, owner’s equity represents the business owners’ claim on the business’s assets. Let’s say we shut down this business right now. Where would that $10,000 go? Right back in our pockets! Or, we could keep the business going, but decide to take a distribution from the business — that would be fine to take any amount up to $10,000, because as the owners, that’s our claim on the business’s assets.

Once again, our accounting equation remains true — both sides have increased by $10,000.

Sales and Expenses

But wait, you say! There’s another way we could increase the assets of the business (cash, truck, or otherwise) — by generating sales! And you’re absolutely right. But here’s the key point — sales and expenses, eventually, roll up to owner’s equity. If I got paid for $10,000 worth of work, then the business has $10,000 more in cash assets than it had before, and it’s not due to any debt; it was my hard work! As the owner of the business, that value has accrued to me.

But what if there are some expenses involved?

Let’s say I sold $10,000 worth of ice cream, but before I made that sale, I had to pay $5,000 to produce it (buying milk, sugar, vanilla, paying for shipping, etc.). My $5,000 profit — sales minus expenses — is what I’ve contributed to owner’s equity.

And here’s what really happened here, from the bookkeeper’s perspective: when I bought my supplies, the bookkeeper saw a $5,000 withdrawal from our bank account, and categorized that as as an expense like Supplies or Cost of goods sold. With that bookkeeper’s categorization of that transaction, my cash went down $5,000, and my expenses went up by that same amount. And here’s the key point: because Expenses roll up to Owner’s equity, my owner’s equity has decreased $5,000.

Next, I made the sale, and our bookkeeper saw a $10,000 deposit into my bank account. They categorized that transaction as Sales or Product sales. So when the bookkeeper did that categorization, my sales went up $10,000, and so did my cash. And here’s the key point with this one: because Sales rolls up to Owner’s equity, my owner’s equity increased by $10,000.

If we sum the $5,000 decrease in owner’s equity, and the $10,000 gain, we have a $5,000 net increase to owner’s equity!

Double-entry accounting

You may notice something happening here — with each transaction, we’re moving two different categories, as in the examples:

- With the loan, cash went up and so did liabilities

- With our supply purchase, cash went down and expenses went up

- With our sale, cash went up and sales went up

This two-category movement on each transaction is why it’s called “double-entry accounting!” With each transaction, the bookkeeper really makes at least two “entries,” to at least two different accounts.

Further reading

Reports

Whew, ok.

We’re out of the woods on the accounting equation. If you remember, WAY back before all that, we said that the primary goal of the bookkeeper was to prepare accurate, up-to-date financial statements. Once the bookkeeper has done all of the categorization so it’s up-to-date with all of our transactions, we’re ready to go ahead and take a look at those statements.

Income Statement

The income statement (also known as a “Profit and Loss” or “P&L”) is arguably the financial report that matters most to many small business owners. The income statement shows exactly what happened in your business — sales- and expense-wise — over a particular period of time.

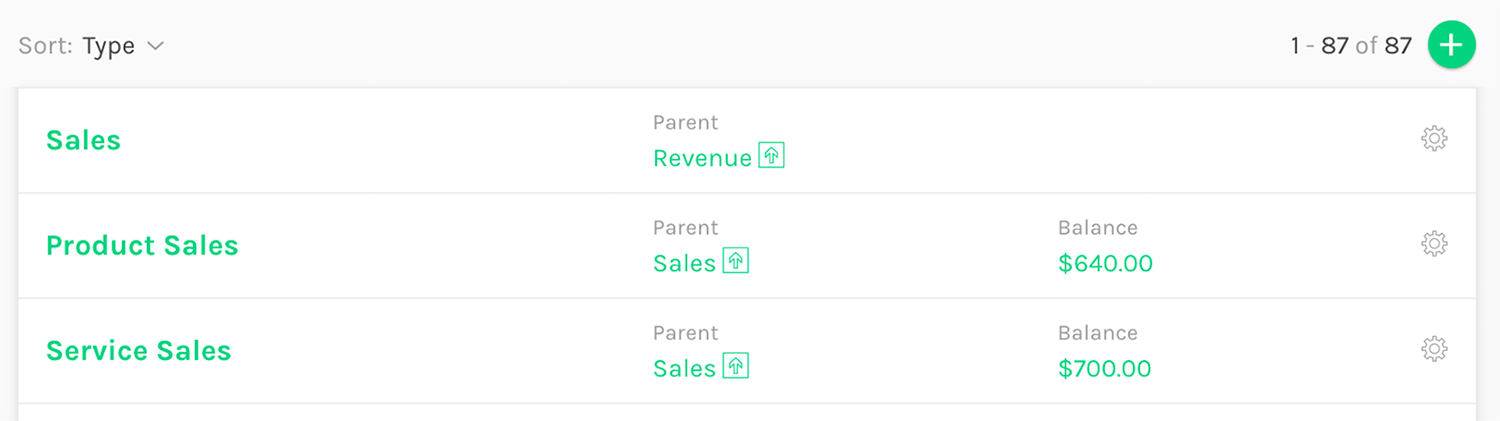

Here’s an example income statement (this is how it appears in ZipBooks):

Let me call your attention to a few things here. First, the left column is made up of the categories we’ve been working with for our chart of accounts (for simplicity, I combined service and product sales here). In other words, your bookkeeper’s setup and categorization efforts have culminated in this beautiful, up-to-date income statement!

Any modern accounting system will do something similar. Once the bookkeeper’s done their work, all of the math will be done by the software to output a similar report (though yes, we think ZipBooks makes this a bit easier to read with color-coding and easy-to-use filters and controls).

This is the first part of your business’s “books” that have been kept by your bookkeeper. Note that once this is done correctly, you can slice and dice anyway you like. You can look at one column or many; you can show monthly, quarterly, or annual results; in some systems, you can even toggle between the cash and accrual method, and in ZipBooks, you can filter different business units, locations, customers, vendors, or projects with advanced tagging.

Let me note that the income statement does not tell you how much your business has in assets, liabilities, or owner’s equity. That’s not its job: the income statement simply gives a detailed breakdown of the income and expenses your business has had over a period of time.

Because sales and expenses roll up to owner’s equity, like we talked about, you can derive the change that your owner’s equity has experienced over that time due to profit or loss, just using the income statement. But it doesn’t tell you where your owner’s equity is at.

That’s a job for the balance sheet.

Balance Sheet

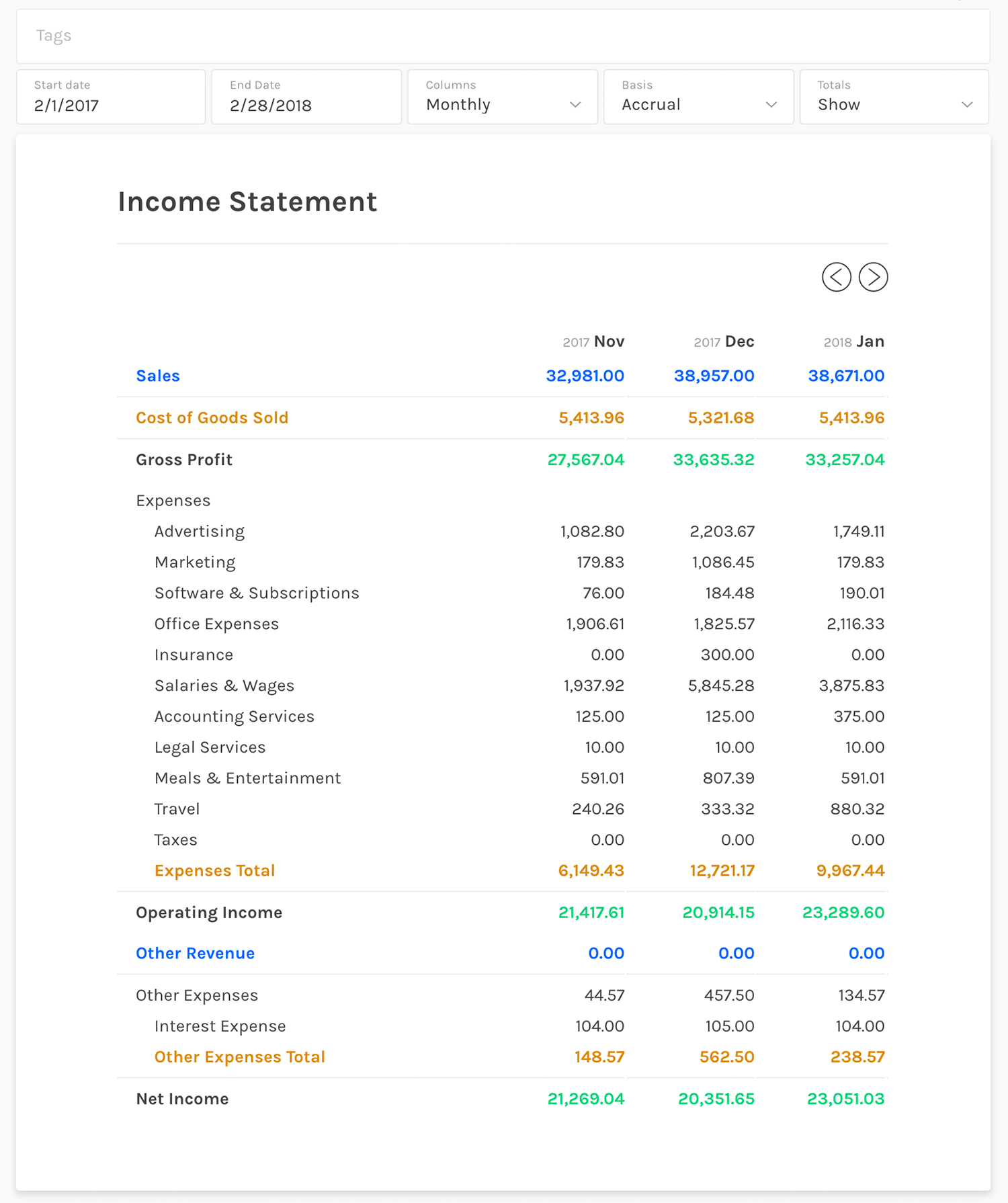

The balance sheet, unlike the income statement, captures a single snapshot in time — where you’re at in any given moment. It details the amounts your business has in assets, liabilities, and owner’s equity.

You’ll notice there’s no date range — there’s simply an “As of” field where you choose the date for which you’d like to see that moment-in-time snapshot. Here’s what a balance sheet looks like in ZipBooks:

If you look at the categories (accounts), you’ll notice that they should all fall in line with the definitions we gave earlier for each of our three fundamental categories:

Assets contain the business’s valuable property, like cash (in your bank account), accounts receivable, and inventory (which no, isn’t as “liquid” as cash, but still has value!).

Liabilities contains a credit card balance (which is, in essence, a loan from your credit card provider), and accounts payable (which is, in essence, a loan from your vendors).

Equity (which we’ve been referring to as Owner’s equity — don’t worry, it’s the same thing) contains categories like those we’ve talked about, that indicate value that belongs to the owners of the business: Invested Capital (either from you, or some other owner, like professional investors), and Retained Earnings, which is where your profits, like the ones we discussed above, will go.

So why is this called a “balance sheet”?

Remember our fundamental accounting equation?

Assets = Liabilities + Owner’s Equity

Look at that “equals” sign. Essentially, that’s another way of saying “what’s on the left balances with what’s on the right.” And the balance sheet expresses exactly this equation!

Take a look at the two blue, bolded lines. The first one is “Total Assets,” the second is “Total Liabitilites and Equity.”

That’s our equation! As long as your bookkeeping has been done properly, your business will always “balance” on the two sides of the equation, and that will show on your balance sheet.

Other reports

Of course, there are other reports you’ll see in any major accounting system — the cash flow statement perhaps chief among them. For our purposes, there’s just one thing to know about each of these reports — if our bookkeeping has been done properly, then all the heavy lifting is already done!

Just as the income statement and balance sheet are generated by software once transactions are categorized appropriately, most (if not all) other reports that have managerial value will be able to be generated automatically based on those transactions.

Bank Reconciliation

Remember 20 years ago, when people had to “balance their checkbooks”? The reason we had to do this was because we needed to know exactly how much was in our bank account. We didn’t have online banking that enabled a quick check to see what remained. So we had to go through transaction by transaction, making sure each was accounted for.

In business accounting, bookkeepers go through a similar process called “bank reconciliation.” Just like in the balancing of a checkbook, an accounting system needs to make sure that each and every transaction is accounted for in order for its books to be correct.

As an example, let’s say that my brand new business bank account, which started out with a balance of $0, had three transactions in its first month of existence: two $10 expenses, and one $100 sale. My cash profit on these transactions was $80, so my bank account balance increased to $80.

Now, I want to log those transactions in my accounting system (let’s ignore automatic bank connections for now). I do the expenses first, and get those in successfully. But when I enter the transaction, I fat-finger it and only enter $10, instead of $100.

Now, I take a look at the balance my accounting system thinks I have in my bank account. It tells me I’m $10 in the hole! (Because I entered $20 in expenses, and only $10 in sales).

The reconciliation step is the workflow a bookkeeper will go through to find and fix this problem.

In a typical reconciliation, a bookkeeper will download your monthly bank statement, and will go through each and every transaction in a given month, matching it to one in the accounting system. When they find discrepancies, they fix them and get the two in alignment. That’s reconciliation.

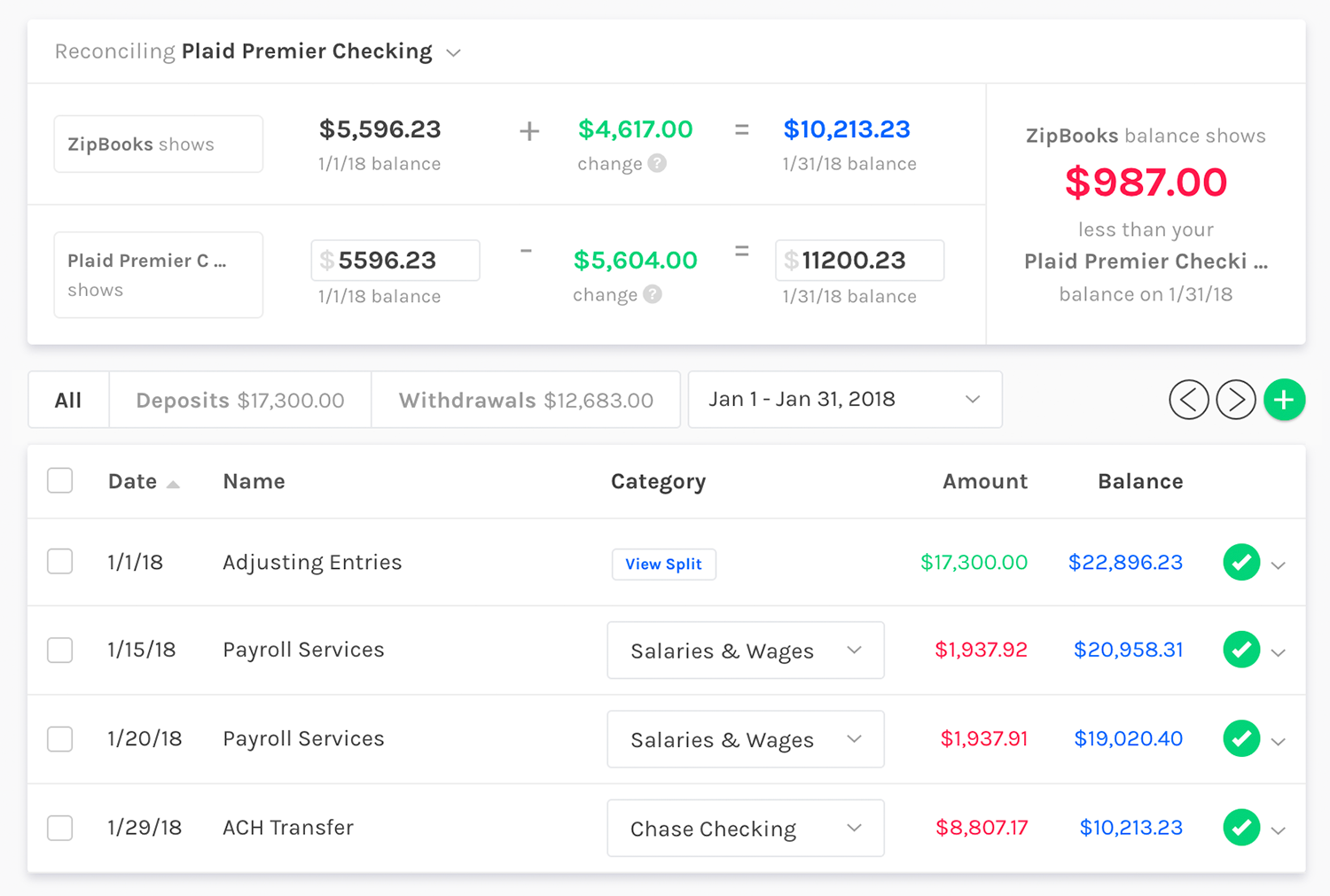

Here’s how a reconciliation tool looks in ZipBooks:

Each accounting system does this a bit differently, but let me point out a couple things we do to make this process a bit easier.

The first row, “ZipBooks shows,” tells you exactly the balances that ZipBooks has in its system at the beginning and end of the period you’re reconciling.

The next row, “Plaid Premier Checking shows,” allows you to input the beginning and ending balance for that month, directly from your bank statement.

These values are compared, to tell you how far off you are (the $987.00 value in the top right).

That’s an easy starting point to know how far you have to go — and it might even be a single $987.00 transaction that you’re missing!

Once a bookkeeper has matched a transaction in ZipBooks with one on the bank statement, they click the checkmark on the right to confirm that it’s done. At the end of that process, if the balance was “off,” to start with, the bookkeeper will normally have found a missing, duplicated, or incorrect transaction (or many), and fixed them.

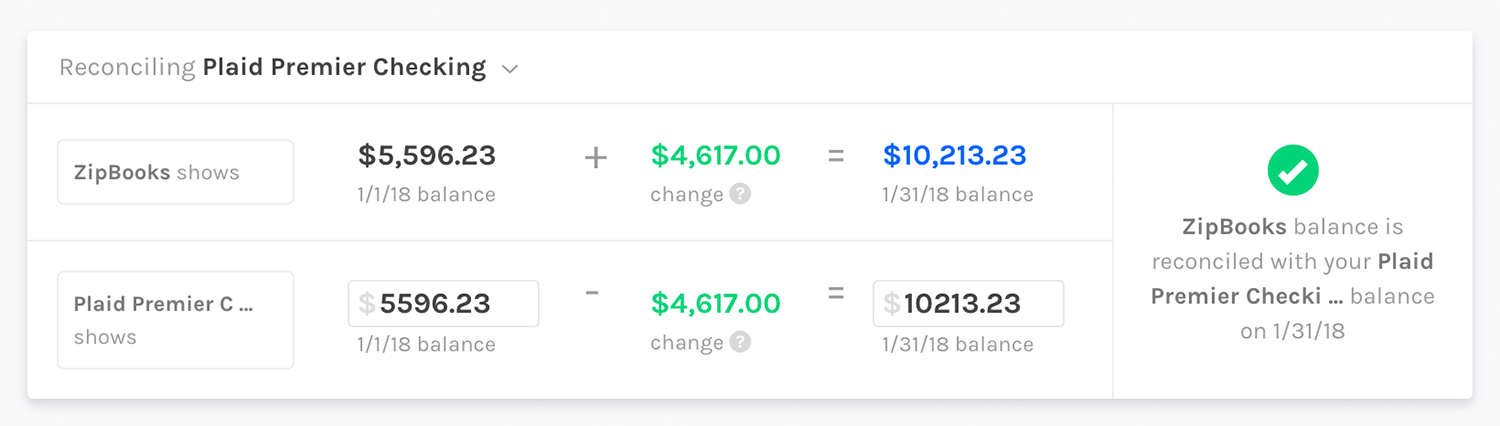

Once everything matches up, your reconciliation system should tell you that you’re all set. Here’s how ZipBooks shows that:

Now, you may be asking how your transactions could ever get “off” if you connect your bank feed to an accounting system electronically. There are two ways:

- Bank connections aren’t perfect. We know this firsthand. Even the biggest players in the industry have sometimes woefully poor connections to financial institutions, meaning transactions are sometimes missing or duplicated (they’re not often wrong, however, if they do make it into your accounting system successfully).

- Someone in the accounting system did something wrong. Transactions can sometimes get edited, deleted, or duplicated without the perpetrator knowing they’ve done anything! Especially in more complicated businesses with lots of transactions, things can get scrambled pretty easily.

Timeliness

Whew. If you’ve made it this far, you’ve probably got a pretty solid understanding of what a bookkeeper does. And I want to make a quick point here about how they do it.

It’s incredibly important that a bookkeeper stay up-to-date and get in to do the books frequently. That’s because there’s a compounding effect to the difficulty of bookkeeping as the transactions get older.

To illustrate what I mean, let’s imagine a fairly simple business that has, on average, four transactions per day. A bookkeeper, heading into those books daily has, on average, four transactions to categorize. Seems very doable — especially because in the event that he or she doesn’t know how to categorize one, a quick call or text to the business owner will clear it up — since it’s only been a day, they’ll remember exactly what that transaction is and what it’s for!

Now let’s imagine that nobody’s been in there to categorize for six months. That means that there are going to be:

4 transactions * 30 days per month * 6 months

720 transactions waiting to be categorized!

Work that previously seemed very simple is suddenly extremely daunting.

But that’s not the worst part — as those transactions age, it’s increasingly unlikely that anyone remembers exactly what they were for. That means the bookkeeper spends more time on digging up records, making phone calls, or sending emails trying to figure out what happened with a given transaction. And the older they are, the worse it gets.

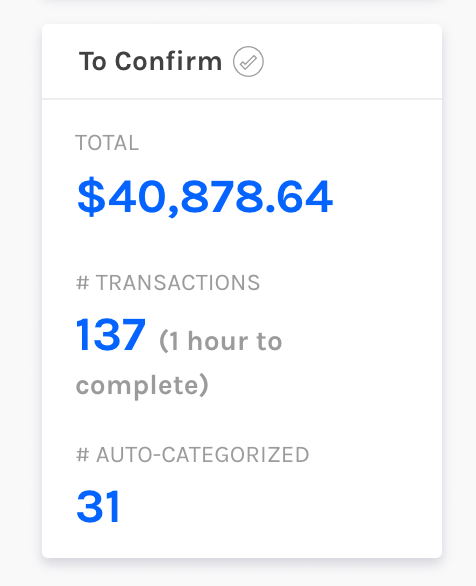

ZipBooks has a handy tool that tracks how many uncategorized transactions you have and how long it will probably take to complete:

We see scenarios a lot where a business owner has meant to get to the books, but it gets pushed off, and before they know it, they’re six to twelve months behind, if not more.

If you’ve found yourself in this situation, definitely get in touch to see if one of our virtual bookkeepers can help. We’ve done a lot of arrears work and have some great ways to optimize old transaction categorization. Our bookkeepers are the best around at staying on top of the books so you never get behind again.

Bookkeepers, accountants, and CPAs – oh my!

You’ve probably noticed that one thing is conspicuously absent from our entire discussion so far: taxes.

And here’s where we need to make some distinctions between bookkeepers, accountants, and CPAs.

As stated in our TL;DR definition above:

There’s no formal designation or certification required to be a bookkeeper — bookkeepers may or may not be CPAs, and in their function as a “keeper of the books,” they do not prepare taxes.

That means anyone can “be” a bookkeeper, though obviously the level of skill and experience matters, and varies widely.

“Accountant” is a more ambiguous term. Generally, when someone says they’re an accountant, that means that they’ve at least achieved a bachelor’s degree in accounting. They may not have gone on to get a Master’s degree, and may not have taken the CPA Exam. An accountant is almost certainly qualified to do the work of a bookkeeper, though they may not be licensed to prepare taxes.

Becoming a CPA (Certified Public Accountant) is different. In order to become a CPA, a person must have at least a bachelor’s degree and 150 or more credit hours of formal education. That person must also take, and pass, the Uniform Certified Public Accountant Examination, a 16-hour test that covers accounting, audit, regulation, and more. In some jurisdictions, aspiring CPA’s will need to pass ethics exams as well.

CPAs, along with Enrolled Agents (who must pass an IRS exam) and tax attorneys, have “unlimited” practice rights when it comes to preparing taxes as part of their certification. Though it’s beyond the scope of this article, there are other types of tax preparers who can prepare on a more limited basis.

Other Tasks

You might also be wondering if bookkeepers can handle accounts receivable, accounts payable, and payroll processing. The short answer is yes; unlike for taxes, there’s no specific certification required to handle these types of tasks.

Experience, of course, is another story, and when hiring a bookkeeper to do any of those things, you’ll want to make sure they’ve done it before or are a quick learner. Again, having done bookkeeping in the past doesn’t necessarily mean they’ve done any of those or had any type of training or education around them.

Compensation

Due to the differences in education between bookkeepers, accountants, and CPAs, average compensation varies as well (clearly, region has a significant effect). Here are the 25th-75th percentile ranges in compensation for each, according to PayScale:

- Bookkeeper: $14-20/hr

- Accountant: $42-59k/yr

- CPA: $52-81k/yr

Some companies, like ZipBooks, have bucked the hourly trend and offer a bookkeeping service at an ongoing monthly rate. That way we can help smooth out any bumpiness that you might experience in the tasks required to complete your books each month.

That’s a wrap

I certainly hope this article has given you a strong foundation of understanding what a bookkeeper does, how they do it, what they don’t do, and how they’re compensated.

If you have questions about bookkeeping generally, hit me up in the comments! And of course, let us know if you’re interested in exploring outsourced bookkeeping options from ZipBooks, or simply using ZipBooks as your accounting system of choice.

Until next time!