by Zipbooks Admin

How to Fill Out a Schedule C Tax Form

If this is your first year in business, you are about to experience filing taxes as a business owner. This can either be a complete pain or a piece of cake, depending on how savvy you are when it comes to taxes and deductions.

When you’re a regular employee, you receive a W-2 form that tells you everything you need to know. You fill out your 1040 form and you file. Easy.

But if you’re self-employed and receive a 1099 as a contract employee, or if you own a business, you’ll have to include an IRS Schedule C form with your personal tax filing.

A Schedule C is also referred to as “Profit or Loss from a Business.” Understanding it is the key to making sure you report your income (or loss) accurately and pay only the tax that you are legally obligated to pay.

With a Schedule C, you’ll report your income, but you’ll subtract deductible business expenses from that income. This way you are reporting only your actual profit or loss to the IRS and not paying more tax than necessary.

Who Needs to File a Schedule C?

If you own a business or work as an independent contractor and are paid on a 1099, you will have to file a Schedule C. You may even have to file more than one Schedule C if you have more than one business or do more than one type of freelance work. (For example, if you work as a website designer and also drive for Uber, that would require two Schedule Cs at tax time.

What kind of information do you need for the Schedule C?

There are five parts to a schedule C:

- Schedule C Part 1: Gross Income

- Schedule C Part 2: Expenses (including business use of your home, if you work from home)

- Schedule C Part 3: Cost of Goods Sold (if you have inventory in your business)

- Schedule C Part 4: Information on your vehicle

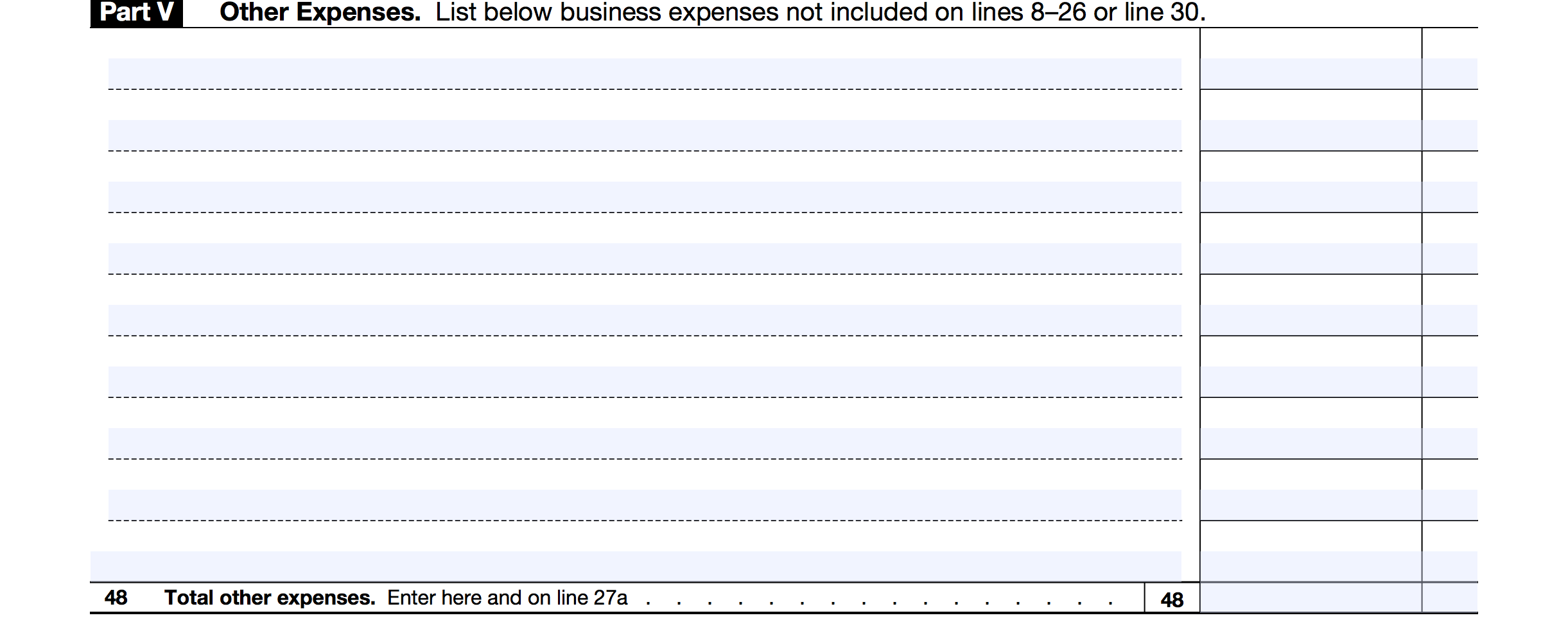

- Schedule C Part 5: Other expenses

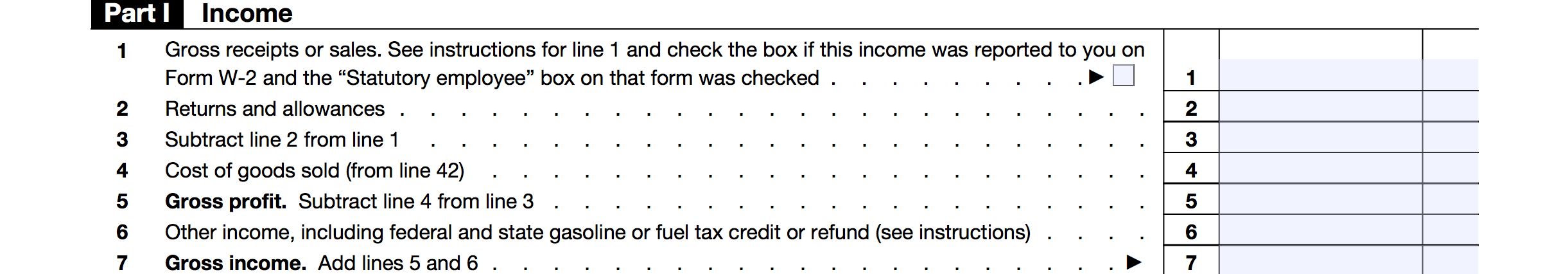

Schedule C Part 1: Income

The first section is pretty easy to understand. The IRS wants to know about all of the revenue that you earned in your business during the course of the tax year.

From that number, you deduct any returns and the cost of producing or obtaining the items that you sold. Add in any other income you may have earned for this business, such as interest on loans or a bank account, renting out office space, etc. These three lines added together total your Gross Income.

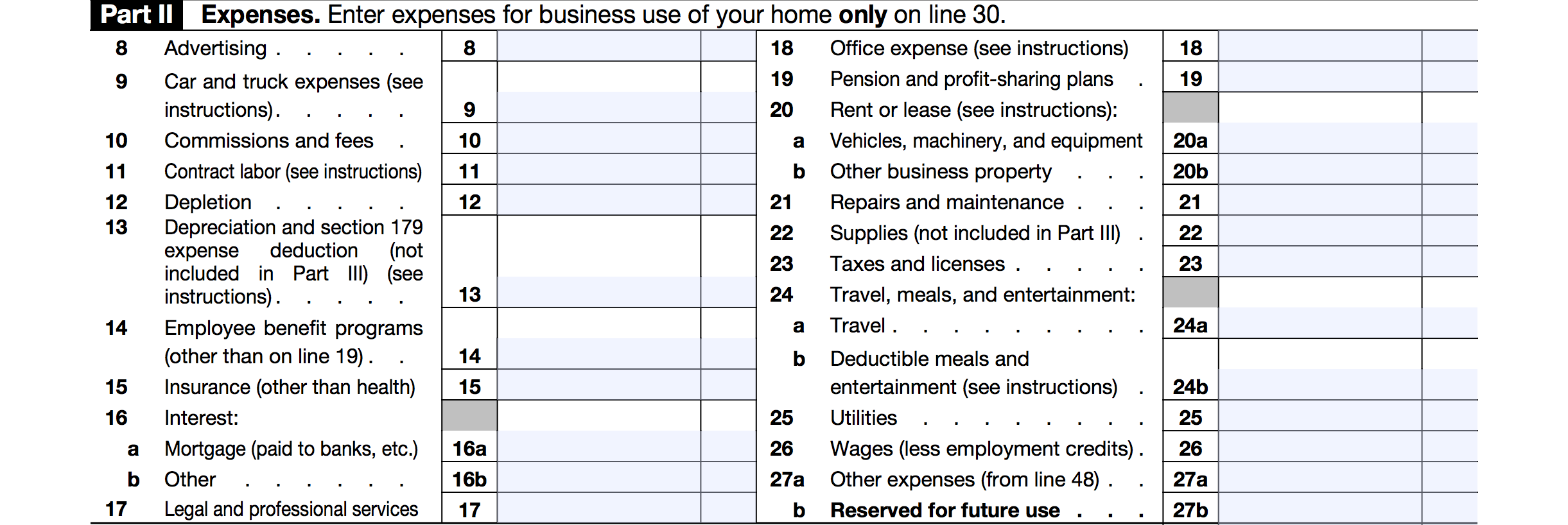

Schedule C Part 2: Expenses

Next is the Expenses section. Here you want to be as thorough as possible and take every deduction that you are entitled to.

The form conveniently separates your expenses into various common categories, like advertising, insurance, office supplies, etc. So if you have used a terrific bookkeeping system like ZipBooks, it will be easy to just pull the totals from your expense report and transfer them to your Schedule C.

Another big expense is contractors. If you paid contractors, you can deduct the cost of their work. You may have to file a 1099 for them, so be sure to read up on the guidelines. ZipBooks provides a way to distinguish which expenses are for 1099 contractors, to make it easier at tax time.

And if you work from home, there is a place (line 30) where you can calculate an expense deduction for that as well.

It’s important to take every single deduction that you can, because these reduce the amount of your total gross profit and the amount of tax that you will have to pay.

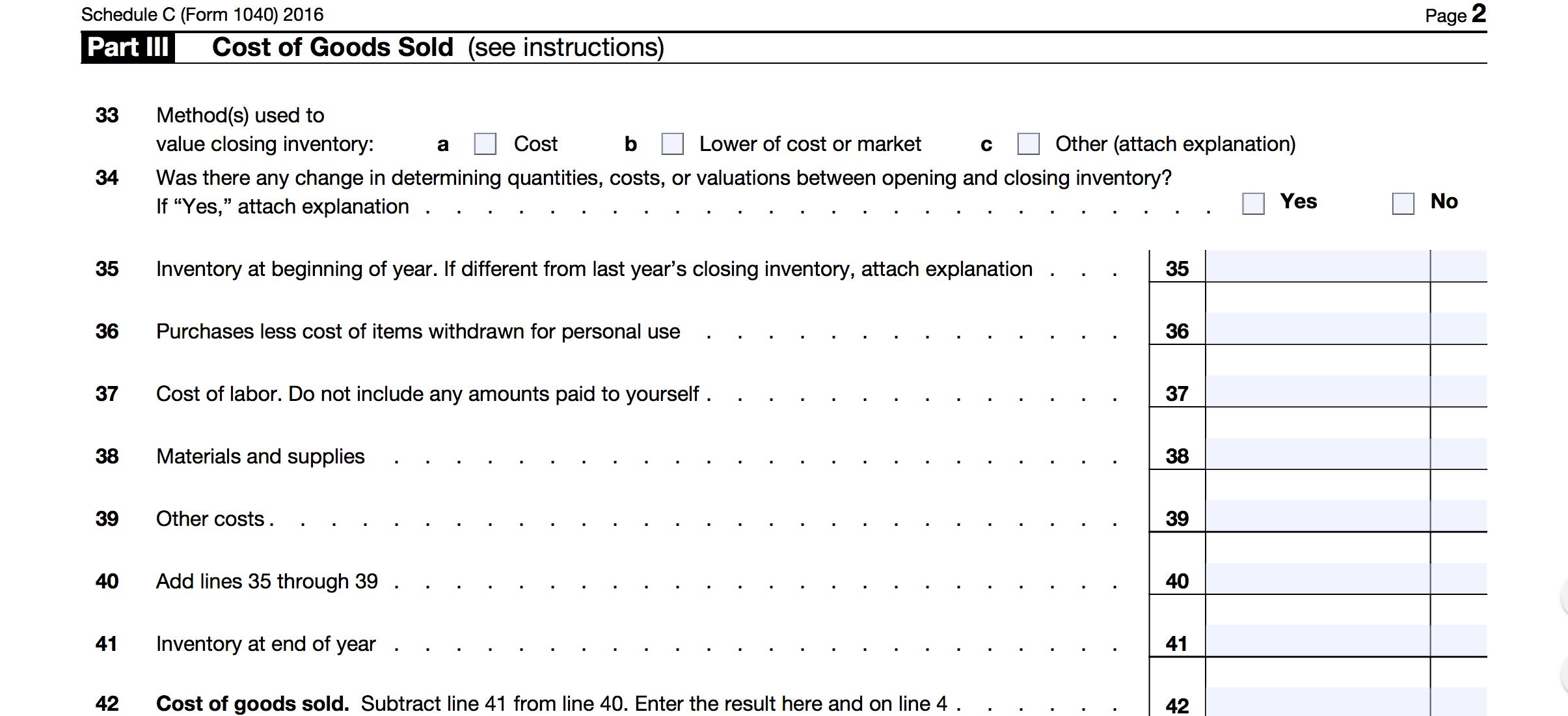

Schedule C Part 3: Cost of Goods Sold

This part of the form is only used for businesses that actually sell a physical product rather than a service. If you sell a product, then you can deduct all of the expenses that went into producing or obtaining the product, which reduces the amount of your profit.

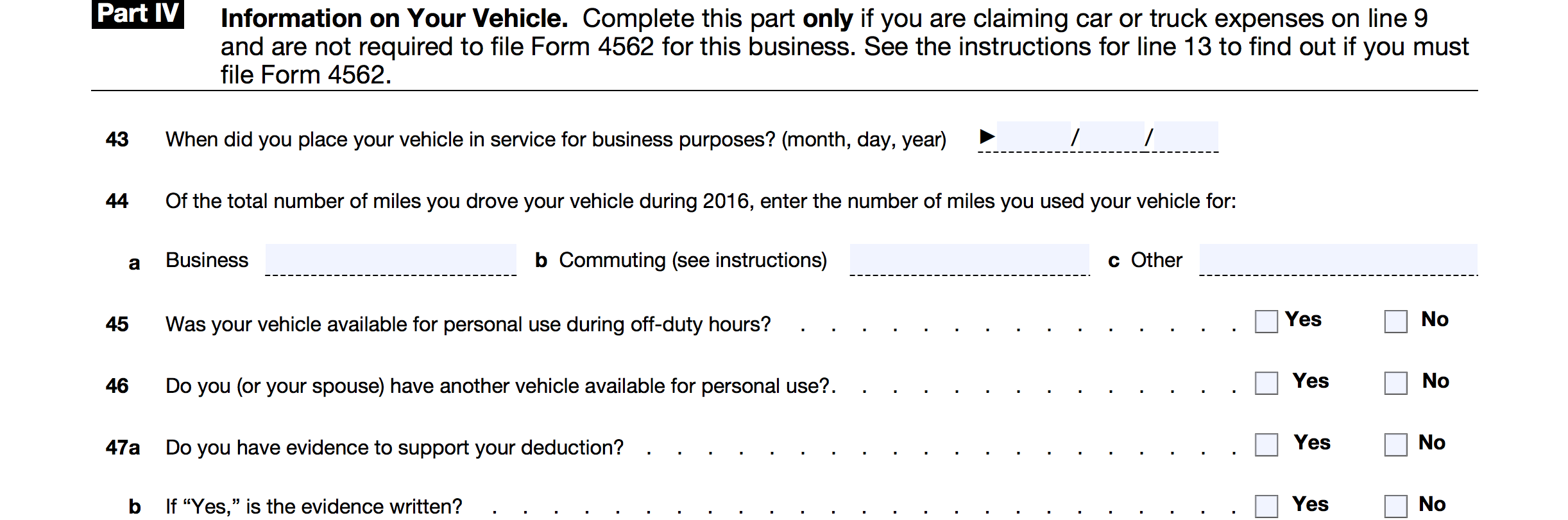

Schedule C Part 4: Vehicle Information

You should fill out this section if you a drive your personal car for business purposes. If you drive your personal vehicle around for your business or to clients’ offices, you can deduct that vehicle’s expenses. So this is where your mileage notes become very important. The IRS allows you a per-mile deduction to cover the cost of using your vehicle.

If you have a vehicle that’s 100% for business use, then you can deduct actual costs for your lease or loan payment, insurance, gas, maintenance and repairs, and depreciation.

Schedule C Part 5: Other Expenses

Other expenses are not common. The IRS has a very specific list of things that fit under this category. It includes bad debts, pollution-control amortization costs, certain business-startup costs that would otherwise be amortized, and Gulf Opportunity Zone clean-up costs.

Do I fill out a Schedule C-EZ?

If you’re lucky, you may qualify to report on a shorter, easier form than the original Schedule C. You can qualify for filling out a Schedule C-EZ if you meet ALL of the following requirements:

- Operate only one sole proprietorship

- Report less than $5,000 in business expenses

- Don’t hold any inventory

- Are reporting a net profit, not a loss

- Have no employees

- Are not claiming a home office deduction

The Key to an Easy Schedule C

The best way to make your Schedule C easy to file is to keep accurate, complete, and detailed accounting records.

Here are some things you can do to make filling out a Schedule C easy:

- Make sure your revenue/sales records are inclusive by issuing invoices and matching them to payment transactions.

- Reconcile bank deposits with your payment transactions on a regular basis to make sure you are keeping track of all incoming money.

- Instead of using a catch-all expense category, separate out your spending and purchases based on distinct categories that make sense for you and your business.

- If you use your vehicle, keep track of your mileage in a way that makes sense and is easy to access.

- Use the ZipBooks 1099 feature to easily distinguish which expenses are for independent contractors and whether or not you have to issue 1099s to those contractors.