by Tim Chaves

Accounting Basics Introduction (with Meg and Earl)

Not many business owners open up shop with a deep understanding of accounting principles. Unfortunately, no matter how big your dream is, your business won’t go anywhere with a little bookkeeping knowledge.

We built ZipBooks to bridge that gap. In short, it’s simple to use—and though it’s capable of doing accounting for high-revenue businesses, the heavy lifting stays behind the scenes.

But you don’t have to take our word for it. Jump into ZipBooks and see for yourself—it’s free!

Whether you have zero accounting experience or you’re looking for a quick review, here is an epic introduction to the basics of accounting.

Accounting basics by a non-accountant

Our goal is to introduce the accounting basics in a way that’s as intuitive and inviting as our accounting app. We figure the best way to do that is to explain accounting from a non-accountant perspective.

As the marketing guy surrounded by a bunch of accounting nerds (even the engineers know a ton more about accounting than me), I have to admit that I’ve spent essentially my whole life knowing little to nothing about the discipline.

I’ve always loved learning and the best way to learn a subject is to learn from someone who knows more than you (anyone else on the ZipBooks team) and teach someone else that knows less than you (you, maybe?).

I’ve spent countless hours reading accounting blogs and taking online courses so that I can talk intelligently about our product. Also, you can rest easy knowing that everything I share here has been vetted by the top accounting minds here at ZipBooks!

Accounting principles and practical applications

I’ll be laying out high-level accounting concepts, but also digging into the nitty gritty of how these principles are applied in a practical setting. After all, an introduction to accounting basics is a lot more useful if it includes details about how to run your business.

I’ll also be avoiding accounting jargon where I can. We’re constantly thinking about the best way to build solid accounting for non-accountants and some of that can inform the topics covered here.

Meet Earl

I’m going to use our friend, Earl, and his consulting business, to illustrate basic accounting principles. We’ll learn along with Earl as his accounting knowledge grows with the needs of a thriving business.

Earl: Hi!

Earl’s created a company and is eager to get started, but he’s not familiar with any kind of accounting. He’s evaluating accounting software solutions and looking for something that’s going to meet his needs while he’s getting up to speed with how accounting works.

Spoiler alert: Earl becomes an accounting genius and a ZipBooks super fan.

Meet Meg the CPA

Earl decides that the next step is to meet with an accountant to figure out what his next steps should be. Lucky for Earl, he’s got a buddy who’s a CPA. Earl calls up Meg the CPA:

Earl: Hey Meg! Just give me, you know, the overall view based on my business plan. I’m going to be a consultant. Between income and expense, I have about 1,000 transactions each year.

Meg the CPA advises Earl to have his LLC taxed as a S corporation because she thinks he’s going to make enough to benefit from the savings in reduced self-employment taxes. He doesn’t have any other employees so doesn’t need to worry about payroll right now. He anticipates that he might have a couple contractors so he’ll plan on issuing a couple 1099s at the end of the year but no W-2s, for now.

Meg helps Earl get started off on the right foot

Meg advises Earl to keep things simple, but to get into the practice of double entry bookkeeping now (since Grasscreek Enterprises might grow into something more complicated in the future). Meg knows that if Earl builds good accounting habits when things are less complicated, Earl’s accounting software will be able to keep up as his accounting needs get more complicated.

Meg the CPA: Earl, you’ll want an accounting software program that’s going to store everything electronically (receipts, tax forms, etc) and retrieve them whenever you need to reconcile your bank statements.

Earl: Anytime I invoice someone I’m going to need to have a record of that and I have lots of expenses to record, too.

Meg the CPA: Right, lots of transactions. So why don’t you start by separating your business and personal expenses? You don’t have to go out and get a business credit card yet—a separate checking account at your personal bank would be great. Just something that will keep your business and personal spending from getting mixed up.

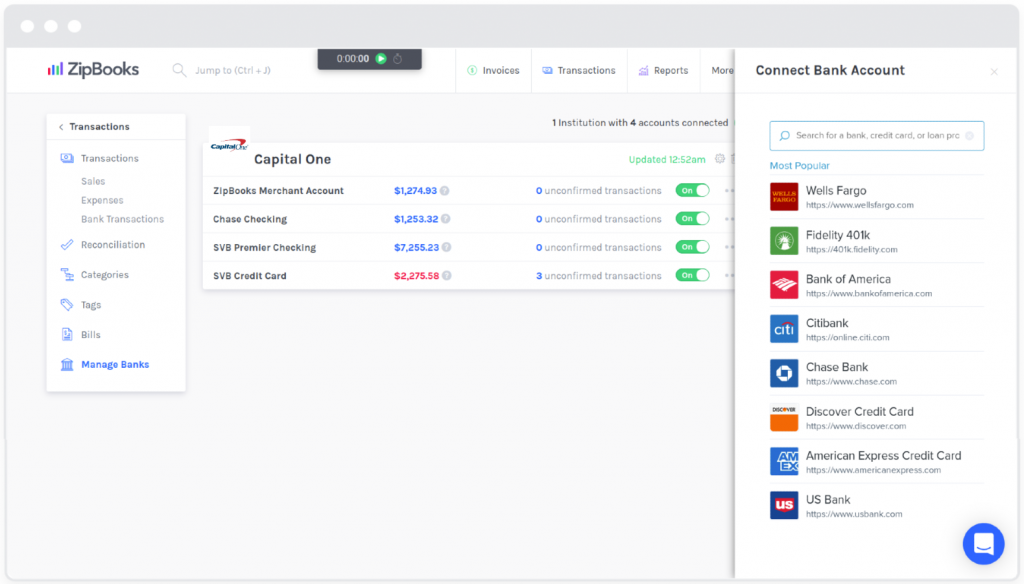

So Earl goes out and opens a new checking account at Grass Region Bank. He downloads free accounting software that connects directly with his account–like ours!–so he doesn’t have to manually enter transactions. He’s already saved himself hours of accounting work.

Now, he wants to know how much money he’s making.

Accrual accounting or cash basis accounting?

Earl calls his CPA again: Okay Meg, I opened my account. Now how am I doing? Am I making money? Am I losing money? How do I know how things are going?

Meg the CPA: Well, there’s a couple of different standard accounting reports that you can use–the Income statement, the Balance sheet–but you’ll want to choose a method of accounting first. Do you want to do accrual accounting or cash-based accounting?

Earl: Huh?

It’s okay Earl, that’s how I felt too. I mean, accounting is foreign enough–why are there two completely separate ways to do it?!

Meg the CPA: Basically, accrual accounting books the income as soon as you send the invoice, while cash-based doesn’t show the income until you actually get paid. So if you send an invoice in February, but get paid in March, accrual accounting says “Hey, I got that revenue in February” and cash accounting says “Hey, I didn’t get paid til March.”

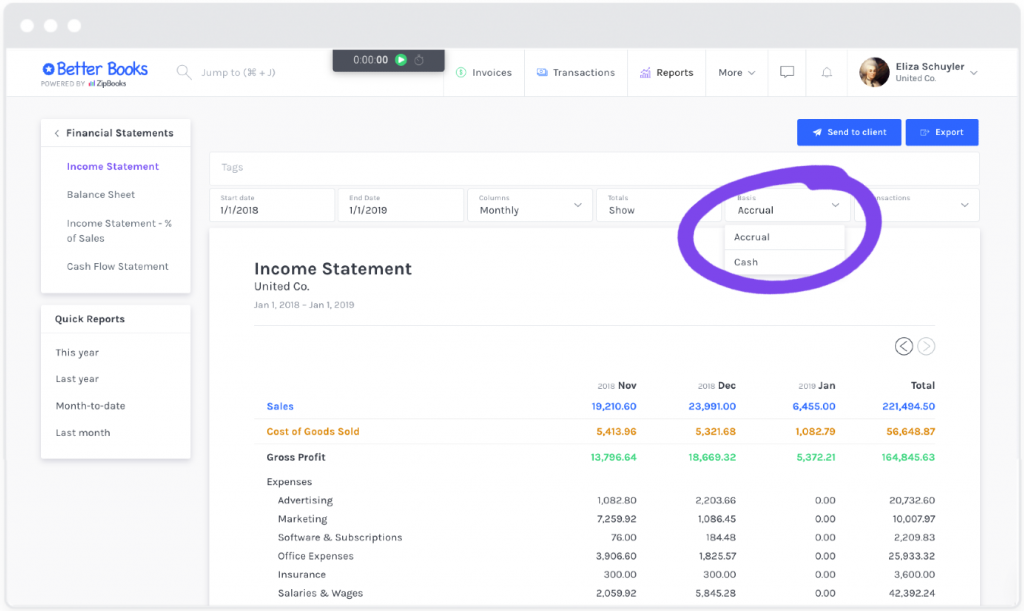

Most businesses—especially those sending out tons of ZipBooks invoices—tend to choose accrual accounting, but there can be some tax advantages to cash-based. ZipBooks makes it easy to switch between the two in your reports:

So Earl has a decision to make: accrual or cash?

Earl: I don’t want to make it too complicated.

Meg the CPA: I recommend that you use accrual basis accounting. I know this is just a side hustle right now, but if it starts growing a lot, it’s going to be a pain to change the way you do your books.

Earl: Accrual sounds kind of a little bit, you know, intimidating. What if I just start with accrual, but use an accounting software that could do both?

Meg the CPA: Perfect.

The Income statement

Earl downloads a powerful accounting software that offers both cash and accrual reports. He connects his bank account and finds that he already has enough transactions to warrant running a report. So Meg starts him off easy and introduces him to the income statement.

The Income Statement (also called “Profits and Losses” or “P&L”) breaks down sales and expenses over a specified time period. Your net income, or “bottom line” on your Income Statement is what you pay taxes on and it tells you if you’re actually making a profit!

If we want to know how profitable Grasscreek Enterprises is during a period of time, we would want to take a look at the increase in revenue during that period minus any expenses. The income statement breaks down revenue and expenses into more detail and shows the net profit / net loss after you subtract all expenses from revenue.

So those are all terms that Earl is somewhat familiar with.

Earl: So far, so good.

Let’s take a look at the revenue sources that Earl predicts. Grasscreek Enterprises is engaged by clients as a consulting service, so Earl will bill them at an hourly rate for any work that he does. Earl sends them invoices at the end of every month with net 30 terms.

Meg the CPA: Now here’s an example of why accrual is going to be an awesome accounting method for you. Let’s say you decide that you want to collect a retainer from a new client because you don’t know them that well.

Earl: Sounds like a good idea.

Meg the CPA: Well, should you really count that as revenue if you haven’t earned it yet? What if the client changes their mind and wants a refund of their unused retainer?

Earl: Hmm.

Under the accrual method, if Earl collects a retainer upfront, that money is booked in the liability account Unearned Revenue that Earl can “earn” overtime as he bills against the collected retainer. Also, if Earl does some consulting for a client and sends them an invoice for $1,000, that $1,000 is going to get booked as revenue the same day he sends the invoice even though the client won’t be paying until later.

When Earl finally does get paid, he’s going to have to make an entry that shows the money was actually paid and that there is no longer money being owed (accounts receivable).

Meg the CPA: We can keep talking about accrual basis accounting until you feel comfortable with it but essentially your revenue is going to show up in the income statement for the period range when the work was billed, not when you get paid.

Earl: Nothing that I have done in life has prepared me for this moment. I’m going to just trust you on this.

Essentially Earl’s revenue is not going to change when he gets paid. Where the money is will shift but there’s not going to be any new revenue.

Meg the CPA: The other main part of the income statement is the expenses. Looks like you’ve got $500 worth of expenses between all of the different sub-contracting and software that you’re paying for as a marketing consultant. Since you are taking home income from those projects as well, you essentially need to subtract those two. Subtracting your expenses from your revenue gives you your income!

Earl: That makes sense!

One thing that’s cool about ZipBooks is that you can create custom tags by client, location, etc. Then, when you’re generating your reports, you can just plug in that tag and see exactly how profitable that individual client is.

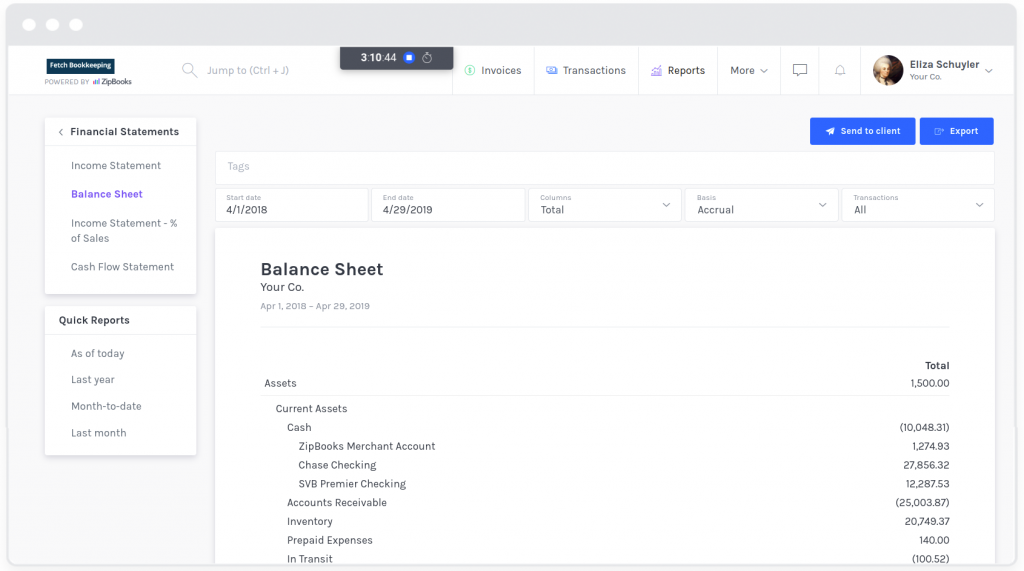

The balance sheet

Meg the CPA: Okay Earl, here comes the big one. Once you understand the balance sheet, you understand the fundamental theory behind accounting. You ready?

Earl: I’ll try to be.

The Balance Sheet is called such because it expresses a “balanced” accounting equation.

Assets = Liabilities + Owner’s Equity

This equation must always be true and, when you’re using accounting software, it will be.

The Balance Sheet represents a single snapshot in time, where your financial standing is at any given moment. (Remember, the income statement shows money made over a period of time). This data is invaluable to business owners because it helps you to see where your business stands right now, particularly in terms of cash in the bank and debts owed.

Earl: Okay, wait—Meg! What is an asset?

Meg the CPA: Anything you have as a company owner that has value. So if you have money in the bank, that’s value. If you have equipment, that’s value. Outstanding invoices that will be paid, value. Make sense?

Earl: Yeah, sort of. So what if I pay a lease on a building. Is that an asset?

Meg the CPA: Well, it depends. Prepaid expenses are definitely value. So if you pay your lease upfront for the first year, then the value has already been paid. So as the year continues on, the prepaid lease money goes down, but that’s still an asset.

Earl: Cool! So just like my house. I just refinanced and now I have an asset worth $320,00.

Meg the CPA: Good for you! But that’s not quite how it works in accounting. When we’re doing accounting for a business we want to be as conservative as possible in terms of how we value a company.

The role of depreciation

Earl: Well, that’s kind of a bummer.

Meg the CPA: It doesn’t have to be. Check out the lines under assets. See the one called “Accumulated Depreciation.” That line is your friend.

Physical assets (like cars, buildings and computers) don’t retain their value over time. Depreciation takes into account the wear and tear your business has on your company’s assets.

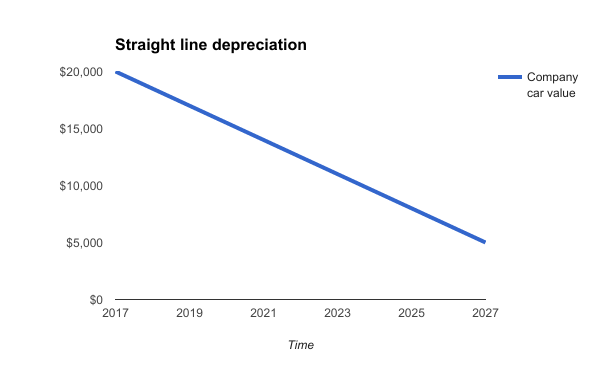

You can depreciate these items every year on your balance sheet–most businesses use straight line depreciation.

Meg the CPA: I’m going to break this down for you using the company car you just purchased. Tell me about it’s value.

Earl: Okay, I just bought a Toyota Camry from $20,000. Those cars don’t really ever drop below $5,000 and I plan on using it for about 10 years.

Meg the CPA: Great, that makes the math easy.

Meg shows Earl how the value of the company car will depreciate over a ten-year period. Notice the shape of the graph: a straight line.

Now in accounting, you have to remember that the car is going to continue to go down in value. This helps you to keep in the back of your mind, ‘Hey! Whatever money I’m making for this company, I’m going to have to replace this car.’

Liabilities + Owner’s Equity

Onto the other side of the accounting equation.

A liability is a debt owed by the business to an outside party. Think obligations: credit card debt, a mortgage, unpaid contractors, etc.

Owner’s equity is value that represents the owners‘ claim on the business’s assets (unlike liabilities, which represent a debt holder’s claim).

Meg the CPA: Okay Earl, let’s say it’s going to cost you $10,000 to get this business off the ground. You’ll need to dig into your savings and transfer that amount to your newly-created business bank account.

Earl: I can do that.

Meg the CPA: So once that’s done, you’re going to need to balance that in your books. Your cash will increase by $10,000 and so will your owner’s equity.

Earl: Slow down.

Meg the CPA: Well, if we look at our definition, owner’s equity represents the business owners’ claim on the business’s assets. Let’s say you shut down this business right now. Where would that $10,000 go? Right back in your pocket!

Earl: You’re right. So that’s how I keep the equation balanced?

Meg the CPA: Exactly.

Double Entry Accounting

So if both sides of the equation have to stay equal, that means that if something changes on one side, then something else has to change on the other. Enter, double entry accounting.

Double-entry accounting is a method in which every transaction recorded will have a corresponding entry in at least one other account. The transactions are normally opposites, meaning that if a transaction results in the increase of one account, there would also be a decrease in another account.

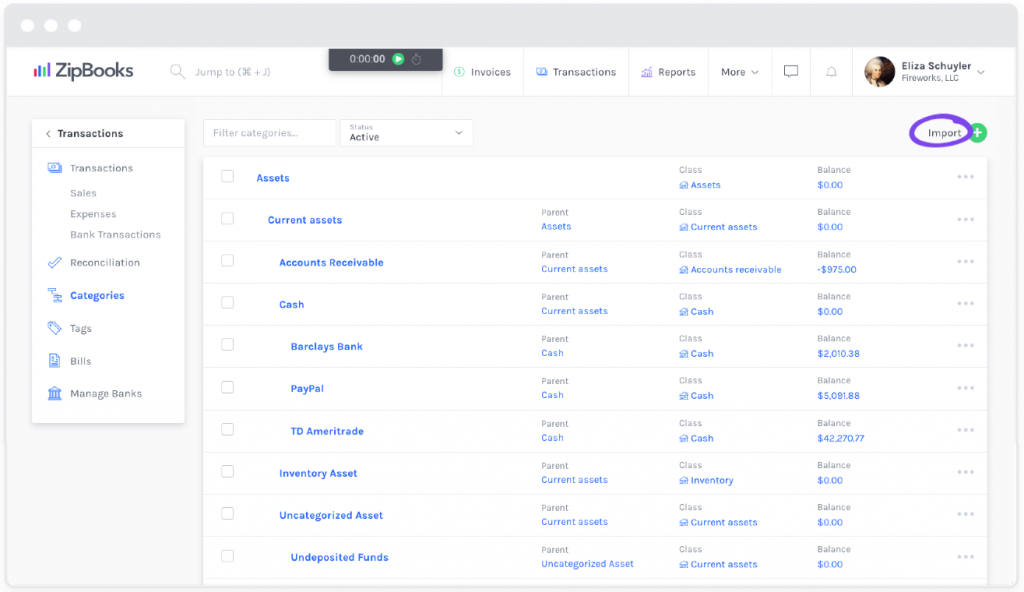

Now, when we say account, we’re not just talking about bank accounts. When you set up your books, you set up a bunch of different accounts called your chart of accounts–in ZipBooks, we just call them categories to avoid confusion.

Meg the CPA: Earl, let’s set up some categories for you. Why don’t you walk me through your accounts.

Earl: Okay, in my new bank account, I set up a checking and a savings.

Meg: Easy, those will be two different accounts in your books.

Earl: And I send out invoices too. Would that be a separate account? Sometimes I don’t get paid right away.

Meg the CPA: Those are your accounts receivable. Be sure to keep an eye on those or else you’ll have customers still owing you money that you completely forgot about.

Earl: Will do. What about my lease payment?

Meg the CPA: That will be a liability. So we’ll start with those three categories in Assets. What other liabilities do you have?

We’ll let Earl and Meg go through the nitty-gritty, personal details on their own, but you get the idea. Your categories represent sub-categories of the accounting equation: Assets = Liabilities + Owner’s Equity.

Note: Sales and expenses do contribute to a business’ financial position, but in context of the accounting equation, they both roll up to owner’s equity.

Setting up a chart of accounts may seem intimidating to newbie accountants, but the good thing is, most accounting software programs will have a default chart of accounts set up for you. For example, most of our small business ZipBookers just use the categories we’ve set up–you really only need to create custom categories if you’re an accountant or extremely complex business.

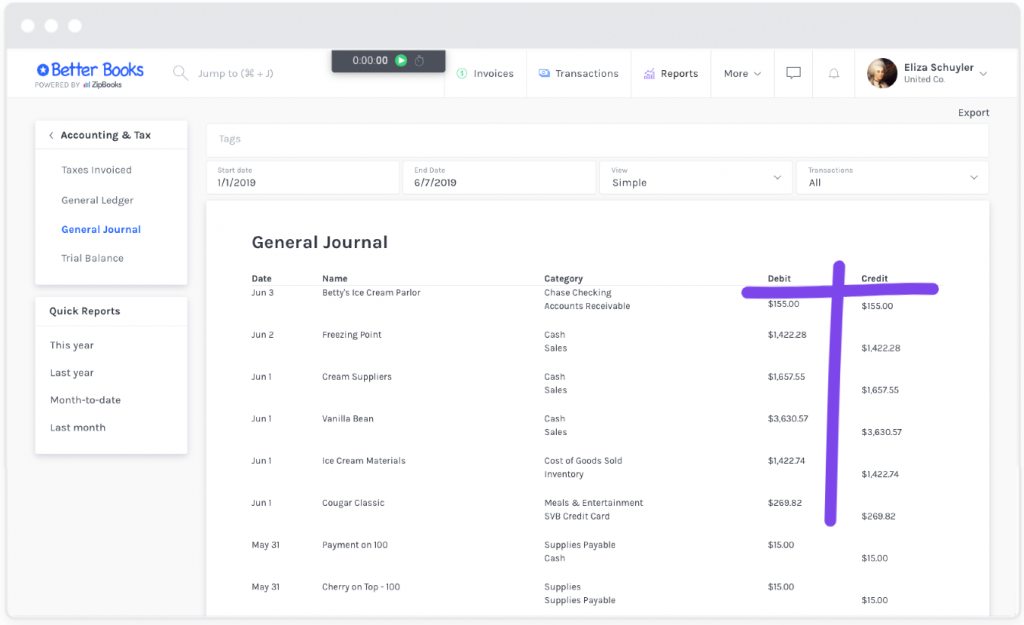

We won’t go much further into double entry accounting, because most of this is done behind-the-scenes in ZipBooks. However, if you are a double-entry fanatic, you can manage every transaction using the Advanced View:

Quick Note on T-Accounts

Debits on the left,

Credits on the right,

When Earl met ZipBooks,

It was love at first sight.

Double-entry accounting deals with debits and credits. A lot of accountants use T-accounts or T-charts as a visual aid to make sure that everything has its opposite. Earl’s using ZipBooks now, so he’s never going to need to make a T-chart, but he can always see what they look like in his General Journal.

Note: Every transaction has an equal and opposite transaction (see the “T”?)

Looking to learn more about CPA’s? Here’s a solid guide that tells how to become a CPA.

Looking for more bookkeeping terms? Check out our complete glossary of accounting jargon.

Tim is Founder and CEO of ZipBooks. He keeps his desk really nice and neat.