by Jennifer Ringger

The Bookkeeping Side of Freelancing: What Works and What Doesn’t

Freelancing can seem like the dream job. And for the most part, it is.

You get freedom to choose when and how you work, what you’ll work on, and who you’ll work for. The only rules are the ones you make.

Pretty dreamy, right?

But there’s a dark side to freelancing too. As a creative person, one of those ugly aspects is bookkeeping.

For me, keeping track of who owes me money, collecting the money, and end-of-year taxes all sound like dirty words. However, once I developed a system, these tedious tasks became a lot easier.

Keeping track of who owes me money

Personally, I like to think about the bookkeeping part of the business as little as possible. My philosophy: keep it simple.

As an independent contractor, I only get paid when I’ve completed projects for my clients. So, I need to maximize the time spent working for clients and minimize the time spent on admin.

I’ve taken a very basic approach.

Every time I receive money from a client, I record that. Every time I spend money on behalf of the business, I record that too.

The easiest way for me to keep track is to use an Excel spreadsheet. There are lots of fancy software programs available to help track who owes money and how much I’ve spent, but a simple spreadsheet has worked best for me so far.

I record:

- Who I received the money from or who I paid it to

- The date

- The amount

- The purpose

Each year is a spreadsheet with one tab for “income” and another tab for “expenses.” There are columns for all the details like date, amount, client, etc. and I just fill them in as I go. For me, it’s important not to complicate this process.

Collecting money, even from difficult clients

When you have a client who pays on time, collecting money is easy. But sometimes, you get those clients who are slow to pay, or simply refuse to pay.

To keep track of who owes me money and to make collecting easier, I start with an invoice. My invoices include what I worked on, how many hours I worked, total due, and the due date.

I create an invoice using a Word document. It’s the easiest method for me to keep track of the money I should be receiving.

At this point, the client pays me. About 90% of my clients pay via PayPal, but the method of payment differs, depending on the client. Individuals, small businesses, and online magazines tend to pay via PayPal.

More established print magazines or larger companies will still pay by check. This is usually because they have an accounting department that has processes to follow.

Every so often, I get that client that makes getting paid difficult. When an invoice isn’t paid within 30 days, I use the following system:

- Send a friendly email reminder. I like to assume the lack of payment is simply an oversight. The day after the payment was due, I send a quick, yet friendly email.

- Make a call. Nine times out of ten, an email does the trick. But if there’s still no response, I make a call. When you can get a person on the phone, they are usually less evasive.

- Add a late fee. If I still don’t have payment after following steps one and two, I will re-submit my bill with a 3% late fee. Often the late fee is enough to get the check sent.

Preparing for end-of-year taxes

If you make more than $400 from freelance work, you need to pay taxes.

You will owe taxes on the profit of the business – total income minus expenses. Usually, this ends up being 20-30%.

Pretty steep, huh? It does seem like a lot of tax to pay, but remember that you are double-taxed as both an employer and an employee because you’re self-employed.

You’ll need a 1099 form from each of your clients. Most will send the 1099 by the end of January, but if you haven’t received one be sure to contact your client.

Remember, you can deduct business expenses, but this is where keeping track of your documents comes in. The IRS is suspicious of deductions made by those who are self-employed, so be sure you have receipts and documentation to back those deductions up! Again, I keep track of all these expenses in my spreadsheet.

Don’t rely on your memory. Back everything up.

If your business starts bringing in $1,000 or more a year, you should look into paying quarterly taxes. The IRS doesn’t like waiting for its money, so quarterly payments are your best option.

Google “quarterly taxes” and you’ll find plenty of information.

How to improve for the coming year

Now that it’s nearing the end of the year, I’ve started to think about my record keeping and what I can do to improve it for the coming year.

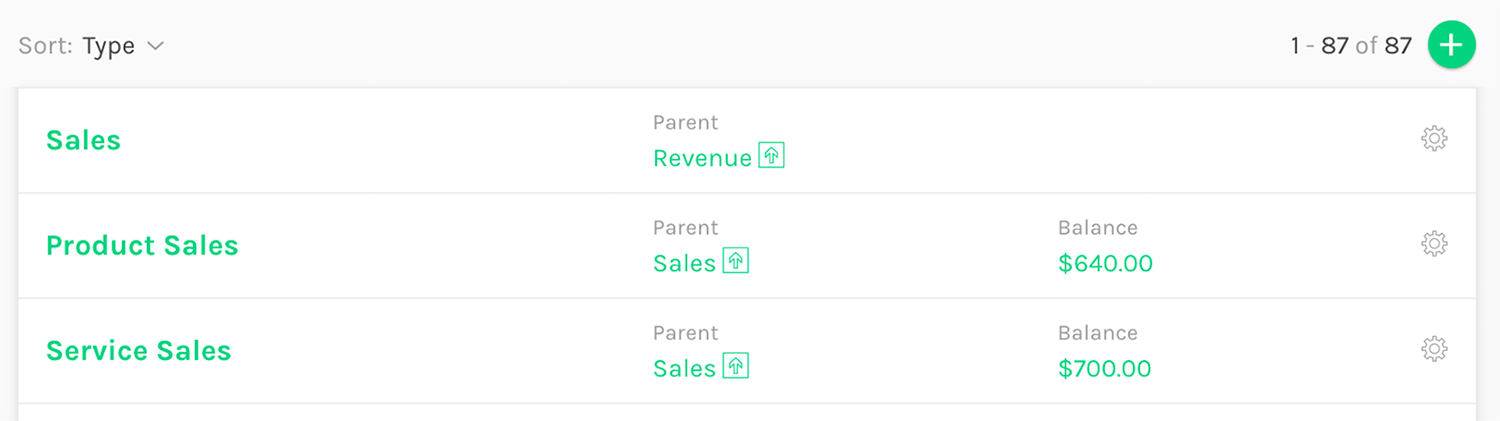

I use the spreadsheet method because it’s simple and easy-to-implement, but I’m thinking ZipBooks will probably save me time in the long run. Once my business expenses, invoices, and payments are entered into ZipBooks, I can set a lot of things to happen automatically. For example, I can schedule emails to automatically remind my customers about payments. I can also do something I haven’t been able to do up to now: accept credit card payments.

While I am pretty happy with the way things are going, I’m thinking that moving to an online accounting app is going to help me in the future as my client list grows and the amount of invoices I have to manage in Microsoft Word becomes unmanageable. A one-stop place for tracking clients, issuing invoices, setting up a budget, etc. may be a great change to make before 2017 hits.

Understanding the bigger picture of my business will definitely help my client base to grow.

Closing thoughts

Freelancing is fun and liberating, but there’s also a large amount of detail work that needs to be done. There’s lots of great information here to help your business be more successful tomorrow than it is today. Check out other articles below!