by Zipbooks Admin

PayPal Invoicing: Everything you need to know in 2019

Sending your customers invoices is key to getting paid for the products and services that you provide. While we think ZipBooks has a fantastic invoicing system, we’re here to help you get info on all kinds of products, like PayPal invoices or Square Invoices, so you can find exactly what you need.

Features of PayPal Invoices

PayPal is a well-known service that helps businesses and customers easily make electronic payments and transfer money securely. But did you know that you can also use PayPal to create invoices to send to your customers?

Let’s discuss a few of PayPal Invoice’s best features–and how they compare to ZipBooks’ invoicing.

Customizable Invoices

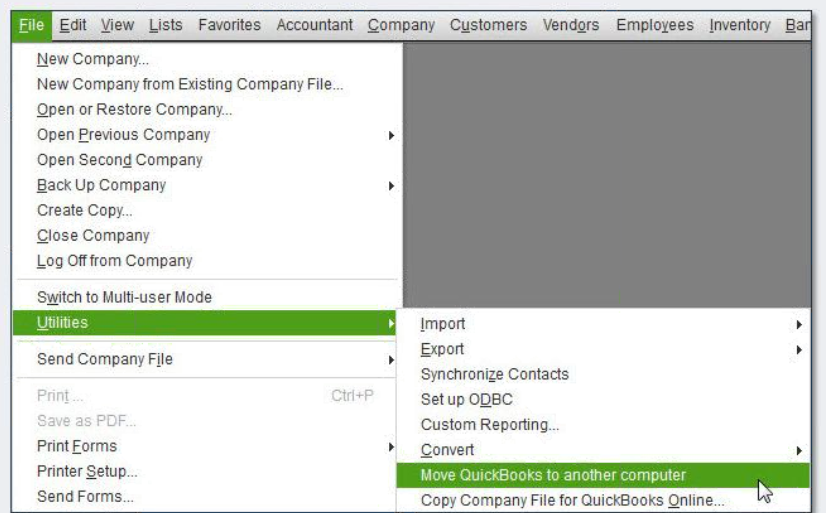

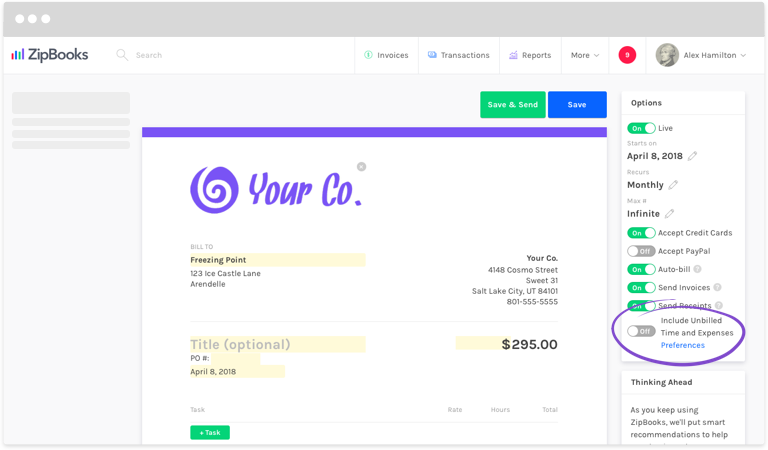

Every business is different. It’s essential that you’re able to customize your invoices to your needs. PayPal lets you add your logo, business info, and customize which fields to include on your invoice template. Add notes and terms, and choose which items you’d like to appear on your invoice. You can even specify what currency you’re using for each payment.

ZipBooks lets you customize invoices with your business logo, colors, and preferences. Itemize each service or product you sell and add individualized taxes or discounts. Specify a default currency for all invoices, but easily change it when you need to. You can even include unbilled time and expenses that you have recorded for particular customers.

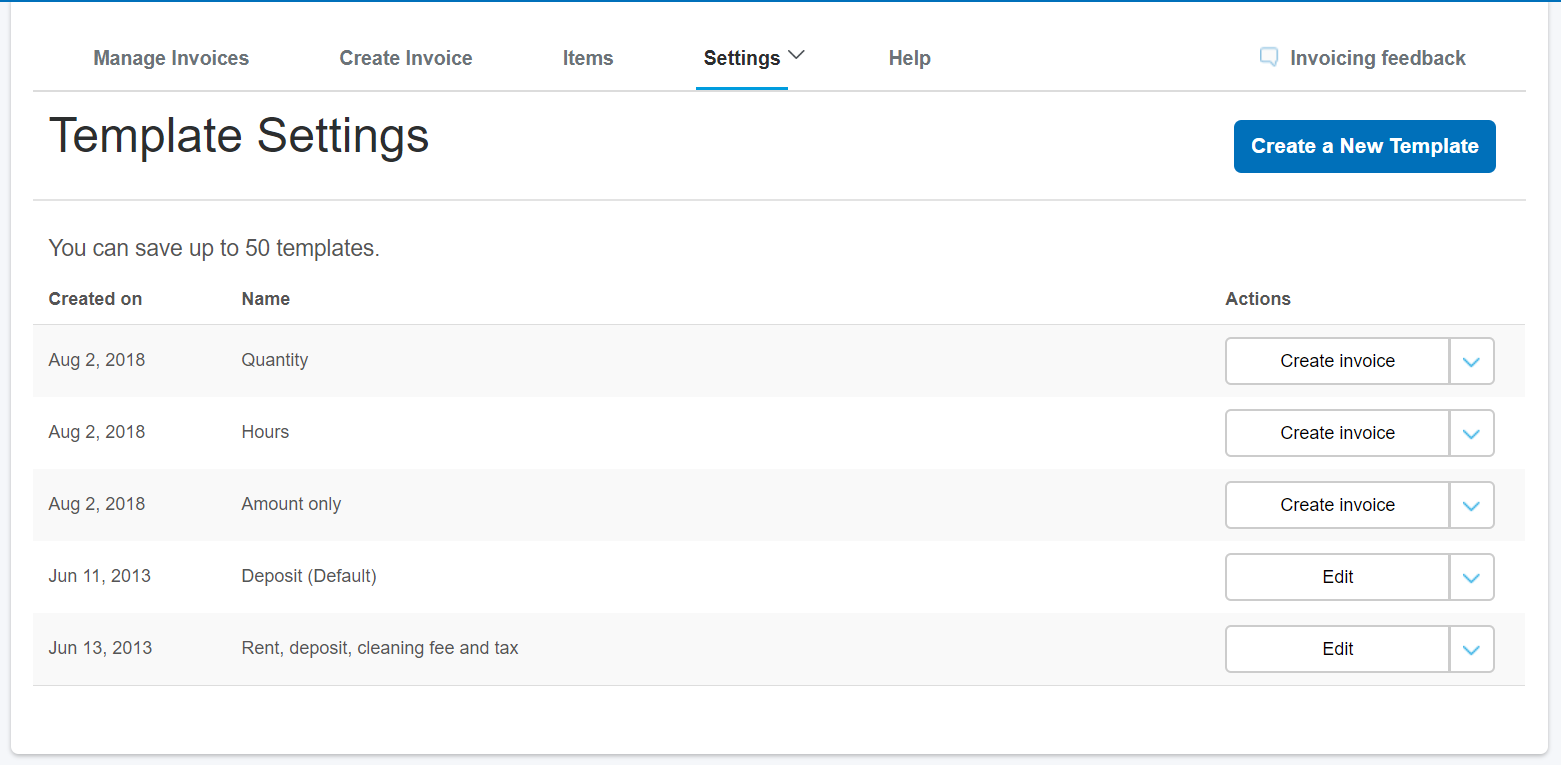

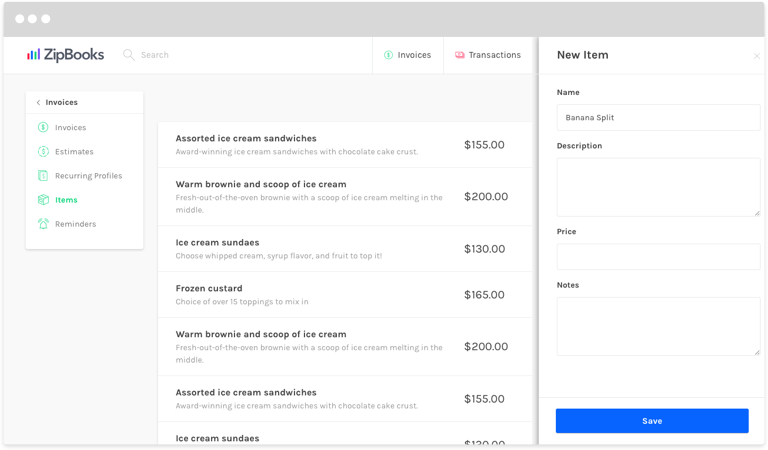

Create Invoice Templates

PayPal lets you create templates for your invoices, so you don’t have to start from scratch each time you bill a customer. You can also save frequently-used line items, and contacts for easy entry. Attach files, like quotes or contracts, and even add a memo to yourself that the customer won’t see.

With ZipBooks you can easily duplicate any existing invoice for repeated use. Save line items and customer and vendor information for quick creation every time. Add notes and terms (and save them as your default), attach files, and make an invoice recurring so you can set it and forget it.

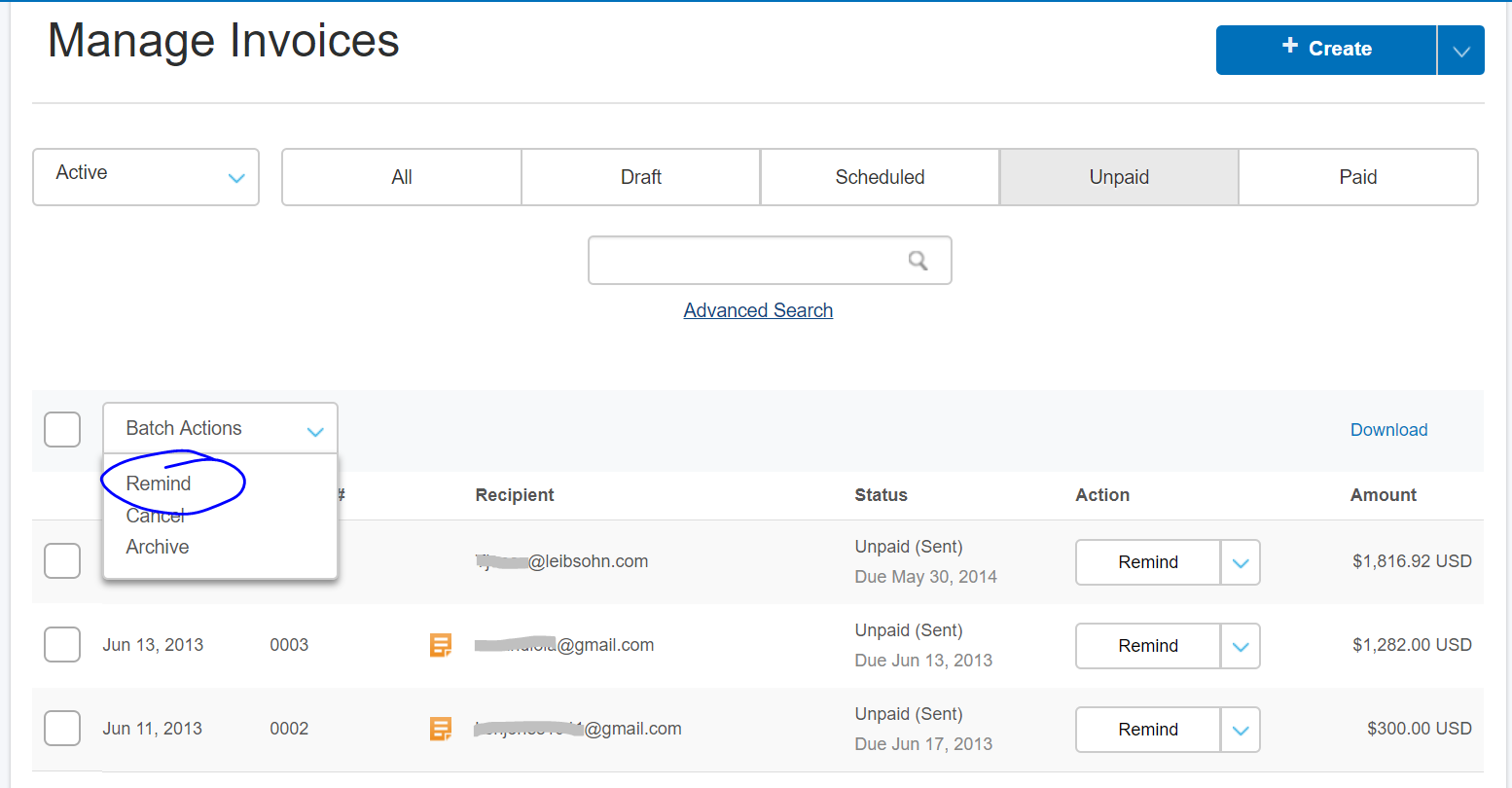

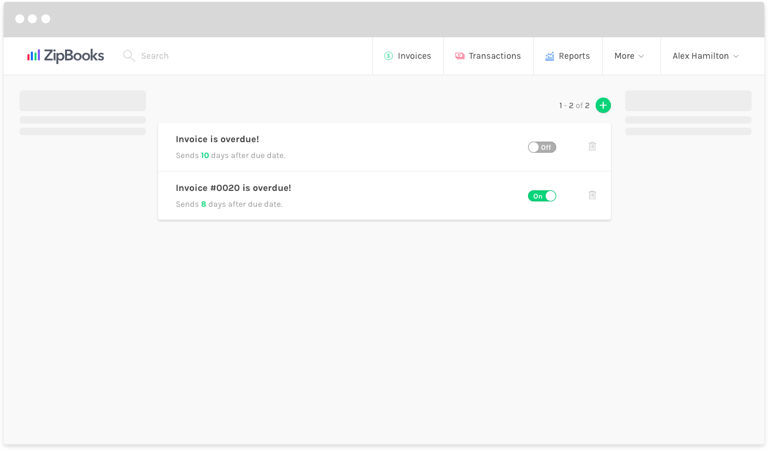

Invoice Reminders

Sometimes customers might simply forget that they owe you money. So, PayPal lets you send out invoice reminders to customers who have unpaid bills–you can even send reminders as a batch action to any outstanding invoices. Personalize your reminder and send a copy of the email to yourself too.

Set up a ZipBooks payment reminder to automatically email customers whose invoices are a certain number of days overdue. You decide how many reminders to send, how often to contact customers, and what message to include each time. Reminders will help your business keep running smoothly as they expedite your invoicing cycles. Who doesn’t love that?

Schedule Invoices

It’s nice to know that your invoicing program has got your back if you’re forgetful. With PayPal you can schedule your invoices to go out on a certain day. If you’d like to bill your customers on a recurring schedule automatically, you will have to pay $10/month (in addition to any monthly fee if you’ve upgraded to PayPal Pro). Read our recent blog post to learn more about PayPal recurring payments.

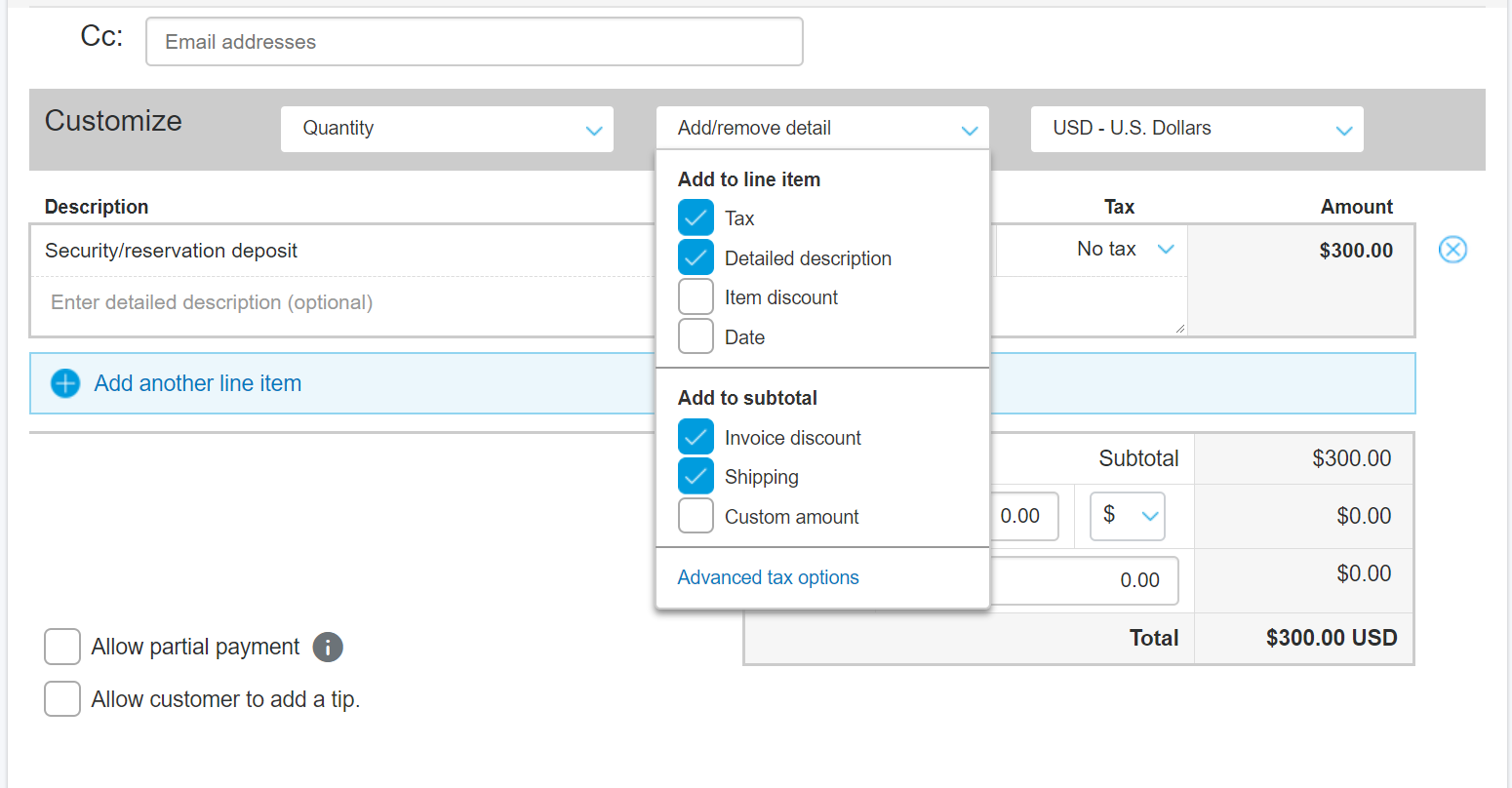

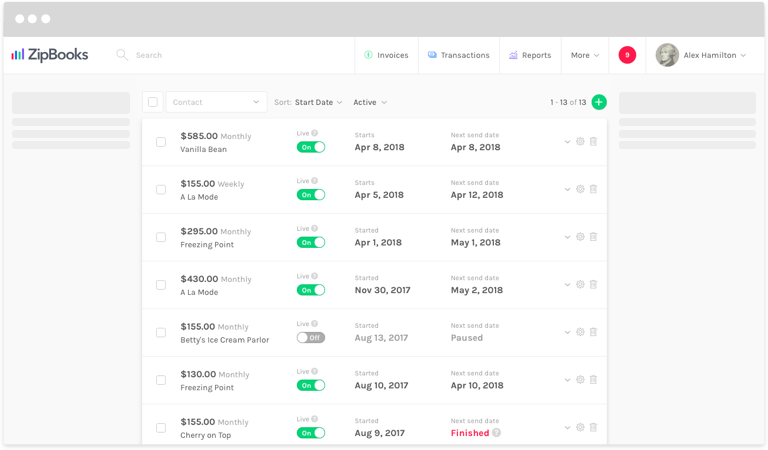

ZipBooks Smarter plan offers unlimited recurring billing! For regularly occurring invoices, set ZipBooks to bill automatically. Choose the start date, how often the invoice recurs, whether to send invoices or receipts (or both), and what payment method to accept. You can even set recurring payments to automatically include unbilled time and expenses related to each customer.

Partial Payments

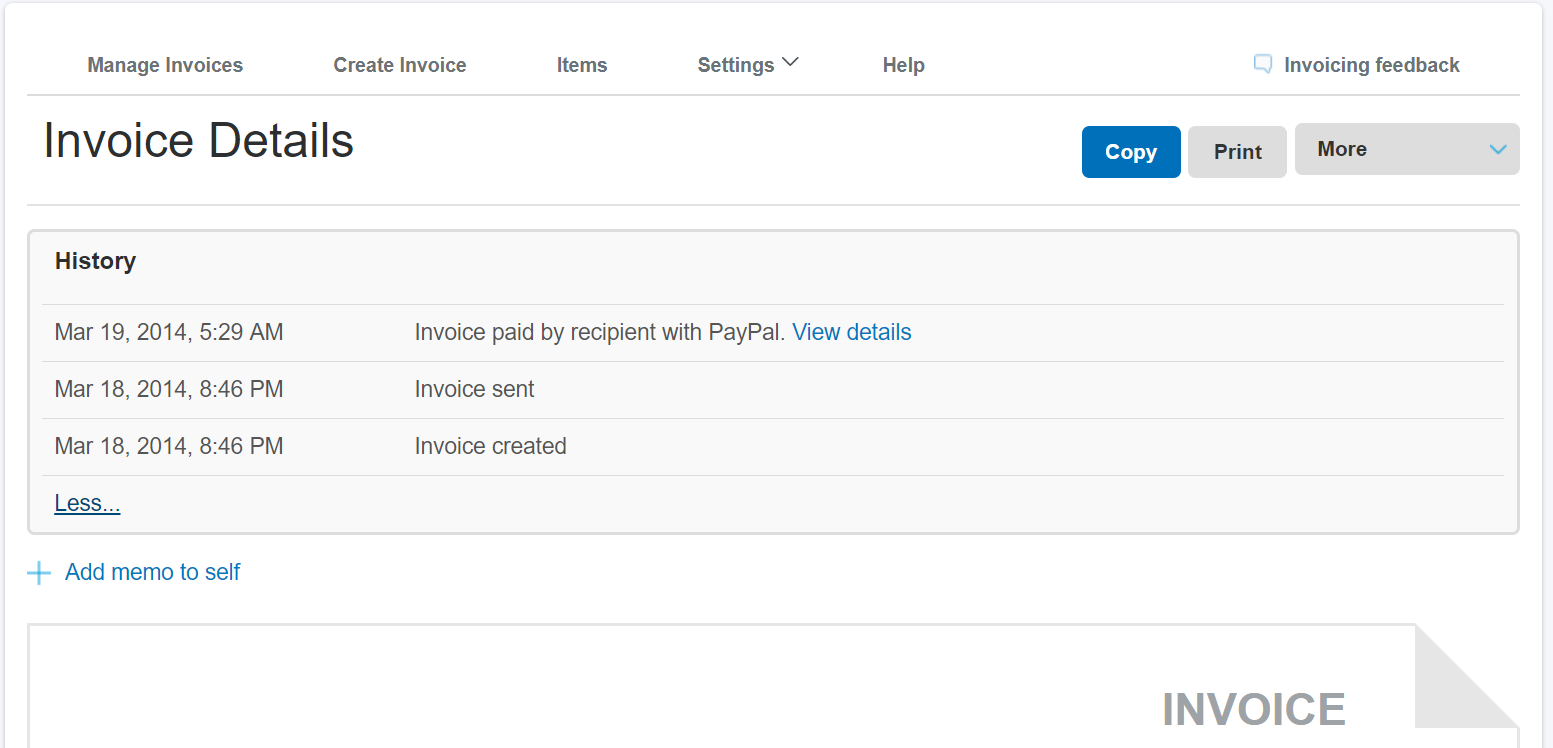

PayPal lets you accept and record partial payments, since customers may not pay all at once. At the top of your invoicing dashboard, you can see the history of each invoice, complete with any payments received. Monitor the status of each invoice in your Manage Invoices screen, and filter your list to see only scheduled, paid, unpaid, or draft invoices. If you have a PayPal Business Account, you can also monitor payments using the PayPal Business App.

ZipBooks payments will automatically record all digital payments you receive–partial or full. Keep track of payments made in cash or check by manually entry. ZipBooks also integrates with payment processors like PayPal, Stripe and Square.

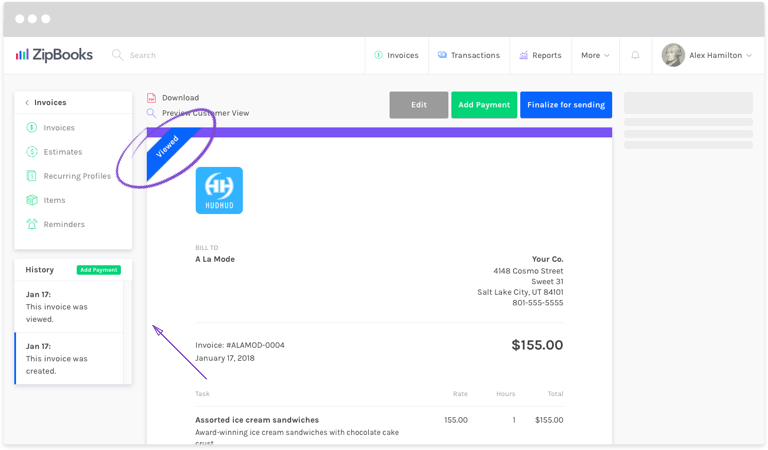

View the convenient invoice history to see any actions taken, like payments received or reminders sent. From your invoice list, you’ll be able to see at a glance which invoices have been sent, which have been viewed, which have been paid in part, and which have been paid in full. Sort your list to see only certain invoices, like those of a specific status, customer, or tag.

Send Bulk Invoices

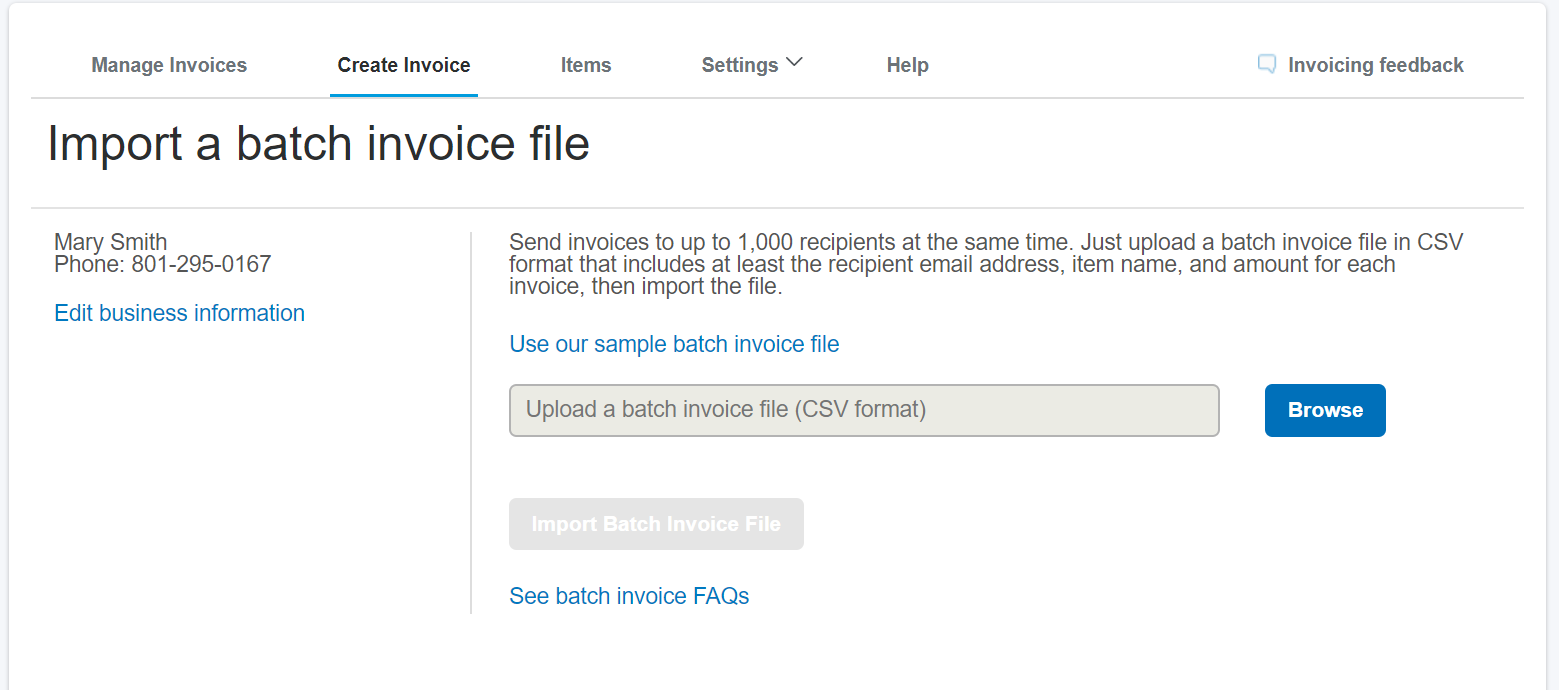

One of the best features that PayPal offers is the ability to send up to 1000 (of the same) invoices all at once–talk about a time saver! Upload a CSV for a batch invoice file of up to 1000 recipients or manually enter email addresses to send up to 100 invoices. If you don’t have an email address for a client, just enter a name, and you can print it out and deliver it in person! (Really! Some businesses still do that!)

Send Invoices Free

With PayPal you don’t have to pay anything to create and send your invoices. There are no setup fees and no monthly subscriptions. But you do pay when your customer pays you. It’s 2.9% + $0.30 per transaction.

If you do choose to take advantage of PayPal’s business account for the full suite of integration with Invoicing, there are additional standard fees.

With a ZipBooks Starter plan you can send as many invoices as you need for free, and you only pay the fee for credit card payments. Specify which payment types are acceptable for each invoice, and pay nothing for cash or check payments that you receive and record.

Possible Disadvantages

Customer Service

One advantage of using PayPal Invoicing is the number of people who use it worldwide. If you have a question, there’s bound to be someone out there with an answer, whether on the community forum or on PayPal’s social media sites. And that’s a good thing, because PayPal is not known for stellar customer service.

Many reviews state that PayPal’s phone support is hit and miss, sometimes erring on the side of reps who seem to know nothing about the program at all. That’s bad news when you absolutely have to talk to someone at PayPal. But for common questions, you’re bound to find what you’re looking for after a little searching through their help or social media sites.

ZipBooks makes it easy to get the help you need. Search our extensive knowledge base to find the answers to common questions. Or chat online with a friendly ZipBooks expert to get answers to all of your lingering questions!

Account Consistency

PayPal’s invoicing and payments systems offer a wide range of convenient integrations. However, one of the common complaints from PayPal customers is the tendency for business accounts to be frozen, even when rules and regulations are being followed. If there is any suspicious behavior, spike in sales volume, or even if you’re selling goods below cost, your account could be frozen or even terminated.

More commonly, PayPal may simply ask for documentation, invoices, or bank statements to answer any questions they might have. While it can be frustrating for PayPal users, ultimately, this is all for the sake of security.

Invoices that work for you

We hope this has given you some helpful insight on the features of PayPal invoices that could benefit you and how they compare to ZipBooks. If you’re still not sure which invoicing platform would work for you, why not take advantage of both of their free trials? ZipBooks starter plan is completely free with no expiration date! We’d love to welcome you into the ZipBooks family if you find we’re the best fit for your invoicing needs.