by Zipbooks Admin

PayPal Business Account Fees as of 2019

If you are using a PayPal Business Account, you are probably already aware of the processing fees. If not, we want to take a little time to tell you about the kinds of fees you’ll encounter using your account.

Maybe you are not sure what the difference is between a PayPal Business Account and a PayPal Personal Account–take a minute to peruse our PayPal Business Account blog post. Up to speed?

Now let’s talk about where your money is going.

PayPal Business Account Fees: Quick Guide

Here is a quick overview of the merchant fees you will encounter using your PayPal business account. We’ll go into the details in a minute, so feel free to click around. This is your quick guide:

Standard Transaction Fees

|

Online Transactions |

In the U.S. |

2.9% fee plus transaction fee |

|

Outside the U.S. |

4.4% fee plus transaction fee |

|

|

In-store Transactions |

In the U.S. |

2.7% fee |

|

Outside the U.S. |

4.2% fee |

Charitable Organization Standard Fees

|

In the U.S. |

2.2% fee plus transaction fee |

|

Outside the U.S. |

3.7% fee plus transaction fee |

Micropayment Fees

|

In the U.S. |

5.0% fee plus transaction fee |

|

Outside the U.S. |

6.5% fee plus transaction fee |

Mobile Card Reader Fees

|

Swiped & check-in |

2.7% fee |

|

Keyed or Scanned |

3.5% + $0.15 per transaction |

|

International |

2.7% fee |

Now, for the fine print.

Understanding Credit Card Processor Fees

In any transaction, everyone who touches the money wants to get paid. There are four kinds of monetary fees that are added together to create the number that PayPal takes from each transaction.

- Interchange fee: paid to the issuer, % of the transaction

- Markup fee: paid to merchant bank, % of transaction

- Assessment fee: paid to credit card association (Visa, Mastercard, etc.), % of transaction

- Transaction fee: paid to payment processor (whether it’s a sale, decline, return, etc.), typically a flat-rate

With PayPal, the three percentage fees are added together and quoted as a single rate. The transaction fee is quoted separately.

PayPay uses flat rate pricing, the easiest pricing structure to understand, so that your fee is the same every time.

Standard Transaction Fees

These fees apply when selling goods or service either online or in store. For Standard Transactions Fees:

- No startup costs

- No termination fee

- No monthly fees

- Express Checkout accepted

- All Major Credit Cards accepted

The “transaction fee” listed in the chart below is a fixed fee based on the currency in use. For the U.S. and Canada, the transaction fee is $0.30.

|

Transaction Type |

Transaction Location |

Fee Amount |

|

Online Transactions |

In the U.S. |

2.9% fee plus transaction fee |

|

Outside the U.S. |

4.4% fee plus transaction fee |

|

|

In-store Transactions |

In the U.S. |

2.7% fee |

|

Outside the U.S. |

4.2% fee |

Charitable Organization Standard Fees

These fees apply when a business has applied for and been verified as a charity with a 501(c)(3) status. Charitable organizations are qualified for discounted credit card and processing fees through PayPal.

The “transaction fee” is the same as above, a fixed fee based on the currency in use ($0.30 for U.S. and Canada).

|

Transaction Location |

Fee Amount |

|

In the U.S. |

2.2% fee plus transaction fee |

|

Outside the U.S. |

3.7% fee plus transaction fee |

Micropayment Fees

You can qualify for Micropayment pricing if your transactions typically average less than $10. If your PayPal account is approved for Micropayment pricing, the following fee scale will apply rather than the standard transaction fees listed above.

Micropayment Fees also require a fixed “transaction fee,” however, the overall fee percentage is higher and the fixed fee is lower.

|

Transaction Location |

Fee Amount |

|

In the U.S. |

5.0% fee plus transaction fee |

|

Outside the U.S. |

6.5% fee plus transaction fee |

Mobile Card Reader Fees

These fees apply when you are accepting payment on your phone or tablet, either on-the-go or in-store.

|

Transaction Type |

Fee Amount |

|

Swiped & check-in |

2.7% fee |

|

Keyed or Scanned |

3.5% + $0.15 per transaction |

|

International |

2.7% fee |

Other Merchant Fees

A few other merchant fees to be aware of (applicable to above):

- International Sales: Additional 2.5% fee for currency conversion and/or 1.5% fee to receive payments from another country

- Chargeback Fee: Varies by country, in the U.S. the fee is $20.00

- Uncaptured Authorization: $0.30 per uncaptured authorization

- Card Verification Transactions: $0.30 per submission

- Refund Fee: Varies, equal to the cost of the transaction fees (aka fixed fees) listed above ($0.30 in the U.S.)

- American Express Fee: 3.5% fee

Add-On Services

PayPal offers a few other services that can be purchased as part of your Business Account. Here are the accompanying fees:

- PayPal Payments Pro: $30/month

- Virtual Terminal Fees: 3.1% + $0.30 per transaction (U.S.)

- PayPal Invoicing: Free

- Recurring Billing: $10/month

- Advanced Fraud Protection: $10/month + $0.05 per transaction (U.S.)

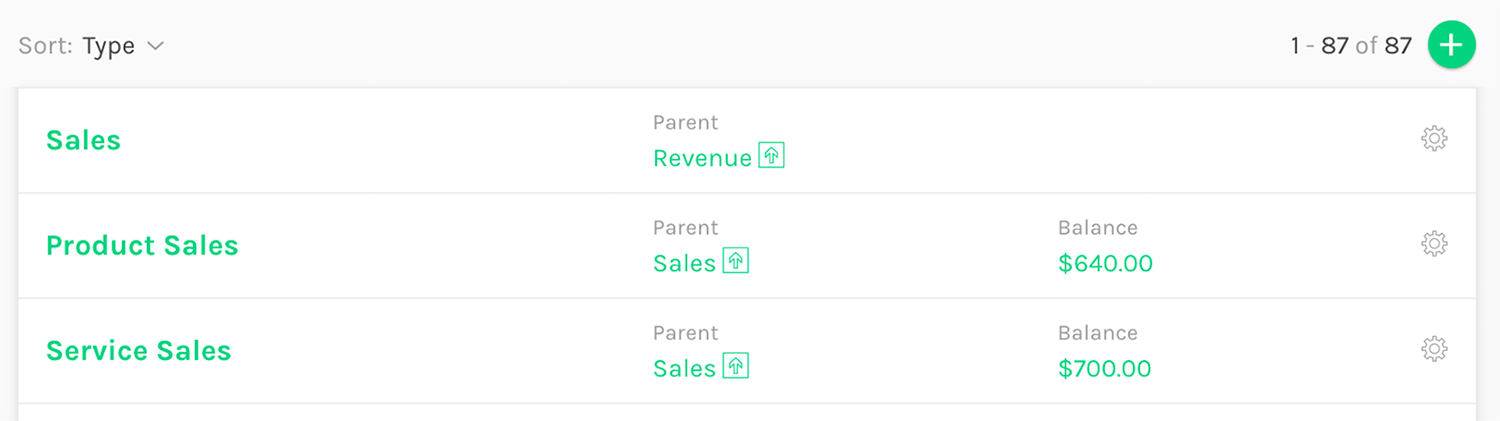

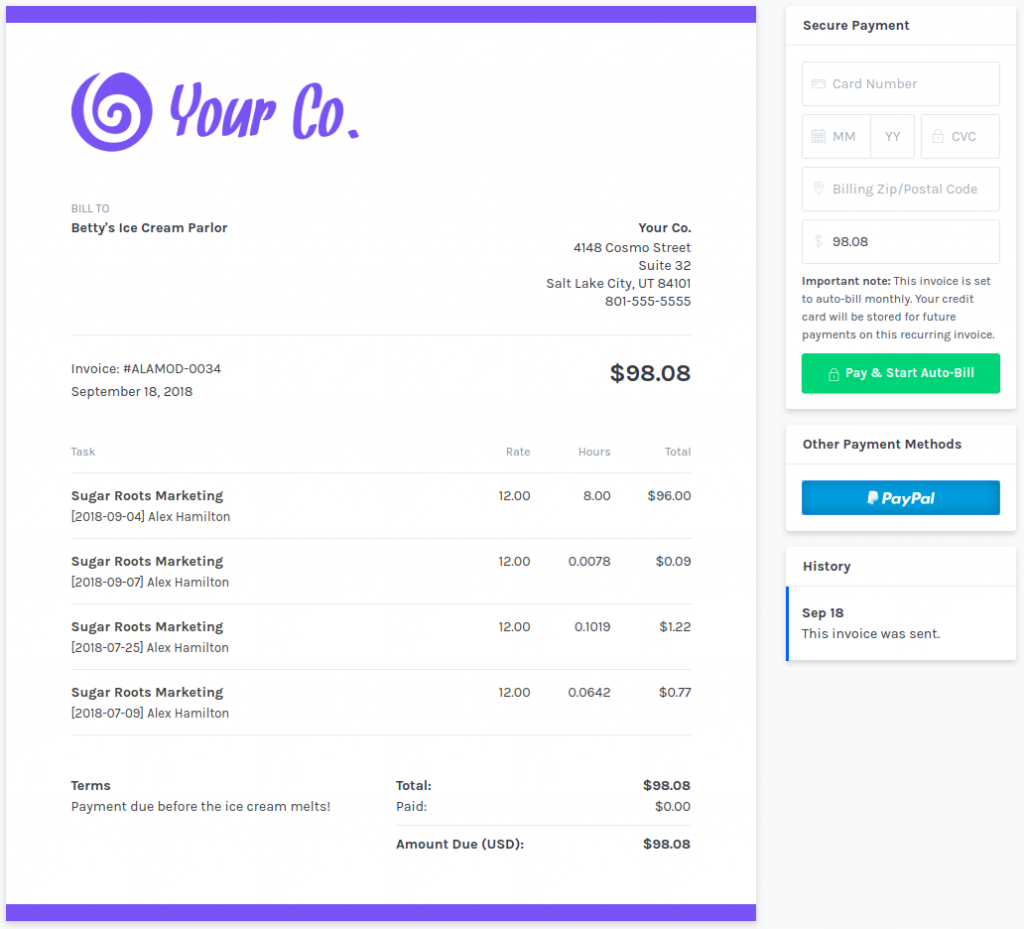

ZipBooks Integration

ZipBooks has integrated with PayPal to help you accept payments, track sales and prep taxes. If you use PayPal as your payment processor of choice, invoicing with ZipBooks is easy. Here’s an example of what ZipBooks invoicing with PayPal looks like:

As you can see, your customers can select “PayPal” as their “Payment Method” and fill your invoice in directly through ZipBooks.

We know how important it is to get paid and we try to make it as easy as possible through ZipBooks by integrating our invoicing and billing software with PayPal.