by Tim Chaves

Form 8829 Instructions: Your Complete Guide to Expense Your Home Office

If you have recently become self-employed, chances are you’re pretty nervous about handling tax season as a single-person business.

Fortunately, while self-employment makes taxes a little trickier, it can also offer a few perks, like the chance to deduct everyday business expenses from your taxable income.

One business expense you may be forgetting that could make a big difference on your taxes? The cost of working from home.

What is Form 8829?

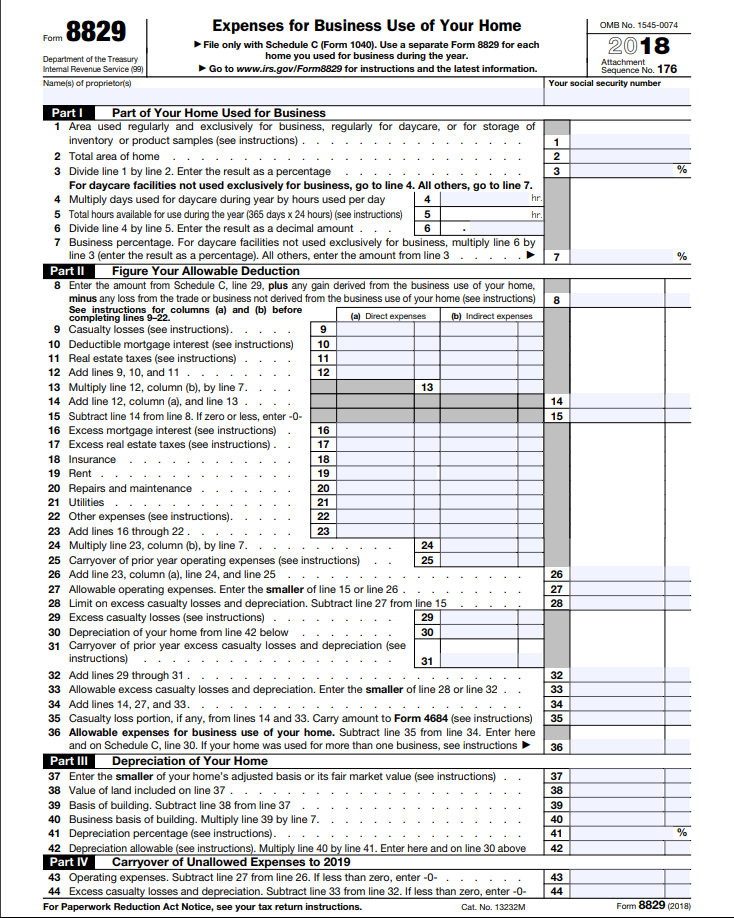

Form 8829, also called the Expense for Business Use of Your Home, is the IRS form you use to calculate and deduct your home office expenses.

1099 contractors and other self-employed individuals process the IRS home office form along with their annual tax return (unless you’re using the simplified method). Qualifying expenses are reported on Line 30 of Schedule C (Form 1040).

Tax forms can seem a little intimidating, but we’ll talk you through the 8829 and show you how to handle it like a pro.

Click the image to download Form 8829

Disclaimer: This post is not intended to replace the counsel of a CPA. If you find that you have more questions than are answered here, please read the instructions on the IRS website or hire a professional accounting service.

Form 8829 Instructions

While having a home office does allow you to deduct certain expenses from the income that is subject to taxes, you unfortunately cannot expense the full cost of your mortgage or utility bills. The IRS has very specific rules regarding which expenses are deductible and which are not.

Here are a couple of rules regarding what you are allowed to deduct:

- Your home office must be your primary place of business. In other words, you can’t work occasionally from home and claim it as a home office.

- The space in your home where you work has to exist exclusively for your business and nothing else. If your home office is also used as a guest bedroom or for kids to do homework, you may not qualify for this write-off. However, the space does not have to be closed off (i.e. a desk in your kitchen would qualify).

What Deductions Are Allowable?

Home office expenses that you deduct using Form 8829 must be directly related to running your business. Typically allowed deductions include:

- Rent

- Deductible mortgage interest

- Utilities

- Homeowner’s or renter’s insurance

- Home depreciation

- Home maintenance

But don’t get too excited just yet. You can only deduct the portion or percentage of those costs that are actually related to your home office.

For example, if your office is 10% of your home’s total square footage, you can deduct 10% of each of those costs. Be careful with this. Intentionally misleading the IRS on the extent of your home office is a good way to get flagged for an audit.

The Simplified Method

If all of this feels too complicated, there is a way around the 8829 form.

Instead of calculating what percentage of your heating bill you use for work, you can elect to take the simplified deduction. The standard deduction amount is $5.00 per square foot (with a maximum of 300 square feet).

This method does not require you to fill out a 8829 form. Instead, on line 30 of your Schedule C, you will indicate the total square footage of your home and the square footage used for business.

You can still claim allowable home-related deductions (like mortgage interest and real estate taxes) on Schedule A. However, you can not deduct for home depreciation.

If you don’t have an exorbitant list of home expenses, the simplified deduction may actually save you more money. Though, it may change year-to-year. The IRS does allows you to choose either the simplified or the regular (8829) method for a single tax year.

Filling Out the 8829 Form

Part I: Portion of Your Home Used for Business

Line 1: First, enter the square footage of your home office that you use exclusively for business purposes. As mentioned above, this can’t be somewhere like your dining room that serves multiple purposes.

Line 2: Then enter your home’s total square footage. Use the same unit of measurement that you used in Line 1.

Line 3: Divide Line 1 by Line 2 and multiply by 100 to find the percentage of your home that you consider to be your home office. Enter this percentage on Line 3.

Line 4: If your home business is a daycare center, enter the number of hours during the tax year that you provided daycare. You can find this number by multiplying the number of hours each day that you provided childcare and multiplying that by the number of days you were open for business that year. If your home business is not a daycare, skip this line.

Line 5: Skip this line as it should already be complete.

Line 6: Divide line 4 by Line 5 if you run a daycare center. If not, skip this line.

Line 7: If your home business is a daycare, multiply Line 6 by Line 3 and enter this number here. If you don’t run a daycare, enter the value of Line 3 here.

Part II: Figure Your Allowable Deduction

Line 8: Generally, you’ll enter the value of Line 29 from your Schedule C here. However, if you had any capital gains or losses from your home office, you’ll have to take those into account here. If you work from home as well as at another location, such as a co-working space, you should enter the percentage of Line 7 from your Schedule C that represents the percentage of your income that you earned at home. If you need help with this, the IRS has specific instructions for this section.

Column (a): Direct Expenses – This column is for expenses that you incurred specifically because of your home office. For example, a new office chair that is solely for your home office would be considered a direct expense.

Column (b): Indirect Expenses – This column is the expenses that you incurred which benefitted both your personal and professional use of your home. Indirect expenses would be things like your water bill—including both your personal and professional use. Don’t try to figure out a percentage here. Just enter the entire amount of your indirect expenses (in this case your entire water bill). Visit the IRS website for more information on direct and indirect expenses.

Line 9: If you’re filling out Form 4684 to claim losses from a casualty, fill out this line using the IRS instructions. If not, skip this line.

Line 10: Enter the interest paid on your mortgage. Your mortgage is considered an indirect expense unless you have a separate structure on your home property that you use to run your business. Please note that you can also claim mortgage interest on your Schedule A. Visit the IRS website for more information about this. If you rent your home, skip this line.

Line 11: Enter any real estate tax you paid during the tax year. This is also considered an indirect expense unless you run your business from a separate building on your home’s property. Similar to Line 10, real estate tax can also be claimed on your Schedule A.

Line 12: Find the totals in the (a) column for Lines 9, 10, and 11, and enter them on Line 12a. Then add the totals in the (b) column for those lines and enter the total on Line 12b.

Line 13: Multiply Line 12b by Line 7.

Line 14: Add Line 12a and Line 13b.

Line 15: Subtract the value of Line 14 from Line 8. If you get zero or a negative number, simply enter 0.

Line 16: If your deductible mortgage interest is limited on your Schedule A, enter the excess here using the IRS instructions.

Line 17: Enter the amount you paid in homeowner’s insurance this year in column (b).

Line 18: If you rent your home, enter the total rent you paid this year.

Line 19: Enter the amount you spent on home repairs and maintenance this year. Depending on the type of work you had to do, the amount can fall in either (or both) of the columns. Check out the IRS instructions for more info

Line 20: Enter the amount you spent on utilities this year. Which column you put the amount in is dependent on the type of utility. Check out the IRS instructions for further details.

Line 21: Fill in any other home business expenses that you didn’t enter elsewhere. For example, this might include the cost of a city-required home business license.

Line 22: Add the (a) columns for Lines 16 through 21 and enter the total on Line 22(a). Then, add the (b) columns and enter the total on Line 22(b).

Line 23: Multiply Line 22(b) by Line 7.

Line 24: Enter Line 42 on your Form 8829 from the previous year.

Line 25: Add Line 22(a), Line 23, and Line 24.

Line 26: Enter either the value of Line 15 or 25—whichever is the smaller number.

Line 27: Subtract Line 26 from Line 15.

Line 28: Use the IRS guide to multiply Line 9 by the business percentage of your casualty losses.

Line 29: Use Line 36 to determine the value of Line 29 and enter it here.

Line 30: Using your Form 8829 from last year, enter Line 43 here.

Line 31: Find the total of Lines 14, 26, and 31, and enter it here.

Line 32: Enter Line 27 or 31 – whichever is smaller.

Line 33: Add Lines 14, 26, and 32.

Line 34: Find the amount of casualty losses from Lines 14 and 32, if any. You’ll also use this number on Form 4684, which you can read about on the IRS website.

Line 35: Subtract Line 24 from Line 33. You’ll also use this number on your Schedule C, Line 30.

Part III: Depreciation of Your Home

Line 36: Enter either the cost of your home, or its fair market value when you began doing business at home, whichever is less.

Line 37: Fill in the cost of your property or the fair market value of your property on the date you began doing business at home, whichever number is less.

Line 38: Subtract Line 37 from Line 36.

Line 39: Then multiply Lines 38 and 7.

Line 40: Line 40 will change depending on the date you began doing business at home. Use the IRS instructions to find the correct value.

Line 41: So, if you haven’t made any additions or improvements to your home since you began working from home, multiply the percentage on Line 40 by Line 39. If you made additions or improvements, use this page to find the monetary value of those additions. After you find the value, also enter this number on Line 29.

Part IV: Carryover of Un-allowed Expenses to 2018

Line 42: You’re almost done. Next, subtract Line 26 from line 25. If the result is negative, enter 0 here.

Line 43: Finally, subtract Line 32 from Line 31. If the result is negative, enter 0 here.

Photo by Brad Javernick of Home Oomph

Tim is Founder and CEO of ZipBooks. He keeps his desk really nice and neat.