by Tim Chaves

How to write an invoice that gets paid faster

Invoicing doesn’t have to be stressful, it can actually be pretty simple–as long as you know how to write an invoice correctly.

What is an invoice?

An invoice is a business document detailing a transaction and requesting a payment. Invoices may also be called “bills,” “statements,” or “sales invoices.”

Invoices include important details like what goods or services were provided, how much money is owed by the client and the terms of payment. Most modern-day businesses use an online invoicing tool to send invoices and receive digital payment from customers.

Invoices are commonly confused with estimates, purchase orders, and receipts. Because invoices are a business communication tool, it’s critical to know the difference between each document and to know how they function in the purchasing process.

Invoice vs Estimate

An estimate is a proposal of services or sales. Estimates can also be called “bids” or “quotes.”

Customers may request an estimate before completing a purchase order so they can check your pricing.

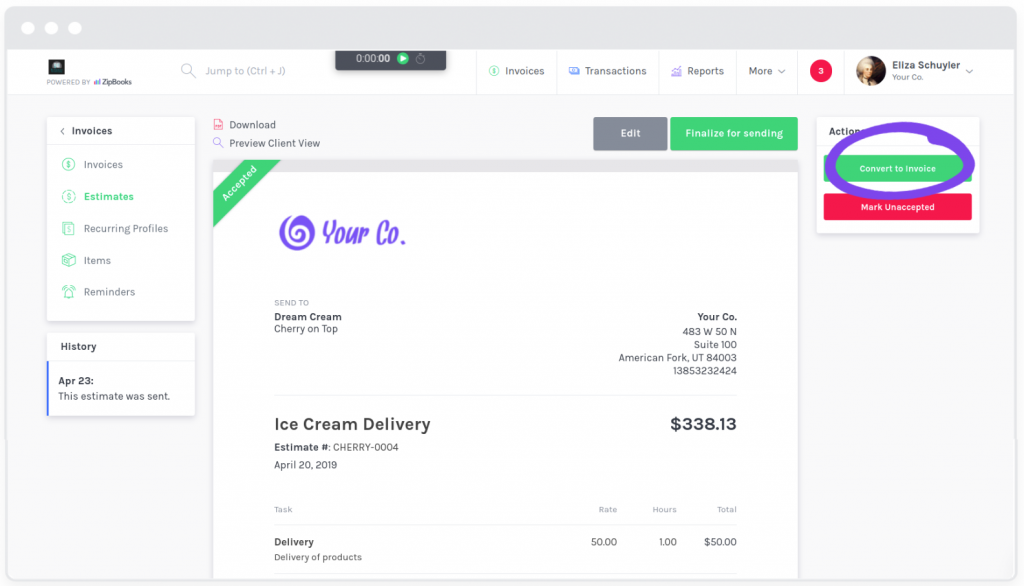

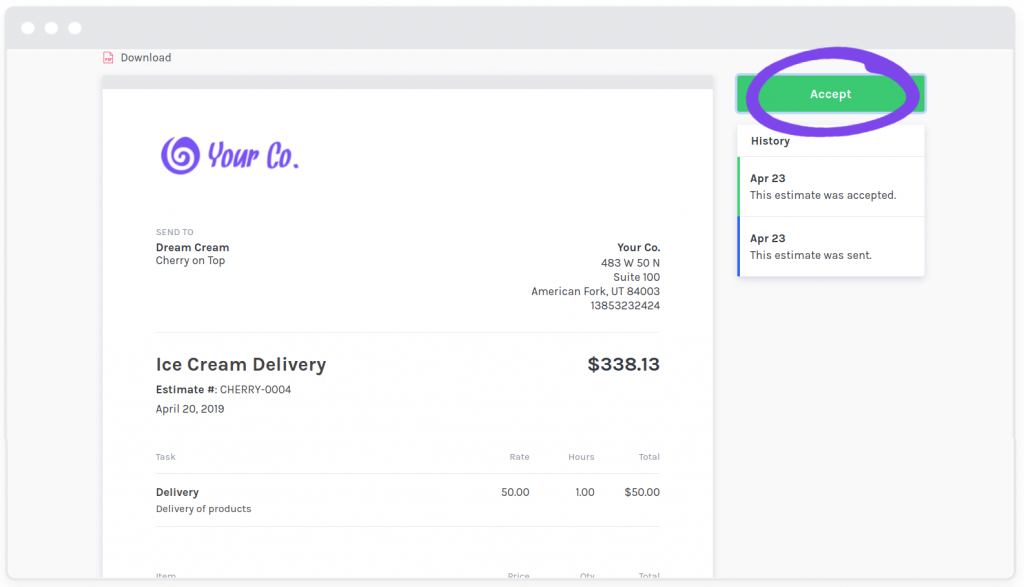

If you’re using digital invoicing software, you’ll probably create estimates and invoices in the same way (which explains the confusion). Using ZipBooks, customers can mark estimates as accepted and then business owners can automatically convert those estimates to invoices.

Customer view:  Invoicer view:

Invoicer view:

Invoice vs Purchase Order

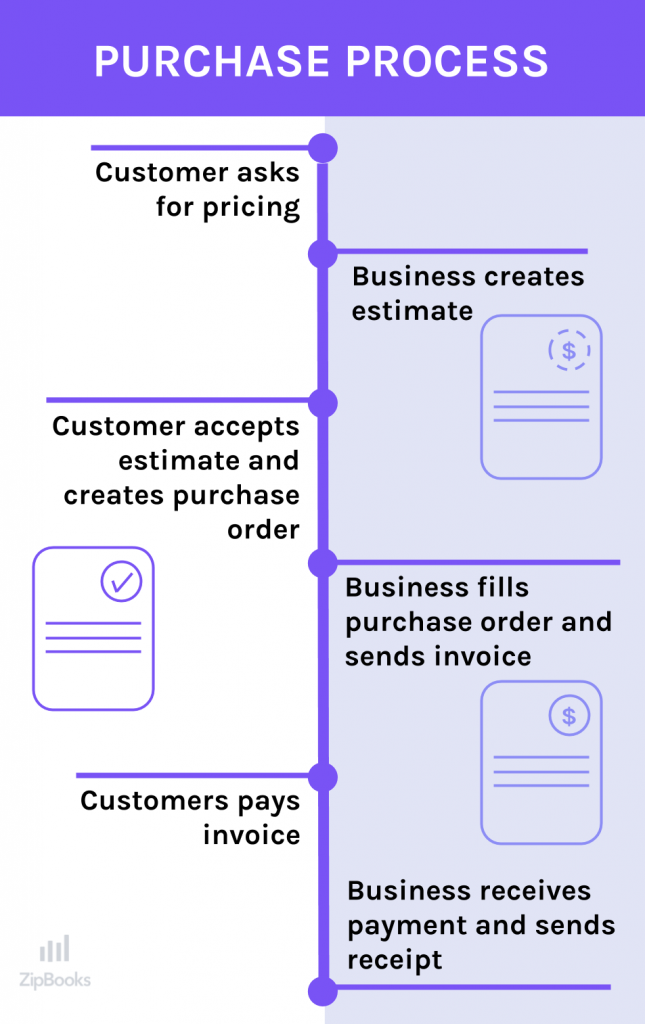

A purchase order (PO) is a document that indicates what is being purchased by your customer. It includes the tasks or items, quantities, prices, and other terms and conditions.

POs are typically sent after an estimate, but before an invoice. They are used by financial departments to manage payments to suppliers, track order status and clarify items. Businesses who receive POs use the information provided to create an invoice. Both documents are legally-binding.

Invoice vs Receipt

A receipt indicates receipt of payment (makes sense, right?). Receipts are provided to customers by the business from which they made a purchase.

Invoices request payment and receipts indicate payment. While these terms can be easily confused, the purchasing process is actually pretty straightforward.

What are the most common types of invoices?

Invoices are used by sole proprietorships and huge corporations alike. Creating a simple invoice that you can use over and over again will save you valuable time.

Invoices can be used for goods or services—in fact, many digital invoicing solutions allow you to bill for both. In ZipBooks, we call these “Tasks” and “Items.” Whatever platform you use, it should be easy to add saved line items to invoices.

Here a few of the most common types of invoices:

- Pro forma invoice—another name for an estimate, can change as the project proceeds

Interim invoice—also known as a Progress invoice, breaks up the work and the payment (common in construction and design)

Timesheet invoice—Bill for time worked rather than for products

Utility invoice—One of the most common bills (think electricity, telephone, internet, etc.)

Final invoice—indicates that a project is finished and payment is due

- Past due invoice—a professional reminder that the payment due date has passed

- Recurring invoice—typical for ongoing services, memberships and subscriptions

How do I create an invoice template?

All invoices include standard details so it’s simple to create a template that you can use on repeat. You can either create a template from scratch or take advantage of free online templates. Whatever you do, just make sure your invoice template is professional and personalized.

Creating an invoice template from scratch

Before digital templates were commonplace, many business owners chose to create invoices using programs like Word and Excel.

The process isn’t too complicated—Word typically provides invoicing templates as well—so there’s no harm in taking an hour or so to draft a personal template that you can use whenever you need to customize payment.

In rare cases, you can even handwrite invoices. For example, if you’re at a construction site and want to write up an invoice right away, you could use a pre-printed template or invoice book. However, there are several mobile apps that provide this same service in a more professional format—and probably faster too!

Creating an invoice template online

Rather than spending your time creating an invoice template, I recommend downloading a free template and just customizing it.

Digital invoicing software allows you to add your logo, customize colors and text. You don’t have to design your template from scratch, but you can still match the invoice to fit your brand identity. The consistency of formatting and process will also help you look more professional to repeat customers.

Not to mention, if you have your invoice template already set up, you’re more likely to get paid faster. And your payments will be automatically linked to your accounting records.

A lot of payment processors like Square and PayPal provide invoicing as part of their service. Bookkeeping and accounting software products also include invoicing and digital payment options. For example, you can link ZipBooks to your favorite payment processor in order to invoice digitally and sync transactions to your books.

When you create an invoice from scratch, you’re likely limited to PDF sending. However, with digital software, you can typically choose to send bills via email, url, PDF or snail mail.

What details do I need to include in an invoice?

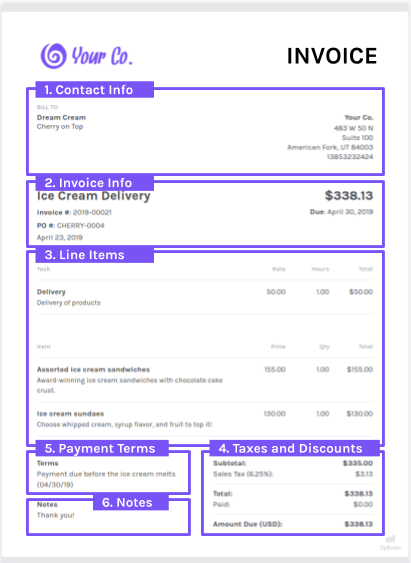

All invoices will include similar information, which is why it’s so nice to use digital templates. Here are all the items you need to include:

1. Contact Info

Customers should be able to tell right away who is billing them for something. Include your business name, logo, address, phone number and even email address.

If customers have a question about the invoice, they should be able to reach you using the contact info listed on the invoice. Give them as many options as possible to reach you so you can clear up any issues quickly and get paid faster.

You should also include the recipient information on the invoice. Make sure that it reaches the right person first, so that the bill isn’t getting passed between departments and you aren’t getting paid.

2. Invoice Info

Information that distinguishes this invoice from others should be immediately clear.

Invoice numbers (and PO numbers if available) are a great way for you and your customer to keep track of the transaction. Most invoicing platforms will generate unique invoice numbers for you, but you can also customize according to your preference. Using a sequence of increasing numbers or letters to indicate a specific client are helpful.

Additionally, any relevant dates should be included (date serviced performed, date invoice sent, date payment due, etc).

3. Line Items

The itemized list of goods or service is the most important part of your invoice. If customers feel that they are being billed mistakenly, they will not pay.

It’s helpful to lists tasks and items in a chart or table that is easy to read and well organized. Use descriptions that are clear, but not lengthy–just long enough for customers to know what they’re paying for.

Break down what you charge by quantities and rates so that customers can do the math themselves if they want to. But to be clear, you should do the math for them–the total due should be some of the largest text on the invoice.

4. Taxes and Discounts

If you apply any taxes or discounts to an invoice be sure to mark those clearly. Customers want to know exactly what they’re paying for and to be certain they’re getting the deal they were promised.

In ZipBooks, you can apply taxes to the entire invoice or to individual line items (including sales tax, VAT, GST and more).

5. Payment Terms

Ideally, you will have agreed on payment terms beforehand (including due dates and payment methods), but it’s a good idea to include these terms on the invoice document.

Not only does this help set expectations and provide direction, this can be legally beneficial to you if the client doesn’t pay on time. Your payment terms are an electronic handshake of sorts, reminding the customer of their obligation to uphold their side of the deal.

6. Notes

Invoices will be paid faster if they are professional and polite. Use the notes field to say thank you or add a personal note about doing business with this customer.

Remember, the notes are the last thing they see, so don’t be pushy. If needed, include details on your return policy and other offers or attach receipts, time tracking records and any documentation that applies.

What are the invoicing best practices for getting paid faster?

If your business is suffering from slow-paying clients, take comfort in the fact that you’re in the majority. One survey released by PaySimple found that 80% of small businesses receive payments past their due dates.

You can make invoicing more effective and speed up payments from customers by taking advantage of digital invoicing solutions and following certain best practices:

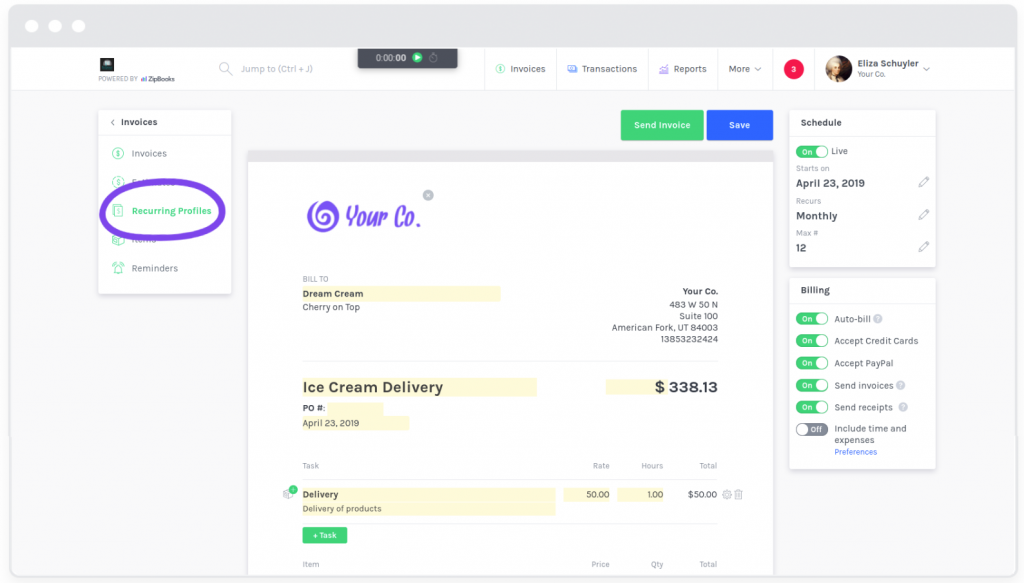

Automate recurring billing

If you have customers who make the same purchase every month, don’t waste your time rewriting the same invoice. Set up recurring invoicing with secure storage of credit card information and automatic payment. Then send automated receipts once the invoice has been fulfilled.

Be Prompt

Detailed, prompt invoices show professionalism. I once had a company tell me they’d send me an invoice that day and it took a week for me to receive it. At that point, you shouldn’t be surprised if your customer decides to go with someone else.

Plus, the faster you invoice, the faster you’ll get paid.

Stay on Brand

Invoices that match your brand are more likely to get paid faster. Customers are purchasing from you because they support your brand, so be sure to represent yourself well.

Colors, logo, fonts and styling should match your brand identity.

Also, if you call your invoices something else in your communication with customers, be sure to label it that way in your final invoice (i.e. call it a bill).

Use clear language

Use language that is clear and easy-to-understand. Saying “Due in 30 days” instead of “Net 30” will bring in payments sooner.

And try to be concise! Stick to around 20-50 words for notes and description and 10-25 words for payment terms.

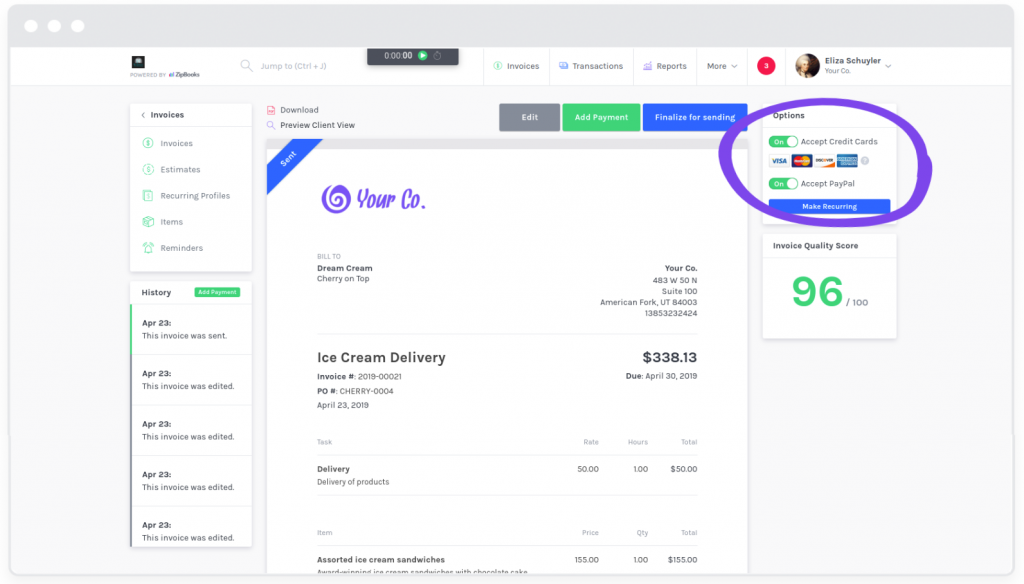

Improve your Invoice Quality Score

Did you know that customers are 15% more likely to repurchase from businesses that include a logo on their invoice? ZipBooks builds this data–and much more–into an “Invoice Quality Score” that updates live as you edit your invoice.

These actionable insights are based on millions of data points to help you make the small improvements that produce huge results. Things like identifying terms of payment and adding detailed descriptions help guarantee that there is no confusion when your customer receives their invoice.

Automate Late Payment Reminders

Use automated late payment reminders so clients don’t go too far from the due date and forget about the purchase.

Follow up the day after payment is due and schedule additional reminders as well.

Digital Payments

By including a direct link to your favorite payment processor, you’re more likely to get paid quickly. For example, with ZipBooks you can accept payments from Square, Stripe, PayPal or credit card–immediately within the invoice.

According to our research, when customers have the option to pay by credit card, ZipBookers receive payment 14.6 days earlier.

Try the carrot, not the stick

Some might suggest expediting invoicing cycles by penalizing late payments. This doesn’t always work. Clients who aren’t in a hurry to pay your bill are unlikely to be in a hurry to pay your late fee. In fact, sometimes late fees justify delaying the payment even further, since they’ve already incurred the cost.

Instead, try to incentivize early payments. Consider offering a discount for early or same-day payments. Advertise these discounts on initial contracts and invoices so that clients know their options and are excited to pay early.

If you can’t afford this kind of cost upfront, consider offering the discount on a future purchase instead, or perhaps offer a payment plan.

Invoicing financing

Invoice financing options can be costly, but they solve the problem of waiting for customer payments.

If you currently have outstanding receivables, you can qualify for invoice financing. Most services offer streamlined, online applications with quick turnaround. Because existing invoices act as the loan’s collateral, you are more likely to qualify for invoice financing—though some companies may look at your credit report too.

Simplify invoicing with ZipBooks

Without regular cash flow, the financial health of your business is at risk. Small business owners should find ways to automate invoicing, so that their billing strengthens their bottom line rather than weakens it.

ZipBooks free online invoicing app makes invoicing your customers for goods or services easy. In just a few clicks, you can send custom invoices to your clients, get paid online, and get notified when your customer pays their balance.

Tim is Founder and CEO of ZipBooks. He keeps his desk really nice and neat.