by Zipbooks Admin

What is a 1099-G?

1099 forms are the forms that the IRS uses to indicate income that was earned in some way other than by working for a traditional employer and receiving a W-2 tax form at the end of the year.

There are many 1099 forms that cover a multitude of income types, and they are all designated by letters attached to the name of the form that indicate which source is identified for the income.

If you’re looking for information on the 1099-MISC or another 1099 form, refer to our 1099 Form: Complete Guide for Businesses & Contractors.

What is a 1099-G?

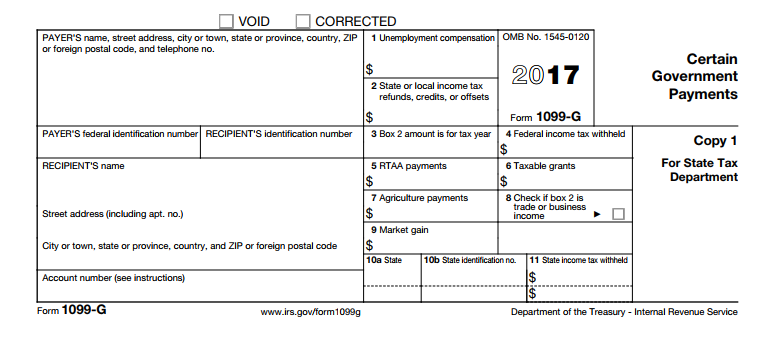

The 1099-G form, Certain Government Payments, indicates income earned from a government source. This does include a number of different types of government payments, both federal and state, so you may get more than one, depending on what type of payments you received throughout the year.

The 1099-G is what is known as an “information return”. This means that the entity who issued it sent a copy to the IRS as well as to you. The IRS, therefore, knows that you should be reporting this on your 1040 form, and will possibly as why if you fail to include it when you file your personal tax return.

1099-G by the numbers

Box 1. Unemployment Compensation

Box 1 contains the payments of $10 or more in unemployment compensation (including Railroad Retirement Board payments). File a separate Form 1099-G for payments for each contributory program that pays you a form of unemployment compensation. Enter the gross amount of the unemployment compensation (before any income tax was withheld). You’ll enter withheld federal income tax in box 4.

Box 2. State or Local Income Tax Refunds, Credits, or Offsets

Enter refunds, credits, or offsets of state or local income tax of $10 or more you made to recipients. These include most state tax credits and incentive payments that are paid under an existing state tax law and administered by the state taxing agency. Film maker incentive credits, home improvement credits paid in low income areas, and solar panel installation credits are some types of state programs which are generally reportable in box 2 if paid by the state taxing agency.

Do not enter in box 2 payments that are not state income tax refunds, credits, or offsets. This may include payments made under state grant, incentive, subsidy, or other individual assistance programs. Taxable grants are reported in box 6; see the instructions below. If recipients deducted the tax paid to a state or local government on their federal income tax returns, any refunds, credits, or offsets may be taxable to them.

You are not required to furnish a copy of Form 1099-G or a substitute statement to the recipient if you can determine that the recipient did not claim itemized deductions on the recipient’s federal income tax return for the tax year giving rise to the refund, credit, or offset. However, you must file Form 1099-G with the IRS in all cases.

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing. claim itemized deductions on the recipient’s federal income tax return for the tax year giving rise to the refund, credit, or offset. However, you must file Form 1099-G with the IRS in all cases.

A tax on dividends, a tax on net gains from the sale or exchange of a capital asset, and a tax on the net taxable income of an unincorporated business are taxes on gain or profit rather than on gross receipts. Therefore, they are income taxes, and any refund, credit, or offset of $10 or more of these taxes is reportable on Form 1099-G.

In the case of the dividends tax and the capital gains tax, if you determine that the recipient did not itemize deductions, as explained above, you are not required to furnish a Form 1099-G or substitute statement to the recipient. However, in the case of the tax on unincorporated businesses, you must furnish a Form 1099-G or substitute statement to the recipient in all cases, as this is a tax that applies exclusively to income from a trade or business. See Box 8. Trade or Business Income (Checkbox), later, and Rev. Rul. 86-140, 1986-2 C.B. 195.

If you pay interest of $600 or more on the refund: you must file Form 1099-INT, Interest Income, and furnish a statement to the recipient. For interest payments of less than $600, you may choose to enter the amount with an appropriate designation such as “Interest Income” in the blank box on Copy B of the Form 1099-G.

Box 3. Box 2 Amount Is For Tax Year

No entry is required in box 3 if the refund, credit, or offset is for the 2016 tax year. If it is for any other tax year, enter the year for which the refund, credit, or offset was made. Also, if the refunds, credits, or offsets are for more than 1 tax year, report the amount for each year on a separate Form 1099-G. Use the format “YYYY” to make the entry in this box. For example, enter 2015, not ’15.

Box 4. Federal Income Tax Withheld

Backup withholding. Enter backup withholding at a 28% rate on payments required to be reported in box 6 or 7. For example, if a recipient does not furnish its taxpayer identification number (TIN) to you, you must backup withhold.

Voluntary withholding. Enter any voluntary federal withholding on unemployment compensation, CCC loans, and certain crop disaster payments. If you withhold state income tax, see Boxes 10a Through Box 11. State Information, later. However, you are not required to report state withholding to the IRS.

Box 5. RTAA Payments

Enter RTAA payments of $600 or more that you paid to eligible individuals under the Reemployment Trade Adjustment Assistance program.

Box 6. Taxable Grants

Enter any amount of a taxable grant administered by a federal, state, or local program to provide subsidized energy financing or grants for projects designed to conserve or produce energy, but only with respect to energy property or a dwelling unit located in the United States. Also, enter any amount of a taxable grant administered by an Indian tribal government.

Report amounts of other taxable grants of $600 or more. State and local grants are ordinarily taxable on your federal returns unless you know of a specific reason why they should be excluded. A federal grant is ordinarily taxable unless stated otherwise in the legislation authorizing the grant. Do not report scholarship or fellowship grants. See Scholarships in the Instructions for Form 1099-MISC.

Box 7. Agriculture Payments

Enter USDA agricultural subsidy payments made during the year. If you are a nominee that received subsidy payments for another person, file Form 1099-G to report the actual owner of the payments and report the amount of the payments in box 7.

Box 8. Trade or Business Income (Checkbox)

If the amount in box 2 is a refund, credit, or offset attributable to an income tax that applies exclusively to income from a trade or business and is not a tax of general application, enter an “X” in this box.

Box 9. Market Gain

Report market gain associated with the repayment of a CCC loan whether repaid using cash or CCC certificates.

A market gain could be anything where you realized a gain buy selling a commodity. Stocks, bonds, etc.

Boxes 10a Through 11. State Information

These boxes may be used by filers who participate in the Combined Federal/State Filing Program and/or who are required to file paper copies of this form with a state tax department. See Pub. 1220 for more information regarding the Combined Federal/State Filing Program. They are provided for your convenience only and need not be completed for the IRS.

Use the state information boxes to report payments for up to two states. Keep the information for each state separated by the dash line. If you withheld state income tax on this payment, you may enter it in box 11. In box 10a, enter the abbreviated name of the state. In box 10b, enter the filer’s state identification number. The state number is the filer’s identification number assigned by the individual state. In box 11, enter the amount of any state income tax withheld.

If a state tax department requires that you send them a paper copy of this form, use Copy 1 to provide information to the state tax department. Give Copy 2 to the recipient for use in filing the recipient’s state income tax return.

Click here to download a blank 1099-G form from the IRS’s website.

Unemployment Compensation

The most common reason for receiving a 1099-G form is that you received unemployment compensation during the year. You’ll receive a 1099-G, listing the amount of compensation that you received and whether or not it’s taxable. (Hint: It usually is, unfortunately.)

State Tax Refunds

If you received a state or local tax refund for a previous year’s tax filing, you will likely receive a 1099-G form stating that. However, that doesn’t mean it counts as taxable income.

You would only have to report the amount if you took a deduction from your federal taxes for that amount. In other words, if you listed your state taxes paid as an itemized deduction in a previous tax year, but then got a refund of some of that state tax paid, then it is no longer allowable as a deduction, and you will have to pay tax on the amount.

Other 1099-G income categories

The remaining types of payments that are reported on a 1099-G are rare, but you probably know if you receive them:

- Trade adjustments

- Taxable grants from government agencies

- Payments from the Department of Agriculture

- Gain on certain loans that are only available to farmers

Save Time on your 1099s with smart software

Freelancers and business owners alike want to simplify tax-processing and accounting. ZipBooks makes it easy to flag transactions as a 1099 expense and tag vendors as 1099 contractors so you don’t miss a beat come tax-time.

We’ve built ZipBooks with small business owners in mind, not just accountants. Because of that vision, we think our platform offers a more streamlined interface, more intuitive reporting, and more visually appealing workflows.

It’s simple to use, but offers the muscle of more expensive products.

You can also take advantage of ZipBooks’ virtual bookkeeping services to hand off your books to someone else. But we promise, accounting with us isn’t scary. You’ll find yourself more empowered and more confident by our smart software–try it out for free!