by Zipbooks Admin

PayPal Working Capital: Everything you need to know

PayPal has a whole arsenal of products designed to help businesses accept and process payments for goods and services. Aside from traditional payment acceptance capability, PayPal also offers loans to certain business customers.

What is PayPal Working Capital?

When businesses needs extra money to get off the ground, to fund a certain venture, or even just to have the cash to make payroll, they may opt to apply for a business loan, credit line, or credit card from a bank or other financial institution. PayPal Working Capital is a financing product that PayPal has designed for businesses that need a little credit, but don’t want the hassle of a long waiting period or a credit check. The actual meaning of the term “working capital” is the amount that a business has on hand to cover day-to-day expenses involved in the running of the business.

How do I qualify?

PayPal Working Capital is for people who sell products or services and use PayPal to collect payment. But it’s not for everyone. Specifically, PayPal Working Capital is for businesses that have had a PayPal business account for at least 90 days and have a certain level of sales every year.

Unlike with traditional loans or credit cards, PayPal doesn’t require a credit check to apply for their Working Capital loan, so your credit score won’t be affected one bit if you choose to go this route. PayPal will, instead, look at your sales history to make a decision on whether or not to lend you money. If you have a Premier account, you need to have $20,000 in PayPal sales annually, $15,000 if you’re a Business account holder.

How much money can I borrow?

PayPal Working Capital gives you an amount based on your business history of sales and payment processing. While there is no minimum loan amount, the maximum amount you can borrow is 35% of your annual PayPal sales. So, let’s say you have $40,000 in PayPal sales last year. You’ll be able to borrow $14,000. If you don’t need that much, no problem. You don’t need to take the full amount.

Also keep in mind that there is a limit if you’re a first-timer. If this is your first loan through PayPal Working Capital, your limit is $125,000. Subsequent loans may be higher if you qualify.

What is the interest or repayment rate?

Again, unlike traditional loans, there is not a specific interest rate associated with your PayPal Working Capital loan. Repayment is one fixed fee determined by three pieces of information:

- The amount you borrowed

- Your PayPal sales history

- The repayment percentage you choose

Your repayment percentage is the portion of each of your sales that is automatically deducted as repayment of your loan.

Let’s look at an example of how this works:

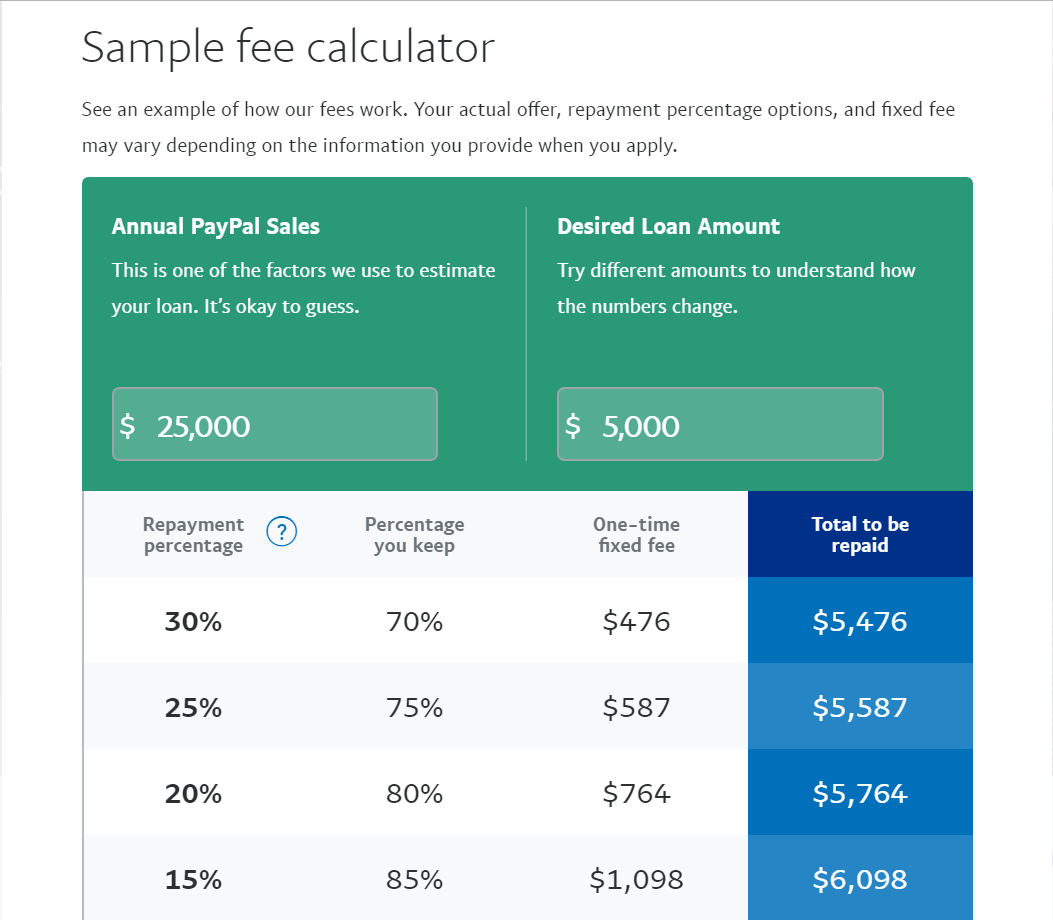

Let’s say that your annual PayPal sales are $25,000 and you’ve had your PayPal Business account for two years. You qualify for a Working Capital loan! You decide that you need a loan this month to cover payroll, and $5,000 should be enough.

To repay your loan, you get to choose a percentage of each of your PayPal sales that will automatically be deducted to go toward your one-time fixed fee. The amount of that fee (and subsequently, the total amount you need to repay) changes based on the percentage you choose. Here are your repayment options based on the parameters above:

You’ll notice that the higher the percentage of sales you choose that goes to repayment, the lower your fee is. Also, the more sales you have, the faster you pay off the loan, automatically. Try PayPal’s fee estimator (scroll down to the “How much does it cost?” section) to see how other loan amounts break down.

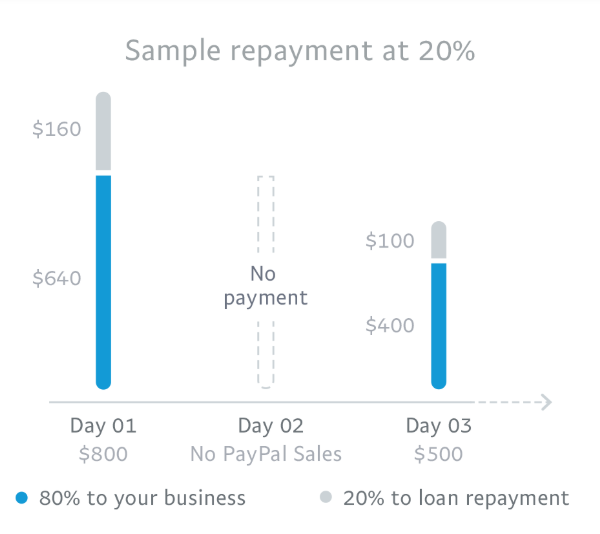

What if you don’t have any sales on a particular day? No sales means that you don’t pay on the loan that day, which isn’t necessarily a problem. Just bear in mind that to keep your loan in good standing, you need to repay 5-10% every 90 days. If your loan is estimated to take longer than a year to repay, the 5% minimum rate applies. The 10% minimum rate applies for loans that can be repaid within 12 months.

Let’s say you choose to repay at the 20% rate. This means that PayPal will automatically deduct 20% of the amount of your sales and put it toward the total amount you need to repay on your loan. On day 1, you make $800 in sales. So, $160 will be deducted toward your loan, and $640 goes to your PayPal account. On day 2, you make nothing. So no money goes toward repayment. On day 3, you make $500, so $100 goes to repayment, and $400 goes to your account.

But let’s say that you decide you want to make extra payments. Can you do that? Yes! If you choose to, you can make extra payments, or repay the loan in full with no early repayment penalty. No need to go back and choose a new repayment percentage or anything like that. Just pay the extra and move on with your life. Just keep in mind that it doesn’t work the same way as a traditional amortizing loan. Your total loan amount will not decrease once you’ve chose your repayment schedule, even if you do pay it off quicker.

Note: Make sure that you keep enough money in your PayPal account to cover the automatic fee. PayPal will deduct it, even if you’ve transferred all your funds out. This means that the next time you have a balance in your account, PayPal will deduct payments to catch up, with no penalty to you, however, be careful because catch up payments can only account for 50% of your loan balance, at max.

What if I’m denied?

If PayPal denies your request for a Working Capital loan because you don’t meet the basic requirements (open account for 90 days, $15,000 or $20,000 minimum yearly sales), you can reapply once you do become eligible.

If you’ve been denied and you fit the profile for a Working Capital loan, it could be that your history of customer complaints, charge backs or returns is too high, or that you didn’t pay back a previous PayPal loan within the agreed upon terms. If you think the denial is an error, you can apply again after 3 days. (No credit check, remember? So no affect on your credit score.)

Can I have more than one loan at a time?

With PayPal Working Capital, you can only have one open loan at a time. When you pay off one loan, you can open another. Your final payment on any loan may take up to three days to process, so keep that in mind when you’re planning additional loans.

How do I apply?

Click here to apply for PayPal Working Capital, or find it in your PayPal account. You’ll need to supply some basic information, like your business name and location, and some of your personal info to verify who you are. You’ll specify how much money you need, and you’ll choose a percentage for repayment. Before you’re locked in, you’ll get to see all the repayment terms including how long it will take to repay and your total repayment amount. There is no credit check, so it won’t affect your credit rating, and if you qualify, you could be approved and funded in minutes.

Pros and Cons of PayPal Working Capital

So, is PayPal Working Capital the right solution for you? Here’s a summary of possibles advantages and disadvantages to weigh before you make a decision.

Pros

One easy rate

With PayPal Working Capital there is no amortizing interest rate that applies to the amount you pay. The fee is a lump sum, and it’s outlined for you before you take on the loan so you know what you’re getting into up front. Compared to other business loans, this can be a cheaper way to go.

Easy application

It’s super easy to apply for a PayPal Working Capital loan, especially when compared to the application processes and waiting times for traditional loans or lines of credit. You could have your money in minutes instead of days or weeks.

No credit check

PayPal won’t run a traditional credit check on your name in order to decide whether or not to lend to you. So, your credit score won’t be affected, even with multiple applications for a Working Capital loan. While this is true, the funding is still coming from an actual bank and not PayPal themselves. WebBank is PayPal’s loan partner and they carry all the traditional safeguards and insurance that other traditional banks do.

Automated repayment

Life gets busy and it’s easy to forget things, like making timely payments. With a PayPal Working Capital loan, your payments are deducted automatically so you don’t need to remember to make payments manually.

Cons

No discount for early payment

While you won’t have any early repayment fees or penalties, you also won’t save any money by repaying extra or paying off your loan in full. Your total repayment amount stays he same. With a traditional loan, the total interest you pay goes down when you pay faster, or if you pay off the loan.

Affects cash flow

Since you don’t have an exact amount you’ll be paying every week or month, rather a percentage of sales, it’s hard to know how your cash flow will be affected on any given day. If you need all of the money you received for sales in any given week, and don’t leave enough to cover your payment, then you’ll be playing catch-up until you’ve covered the amount you’re responsible for. If your sales levels are highly unpredictable, PayPal Working Capital may not be the best way to go.

Small loans

With a PayPal Working Capital loan you only get, at most, 35% of the amount of your annual sales. If it’s your first loan, your upper limit is $125,000, even if that’s less than 35% of your sales. If you need a substantial amount in order to start generating sales, or to get a product line off the ground, this loan may not cut it.

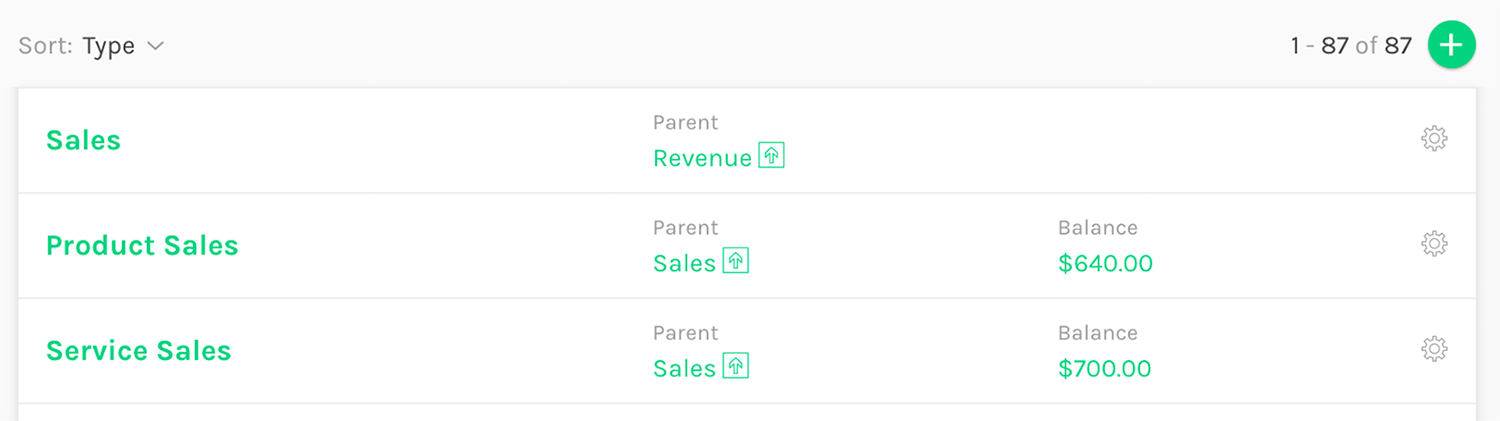

How can ZipBooks help?

ZipBooks offers you the tools you need to run and grow a successful business. Create and send invoices to your customers, track sales and expenses, run accurate reports, and gather reviews from your best customers. ZipBooks will even give you smart suggestions on how to run your business more efficiently. Combine with PayPal to easily collect your payments and it’s a win!