by Jennifer Ringger

Bookkeeper or Accountant: Which Is Right for Your Business?

As you run your business, one thing requires particular attention and detail: keeping track of your invoices and expenses. Typically, a bookkeeper or an accountant manages this task. But what’s the difference between the two roles?

Many people believe that a bookkeeper and an accountant are exactly the same, because of the similarity of their work. However, despite the fact that both perform similar services, a bookkeeper and an accountant are two different professions.

Bookkeeping and accounting share common goals, but each works with a different stage of the financial cycle. Understanding the difference between the two can be very empowering for a business owner.

What is a bookkeeper?

The term “bookkeeper” is quite literal. The bookkeeper “keeps the books” by recording and documenting various transactions. A bookkeeper’s primary responsibility is to keep track of transactions on a daily level, which include receipts, purchases, payments, and sales.

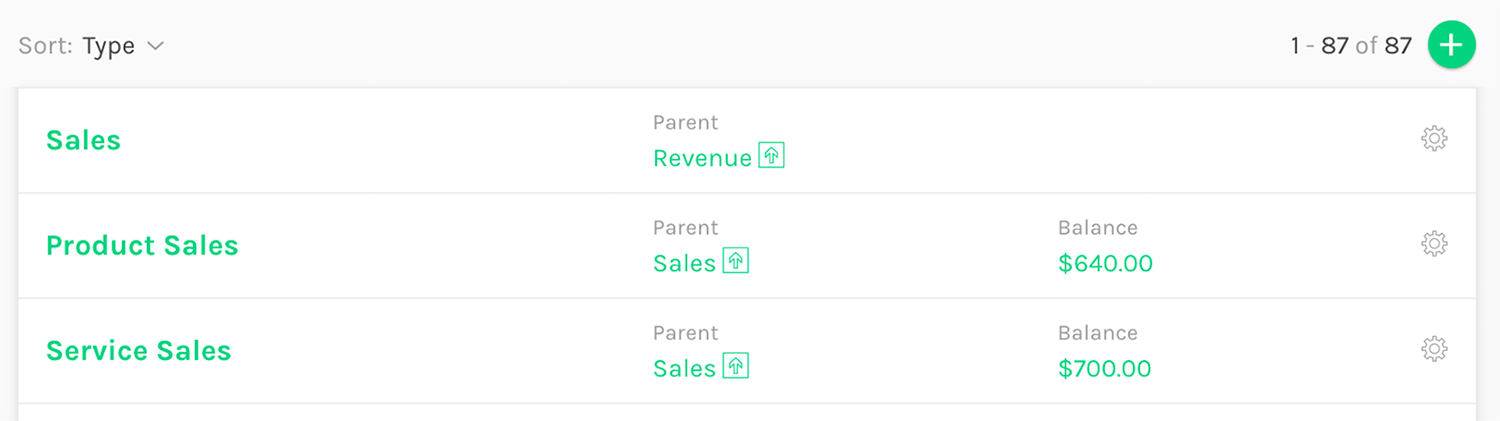

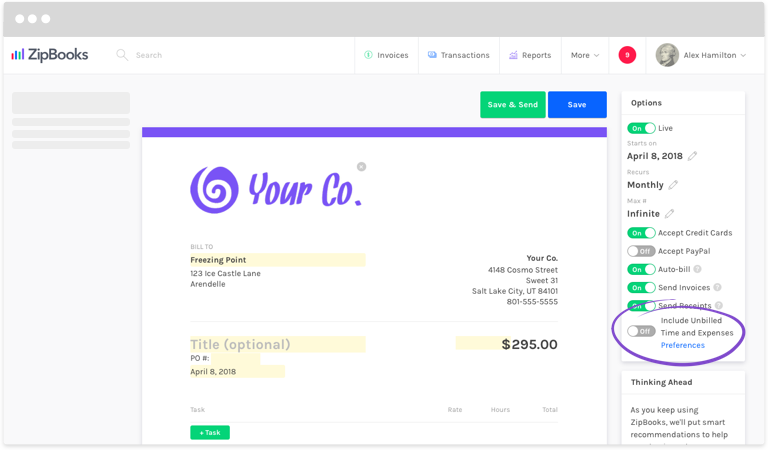

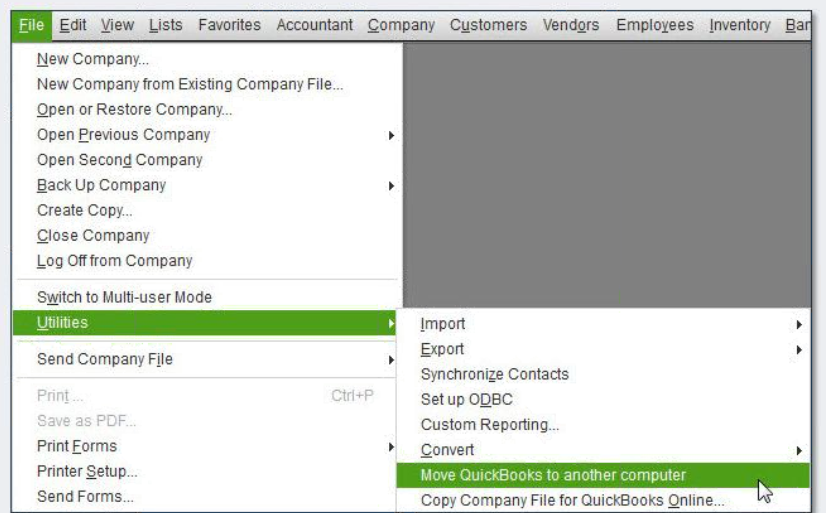

Bookkeepers usually record these items in a general ledger. Many small businesses rely on software like QuickBooks, Peachtree, or Zipbooks. They use this software to keep track of debits, credits, and entries in the ledger. These efforts combine to ensure the final totals of debits and credits match up.

Bookkeepers track day-to-day, hands-on tasks. They also get the business ready for tax time, along with filing any reporting to creditors or investors. A bookkeeper will:

- Keep track of purchases, payments, receipts, and sales

- Maintain and review internal business processes

- Organize, collate, and record financial data on a day-to-day basis in the general ledgers

- Record financial information in a standardized manner, so an accountant can also access the information

Many bookkeepers start their careers as data-entry clerks or in an entry-level role. Through experience, they grow into a role of being the go-to person for day-to-day financial recording.

What is an accountant?

An accountant’s role is to verify the data entered and then use it to generate reports, perform audits, analyze accounts, and prepare financial reporting records. The analysis from an accountant leads to business forecasts, trends, and growth opportunities, as well as monitoring cash flow.

Accountants make sure that records are accurate and that taxes are prepared and paid properly. Financial overviews prepared by an accountant ensure the business runs efficiently. Some duties may include:

- Examining statements to ensure accuracy

- Computing taxes owed, preparing tax returns, and paying taxes promptly

- Inspecting account books and systems

- Ensuring statements and records comply with local laws and regulations

- Organizing and maintaining financial records

- Suggesting ways to enhance revenues, improve profits, and reduce costs

An accountant can also work in various areas of accounting, such as financial accounting, managerial accounting, cost accounting, auditing, tax accounting, and review services.

As accounting and bookkeeping software have become more sophisticated, many accounting processes have been absorbed into the bookkeeping process. For example, some bookkeeping software is capable of building financial statements, which can blur the lines between bookkeeping and accounting responsibilities.

Do I need a bookkeeper or an accountant?

Whether you have a small business or a large corporation, success depends on the financial accuracy of your daily transactions. You use that data to make decisions that affect the future of your business. For a business to run smoothly, ideally both a bookkeeper and an accountant are needed. You’d hire a bookkeeper for daily work and an accountant to handle official reporting and high-level business advice.

Many small businesses and entrepreneurs will hire an accountant outside the company and do their own small business bookkeeping. The bookkeeping data is then shared with the accountant on a weekly, monthly, or quarterly basis.

Small business owners can stick to outsourcing accounting services for quite some time. For most small businesses, these tasks don’t need to be brought in-house until well above the $100 million revenue mark, or until there are about 30 employees. The reason small businesses can still outsource at this point is because there usually isn’t enough work to keep a full-time accountant or bookkeeper busy every day.

A full-time bookkeeper can be hired when part-time help starts spending two to three full days in the office and the work still isn’t getting done. If you’re to the point of calling your accountant on a weekly basis, it’s time to bring in a full-time accountant.

Most business owners find a solution somewhere between trying to go at it alone and paying for full-time help.

Wrapping it up

Understanding the difference between a bookkeeper and an accountant is empowering to a business owner. A successful venture between bookkeeping and accounting will contribute to the long-term financial success of the business.

Organized financial records and properly balanced finances are both key factors to business success. Some business owners learn to manage finances on their own. Others may need to hire a professional so they can focus on the parts of the business they really love.

No matter what option you choose, bookkeeper or accountant, investing in your business financials will surely help your compamy grow.